US Dollar Weekly Forecast: Inflation data and Fedspeak return to the fore

- The US Dollar closed its second consecutive week of gains.

- The US Nonfarm Payrolls came in below estimates in December.

- Markets’ attention now shifts to upcoming US CPI data and Fedspeak.

The week that was

And we’re off!

Another positive week for the US Dollar (USD) saw the US Dollar Index (DXY) extend a promising start to the new trading year, managing to at least scare away the spectre of being one of the worst-performing currencies during the last year.

In addition to the ongoing strong recovery, the index managed to clear its critical 200-day SMA around 98.85 on Friday, a harbinger of potential extra advances in the relatively short-term horizon.

Adding to the currency's challenges, Federal Reserve (Fed) officials have maintained a divided stance on the monetary policy outlook, particularly regarding the pace and extent of rate cuts, which has left investors cautious ahead of the upcoming release of US inflation figures tracked by the Consumer Price Index (CPI) on January 13.

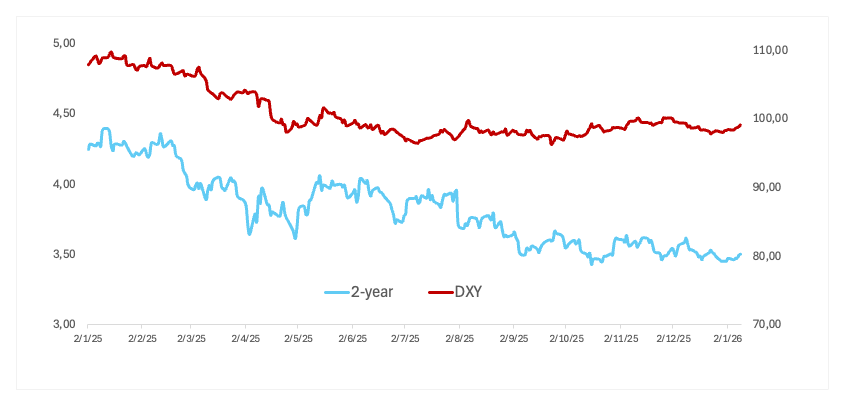

The weekly move higher in the Greenback was only accompanied by an equally firm recovery in US 2-year yields, while the belly and the long end of the curve edged lower in that period.

Consensus around the FOMC remains absent

Recent remarks from Federal Reserve officials reflect a growing focus on balancing cooling inflation against emerging labour-market risks, with views diverging on how restrictive policy remains and how quickly rates should be adjusted.

Neel Kashkari (Minneapolis) said inflation is gradually easing but warned that tariff-related pressures could prove persistent, even as the unemployment rate risks rising from current levels, a sign that labour-market weakness could surface before inflation is fully tamed.

Tom Barkin (Richmond) stressed the need for “finely tuned” policy decisions, noting that while inflation has fallen, it remains above target, and unemployment, though historically low, has begun to edge higher. He added that interest rates are now close to neutral.

By contrast, Stephen Miran (FOMC Governor) argued policy is clearly restrictive and called for aggressive rate cuts this year, suggesting more than 100 basis points of easing may be needed to support growth.

So far, implied rates point to just over 53 basis points of easing by year-end and around a 95% chance of an on-hold decision at the January 28 gathering.

The US labour market keeps cooling…or not?

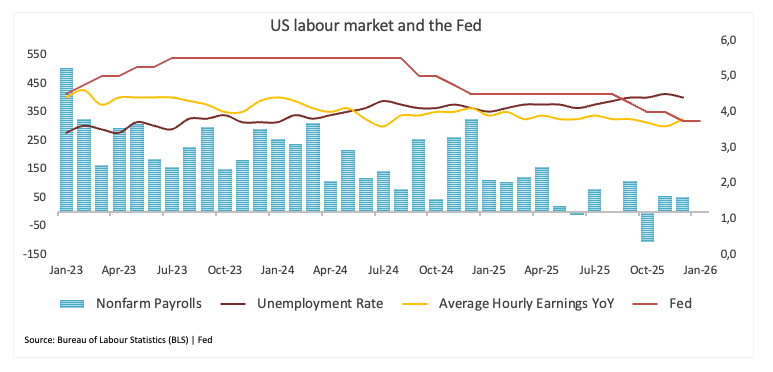

The Greenback found in the latest US Nonfarm Payrolls (NFP) another excuse to extend its robust recovery. Indeed, in December, the US economy added just 50K jobs, a tad below consensus, while the Average Hourly Earnings, a proxy for wage inflation, ticked higher to an annualised 3.8%, and the Unemployment Rate challenged analysts’ opinions after receding to 4.4%.

