Imagine you're discovering the first signature playbook trade.

Playbook trades go hand in hand with the market's narrative, which we'll cover shortly.

But before that, each playbook trade features signature characteristics making the trade uniquely identifiable.

Yet the reason for grasping this trade first is that it offers an unusually high 'don't-get-hurt' percentage—meaning over 90% of the outcomes fall into three categories:

-

You take money.

-

You don't take or lose money.

-

You have a slight paper cut loss.

(A paper cut loss occurs when the initial risk on a trade is reduced to a fraction of that amount.)

Once you can identify it, you 'time' your entry to ensure more than 90% of these trades fall into the three categories.

Let’s say it’s Saturday, the market’s closed. You’re walking through how to identify and time your entry into the first signature trade—guided by someone who’s traded it daily for years.

From knowledge to the real-life game

But before placing this trade on your live account, it's essential to confirm you can enter it as covered—during real market conditions. For safety, you use a simulated account.

What happens next?

It doesn't matter if you've been trading for 3, 5, or 10 years—you mess it up.

Why? Because everyone messes up a 'doing' activity in the beginning.

But this signature trade appears every single day—once, twice, or several times—giving you the chance to repeat it.

And with an experienced trader reviewing your progress and giving feedback to steer you in the right direction—you get better and better.

And that's when it hits you

Now you know the importance of playbook trades—isolating trading to a specific scenario where there are no shades of grey—just absolute clarity on what the trade looks like and how to trade it.

It's so specific, you rinse and repeat. Competence lives in repetition.

Yet, simultaneously, you make a powerful insight into the trading game—call it an 'ah ha' moment.

If you didn't know the significance of a playbook trade and the process of repeating it until you can trade it successfully...

Imagine how many other traders aren't aware of this—but are attempting to compete with you?

And now you understand why you don't trade to make money—but trade to take it.

You take money from traders who aren't trading with the same level of 'doing' skill as you do.

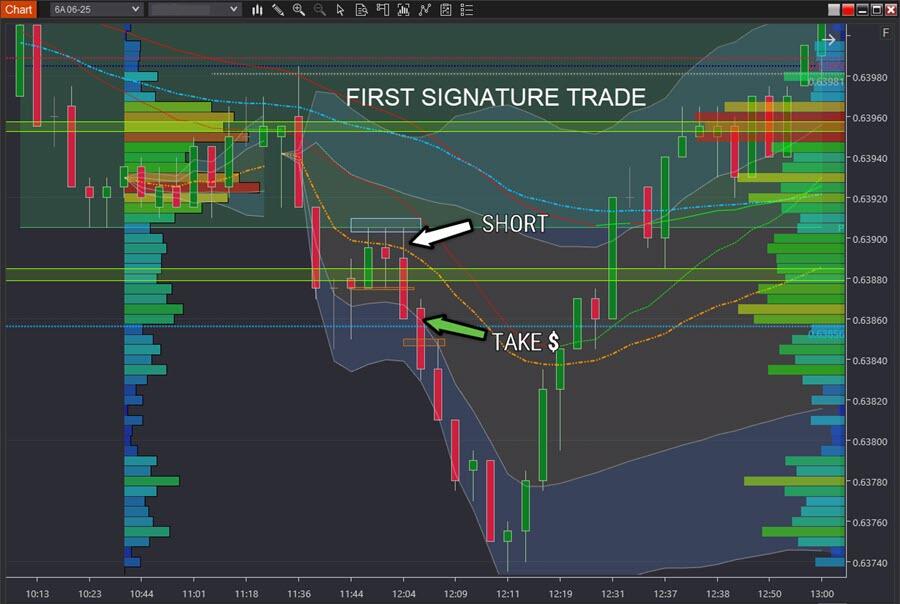

Now let's look at a chart of trading from today:

At first glance, it might appear overwhelming because you are looking at numerous executions representing various playbook trades.

But do you see the 'First Signature Trade' amongst all these trades?

The first signature trade is still present because of its high success and safety. It always remains part of your trading arsenal.

But by focusing first on that one playbook trade, you fast-track consistency—because your focus compounds. Spread it across several, and progress slows.

So, in the beginning, a chart view of your trading over the same period would look like the view below. Yes, it's a different-looking chart derived from a different data set.

Opportunities multiply with skill

The more times you take the same trade, the sooner it becomes an unconscious behaviour, freeing up your mental capital.

You recognise this happening because you now notice more of what's happening in the market—now that you're not as mentally consumed with the first playbook trade.

But the difference is—now you're seeing the market from the viewpoint of having gained some refined trading skills—hence, you're noticing more intelligible trading behaviours only specialist knowledge can decipher.

Which brings us to the market narrative.

