The growth in online trading platforms is opening the doors to gender equality and slowly eroding the traditional male trader stereotype. Although there's still a big gender gap in the industry, more women are trading and proving that they have what it takes to succeed in the markets.

Here are the top 6 female traders who are making a name for themselves in the industry and paving the way for other female traders.

1. Kathy Lien

Described as a "fundamental guru" Kathy's Wall Street career began when she was just 18. She launched DailyFX.com when she was 23 and has become a leading voice in the forex trading world with her in-depth knowledge of the global currencies.

Kathy is a respected forex trading author who writes for various high-profile sites and has published numerous books.

She's currently a Founding Partner and current Managing Director of FX Strategy at BKForex and she's often quoted in top media platforms including Bloomberg and Wall Street.

2. Linda Bradford Raschke

Linda is a world-renowned commodities and futures trader and a veteran in Wolfe Wave technical research who began her professional trading career in 1981.

Her name is preeminent in the industry and she has granted her initials to LBR Group Inc., a registered Commodity Trade Advisor and LBR Asset Management, a Commodity Pool Operator where she currently serves as president.

Renowned for her ability to recognise and act on trading patterns, Linda has lectured on behalf of prestigious associations like Bloomberg and she's coached aspiring professional traders in over 20 countries.

One of Linda's trading rules is to have a strategy that allows you to react to market movements as they occur because you can't foretell future movements. In Linda's words "In the world of money, which is a world shaped by human behaviour, nobody has the foggiest notion of what will happen in the future. Mark that word – Nobody!"

3. Jennifer Fan

At just 19, Jennifer graduated from business school with degrees in statistics, finance, and operation research. She has worked at Morgan Stanley and at Arrowhawk Capital Management where she was partner and portfolio manager.

Jennifer is a hedge fund manager and chief investment officer of a $650 million hedge fund that specialises in energy and agriculture commodities. She recently left New York- based Millennium, where she traded commodities, to set up a family office.

4. Raghee Horner

The creator of the famous 34 EMA wave method, Raghee may be a long way from charting her mutual fund progress on engineering paper, but her love for trading is still very strong. She has dedicated three decades to understanding the markets and helping other traders to gain an edge in the market.

Raghee is the Managing Director of Futures Trading and a valued contributor at John Carter's Simpler Trading. She's an expert in trading spot currencies, future, options and equities.

One of Raghee's trading tips is to be open-minded and formulate a strategy that works for you. In her words "There is no ‘one way' in trading."

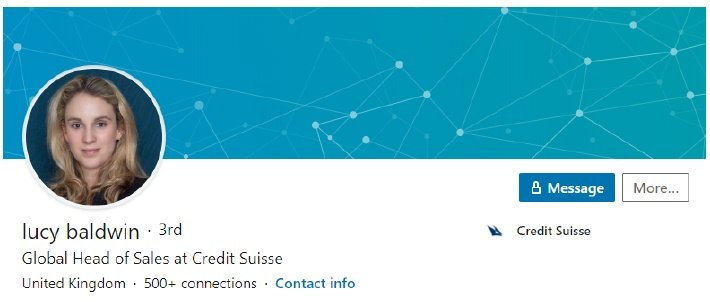

5. Lucy Baldwin

Lucy Baldwin is a formidable trader who's managed to land on the highly-coveted the Forbes "30 Under 30 in Finance" list for two consecutive years.

Besides the prestigious accolade, she has assumed the sought-after title of Managing Director at both Goldman Sachs and Bank of America Merrill Lynch where she was in charge of trading European equities. She's currently at Credit Suisse where she has taken up a leading position in equity trading.

A trading tip from Lucy is to possess some emotional intelligence and a strong IQ. These two elements enhance a trader's discipline – a vital quality for trading success.

6. Lauren Simmons

In 2017, at age 23, Lauren became the youngest and only current full-time female equity trader at the NYSE. She's become affectionately known as the "Lone Woman on Wall Street."

Lauren majored in genetics at Kennesaw State University but moved to New York City where she met the CEO of Rosenblatt Securities and started her trading journey.

Lauren has shared her success story in several countries and she's been featured on several top news networks like CNN and CNBC. She's currently working on her first publication that's centred on women and millennials in finance.

Lauren's trading tip is to be financially savvy. Success in the markets requires making educated moves rather than leaving things to chance.

These women have shown that good trading is not strictly reserved for men and they are ushering in a new breed of female traders who will undoubtedly disrupt and reshape the trading industry.

This material on this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. Commission, interest, platform fees, dividends, variation margin and other fees and charges may apply to financial products or services available from FP Markets. The information in this website has been prepared without taking into account your personal objectives, financial situation or needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any financial product. Contracts for Difference (CFDs) are derivatives and can be risky; losses can exceed your initial payment and you must be able to meet all margin calls as soon as they are made. When trading CFDs you do not own or have any rights to the CFDs underlying assets.

FP Markets recommends that you seek independent advice from an appropriately qualified person before deciding to invest in or dispose of a derivative. A Product Disclosure Statement for each of the financial products is available from FP Markets can be obtained either from this website or on request from our offices and should be considered before entering into transactions with us. First Prudential Markets Pty Ltd (ABN 16 112 600 281, AFS Licence No. 286354).

Editors’ Picks

USD/JPY drops back below 157.00 on Japan's verbal intervention

USD/JPY has come under moderate selling pressure below 157.00 in the Asian session on Monday. The Japanese Yen lost ground to near 157.70 following Japan’s ruling Liberal Democratic Party's outright majority win in Sunday’s lower house election, opening the door to more fiscal stimulus by Prime Minister Sanae Takaichi. However, JPY buyers jumped back and dragged the pair southward on FX verbal intervention by Japan’s Finance Minister Katayama.

Gold eyes acceptance above $5,000, kicking off a big week

Gold is consolidating the latest uptick at around the $5,000 mark, with buyers gathering pace for a sustained uptrend as a critical week kicks off. All eyes remain on the delayed Nonfarm Payrolls and Consumer Price Index data from the United States due on Wednesday and Friday, respectively.

AUD/USD: Buyers eyes 0.7050 amid upbeat mood

AUD/USD builds on Friday's goodish rebound from sub-0.6900 levels and kicks off the new week on a positive note, with bulls awaiting a sustained move and acceptance above mid-0.7000s before placing fresh bets. The widening RBA-Fed divergence, along with the upbeat market mood, acts as a tailwind for the risk-sensitive Aussie amid some follow-through US Dollar selling for the second straight day.

Top Crypto Gainers: Aster, Decred, and Kaspa rise as selling pressure wanes

Altcoins such as Aster, Decred, and Kaspa are leading the broader cryptocurrency market recovery over the last 24 hours, as Bitcoin holds above $70,000 on Monday, up from the $60,000 dip on Thursday.

Weekly column: Saturn-Neptune and the end of the Dollar’s 15-year bull cycle

Tariffs are not only inflationary for a nation but also risk undermining the trust and credibility that go hand in hand with the responsibility of being the leading nation in the free world and controlling the world’s reserve currency.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.