There are no 2:1 trades.

If I were ever to come back into the markets in another life, it would definitely be as a YouTube trader. Oh, how sweet life would be as I would trade only the past, creating perfect 2:1, 3:1, even 5:1 setups while convincing everyone that I could be a millionaire by Friday by trading something called "support and resistance."

Alas, unfortunately, I've chosen to trade the future, and the future is nowhere near as easy or as kind to your account. There is, of course, no such thing as "support and resistance." There are simply just peaks and valleys on the chart left by past price action, and if the market is in a range-bound mood, then those points occasionally line up with a market turn. But woe to the trader who thinks that they are anything important if the market suddenly changes into continuity mode. Those points of "support and resistance" will fall faster than the Russian front line in a mechanized Ukrainian assault.

But the wiggles on a chart are something to discuss for another time. Today, I want to focus on the very pernicious belief that in trading, you should always trade with a 2:1 win ratio. This sounds very seductive. In most newbie traders' minds, they imagine that every second trade they take will make $2 for every $1 they lose. The reality is that most traders will probably lose $1 three, four, five, or even six times in a row before eking out a lonely $2 win.

I still remember in my youth how I tried to blindly follow the "discipline" of the 2:1 dogma to lose not six, not seven, but FIFTEEN TRADES in a ROW. Go ahead, give it a try; I am sure you can match my record, especially if you day trade the markets for tiny margins.

Markets simply don't hand out $2 bills for $1 worth of risk with any consistent frequency. Almost every strategy you backtest at a 2:1 ratio will come in at a 25% win rate or worse, unless it was perfectly optimized for a particular slice of time.

I've shown many times in the past that anyone on YouTube who claims they trade with a 2:1 win ratio and a 70% win rate is just lying their a** off. Otherwise, they'd be in possession of a money machine that would make them wealthier than Elon Musk.

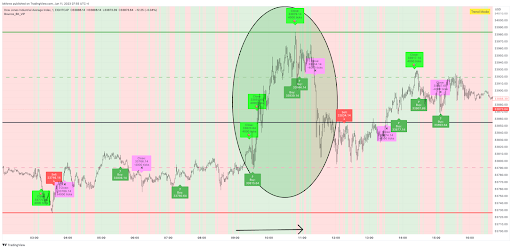

The best that can be said about day trading the markets is that there are certain times of the day when a particular regime dominates trade, and even that is not a certain assumption. Take a look at my Bounce strategy (the purple tiles indicate losses, green ones indicate wins)...

Continuity dominates only during the market open periods when you have the greatest number of participants running for the same exit at the same time. And mind you, these are 1:1 trades for basically 10 basis points of the underlying, and 1:1 is as good odds as you will likely get if you want to squeeze out a positive expectancy on a day trading basis. Keep in mind that HFTs like Citadel and Virtu, which have far more firepower and brainpower than you, only win 52% to 54% of the time with a 1:1 ratio because, of course, unlike the YouTube gurus, they trade live and actually understand the real odds.

Which brings me to my last point of the day. In day trading, the order of importance is When, What, How. Know when your strategy has the greatest chance of success during the day, know what instrument will likely offer the smoothest expression of that behavior, and only worry about the entry criteria last. They are not unimportant. They are just the least important.

Figure out your own When What How framework. It will be a lot more productive than blindly chasing 2:1 trades

Past performance is not indicative of future results. Trading forex carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD holds near 1.1900 ahead of US data

EUR/USD struggles to build on Monday's gains and fluctuates near 1.1900 on Tuesday. Markets turn cautious, lifting the haven demand for the US Dollar ahead of the release of key US economic data, including Retail Sales and ADP Employment Change 4-week average.

GBP/USD declines toward 1.3650 on renewed USD strength

GBP/USD stays on the back foot and declines to the 1.3650 region on Tuesday. The negative shift seen in risk mood helps the US Dollar (USD) gather strength and makes it difficult for the pair to find a foothold. The immediate focus is now on the US Retail Sales data.

Gold stabilizes above $5,000 ahead of US data

Gold enters a consolidation phase after posting strong gains on Monday but stays above the $5,000 psychological mark and the daily swing low. US Treasury bond yields continue to edge lower on news of Chinese regulators advising financial institutions to curb holdings of US Treasuries, helping XAU/USD hold its its ground.

Bitcoin Cash trades lower, risks dead-cat bounce amid bearish signals

Bitcoin Cash trades in the red below $522 at the time of writing on Tuesday, after multiple rejections at key resistance. BCH’s derivatives and on-chain indicators point to growing bearish sentiment and raise the risk of a dead-cat bounce toward lower support levels.

Dollar drops and stocks rally: The week of reckoning for US economic data

Following a sizeable move lower in US technology Stocks last week, we have witnessed a meaningful recovery unfold. The USD Index is in a concerning position; the monthly price continues to hold the south channel support.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.

-638220995555022954.png)

-638220995605528946.png)