The 'narrative'

The advanced trading phase involves seeing beyond the lines, numbers and charts to recognise the different characters in the market—including:

-

Gamblers not traders.

-

Under-skilled traders.

-

Highly skilled traders.

-

Institutional players.

-

Market makers, and

-

Algorithmic and high-frequency players.

- Based on where and how they trade.

When you know all the different characters, you truly comprehend the story behind the market's movements to act accordingly.

And as you gain unconscious competence in your first playbook trade, second, and so on, your narrative comprehension deepens. Your opportunities multiply with skill.

You can take more out of the market the more you can comprehend the story.

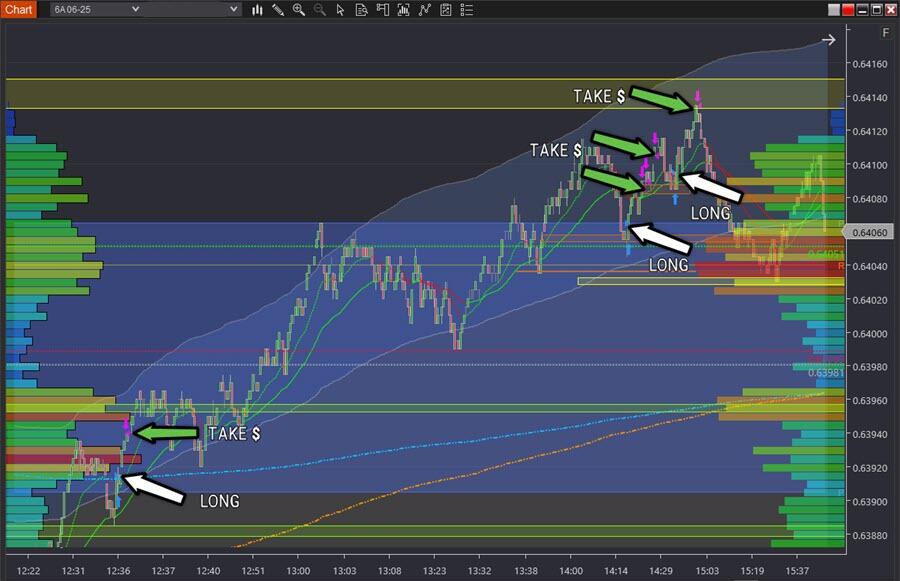

Consider the first chart of trades:

40 minutes of trading, comprehending the narrative, and executing numerous playbook trades—which was preceded by allocating time to the day's game plan.

Then it was time for a break, only to return later in the afternoon to resume:

-

Comprehending the market narrative.

-

Waiting for the market to align with a daily game plan.

-

Executing those signature trades which align with the first two points.

Note: This is an unusual day on which no taxes were paid.

Most trading days include necessary losers—the tax you pay to keep the game exclusive to the minority who consistently take money out of the market. I'll expand on that in the next article.

In the meantime, if this level of structured, feedback-driven repetition is missing from your trading—you’re not seeing what’s possible.

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

EUR/USD holds firm above 1.1900 as US NFP looms

EUR/USD holds its upbeat momentum above 1.1900 in the European trading hours on Wednesday, helped by a broadly weaker US Dollar. Markets could turn cautious later in the day as the delayed US employment report for January will takes center stage.

USD/JPY cracks 153.00 on unabated demand for Japanese Yen

USD/JPY is extending its three-day rout below 153.00 in the European session on Wednesday, awaiting the closely-watched US NFP report. Rising bets on Fed rate cuts keep the US Dollar depressed. In contrast, expectations that PM Takaichi's policies will boost the economy and allow the BoJ to stick to its hawkish stance bolster the Japanese Yen, weighing on the pair amid intervention fears.

Gold sticks to gains near $5,050 as focus shifts to US NFP

Gold holds moderate gains near the $5,050 level in the European session on Wednesday, reversing a part of the previous day's modest losses amid dovish US Federal Reserve-inspired US Dollar weakness. This, in turn, is seen as a key factor acting as a tailwind for the non-yielding yellow metal ahead of the critical US NFP release.

Bitcoin, Ethereum and Ripple show no sign of recovery

Bitcoin, Ethereum, and Ripple show signs of cautious stabilization on Wednesday after failing to close above their key resistance levels earlier this week. BTC trades below $69,000, while ETH and XRP also encountered rejection near major resistance levels. With no immediate bullish catalyst, the top three cryptocurrencies continue to show no clear signs of a sustained recovery.

Dollar drops and stocks rally: The week of reckoning for US economic data

Following a sizeable move lower in US technology Stocks last week, we have witnessed a meaningful recovery unfold. The USD Index is in a concerning position; the monthly price continues to hold the south channel support.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.