All in all, a steady cooling of the labour market appears bumpy, to say the least, removing fuel from those who expect job creation to stall somewhat and the jobless rate to tick (dramatically?) lower in order to reignite the thirst for lower rates.

Now, about inflation…

Political noise unlikely to weigh on the buck

After news out of Venezuela over New Year’s Eve, markets have once again found themselves digesting geopolitical headlines, this time sparked by renewed comments from Donald Trump about the US potentially “acquiring” Greenland. The remarks have raised fresh questions about US strategic intentions, relations with Europe, and whether any of this really matters for the Dollar.

Trump has revived the idea of bringing Greenland under US control and, notably, refused to rule out the use of military force. The response from Europe was swift. Denmark’s Prime Minister, Mette Frederiksen, and Greenland’s leader, Jens-Frederik Nielsen, both pushed back firmly, stressing that Greenland’s future is for its people to decide. The island remains an autonomous territory within the Kingdom of Denmark.

Strategically, Greenland’s appeal is not hard to see. Its location is critical, and it is thought to be rich in minerals, oil and natural gas. That said, the economic story is far from straightforward. Oil and gas extraction are banned on environmental grounds, while mining projects have been slowed by regulation and opposition from indigenous communities, meaning any payoff would likely be distant and uncertain at best.

In terms of options, the Trump camp has reportedly floated everything from an outright purchase to a Compact of Free Association, similar to arrangements the US has with some Pacific island states. A military seizure, however, would be a different order of magnitude altogether, an unprecedented move against a close ally that would send shockwaves through NATO and further strain already fragile US–European relations.

For the Greenback, the market impact looks limited for now. Investors are likely to treat the Greenland talk as political noise rather than a genuine shift in policy. Unless it snowballs into a broader diplomatic or trade dispute with Europe or materially alters US fiscal or defence spending plans, the buck’s response should remain muted, with rates, growth and overall risk sentiment still doing the heavy lifting.

What’s in store for the US Dollar

Next week is shaping up to be a particularly interesting one, both on the data front and in terms of Fed speak.

The main focus will be the US CPI inflation release, but investors will be just as attentive to what policymakers say about how those numbers could influence the Fed’s thinking ahead of its next meeting in late January.

Technical landscape

Since bottoming out near 97.70 on December 24, the US Dollar Index (DXY) has embarked on a solid recovery that has not only reclaimed the 99.00 barrier but also left behind its significant 200-day SMA around 98.80.

This latter development paves the way for a potential return to the November 2025 peak at 100.39 (November 21). Once cleared, the index could then attempt a move toward the May 2025 ceiling at 101.97 (May 12).

On the flip side, there is immediate contention on the December floor at 97.74 (December 24). If bears push harder, the DXY could slip back to the 2025 bottom at 96.21 (September 17). The loss of this level could expose the February 2022 valley at 95.13 (February 4), seconded by the 2022 base at 94.62 (January 14).

Momentum signals have strengthened decently: The Relative Strength Index (RSI) approaches the 62 mark, while the Average Directional Index (ADX) near 21 suggests quite a firm trend.

-1767983472579-1767983472579.png&w=1536&q=95)

Bottom line

The US Dollar has found a second wind over the past few days, with momentum clearly swinging back in its favour, at least for now.

Part of that support is coming from a handful of Fed officials who are sticking to a hawkish line, helping to steady the Greenback in the near term.

Policymakers seem especially focused on the labour market at the moment, watching closely for any signs of weakness. But inflation hasn’t gone away. Price pressures are still running hotter than the Fed would like, and if they prove stubborn, officials may be forced to pivot back towards fighting inflation sooner than markets expect.

That would point to a more cautious Fed and a firmer Greenback, regardless of the political backdrop.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.