As I have written about many times, I am a big Dr. Suess fan. I had the stories read to me many time as a child and that has shaped much of who I am today. Many close to me would say I am very loyal. I can thank Horton, my favorite elephant, for that. Others know that I care very much about all living creatures and deeply appreciate all that nature has to offers us. I can thank the Lorax for that. I can go on and on but then I would be rewriting a Dr. Suess book and I’m sure you aren’t reading this article for that. I collect original Suess art and recently found a treasure of Dr. Suess artifacts; the kind of place that could trigger emotional buying. There were pictures of all my favorites, a Statue of Yurtle the Turtle, a Green Eggs and Ham plaque and more. They even had a statue of the Lorax; one of my favorites that I hope to add to my collection at some point.

The gentleman in the store saw how excited I was when I saw the Lorax and recognized the opportunity to steer me into an emotional buying decision. He also knew I was not a local and likely had a credit card in my pocket. As soon as he introduced himself, I knew right away he was Canadian by his accent. Quickly the conversation went to hockey as he was wearing a shirt from Toronto. He played hockey like I did so we had much to talk about. We connected quickly with having hockey and Suess in common. He then proceeded to tell me that the Lorax was $8,900 and that they were only selling a few of them. Next, he told me that as soon as I bought him, I could easily sell him for $10,000 because of the demand for the collectible.

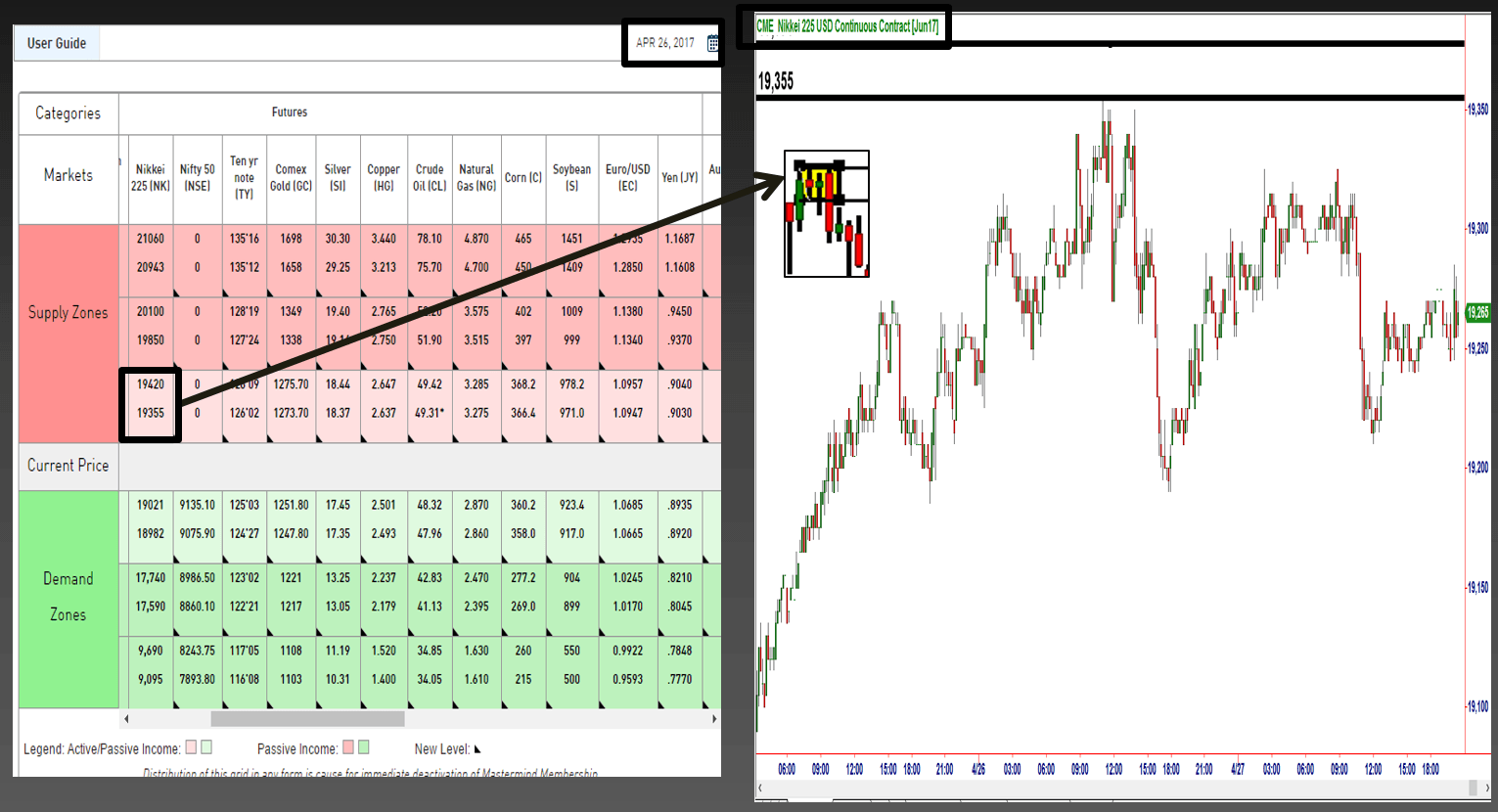

OTA Supply / Demand Grid – 4/26/17: Nikkei Futures

The chart above is the Nikkei futures and represents not only a great trading opportunity for our students who were able to take it this week, but also represents my exact experience with my new hockey friend (sales guy) and the Lorax. Notice the Nikkei supply level of 19355 – 19420 on the Supply / Demand grid April 26th, last week. This was a price level at which our market timing strategy told us Banks and Financial Institutions were selling. Notice the Rally-Base-Drop on the chart representing that strong supply. Later that morning, price rallied up to our supply level which means people were willing to buy at that level. Members of our academy (OTA) are instructed to sell at that price.

Who would buy at that level when the big, smart money and OTA students are selling? Do you think it is someone who knows what they are doing or someone who doesn’t, someone who is thinking logically or based on emotion? If we stick to what we know to be true, the answer becomes clear. When price rallied back up to our supply level as seen on the chart, the buyer is making two key mistakes that almost guarantee they will lose money. First, they are buying after a rally in price, and second, they are buying at a price level where supply exceeds demand (our supply/demand grid and strategy already told us that).

Only a novice trader would make those two mistakes. The buyer is buying either because of good news, the strong rally uptrend or both. In either case, the novice trader is making an “emotional” decision to buy, not a logical one. The logical trader at that supply level is the seller. The seller realizes that prices are at retail levels and when that is the case, you want to be the seller.

In trading, our goal is to make decisions logically and based on our rules following the supply and demand strategy. Otherwise, we end up making emotional buying decisions and pay too much. The salesman in the Dr. Suess store was no different in that he was trying to get me to make an emotional buying decision. If he really thought I could sell the Lorax for $10,000 minutes after buying from him for $8,900, would he really sell it to me for $8,900? While he was very convincing and my connection to the art is very strong, the gentleman didn’t know one thing. He was talking to a trader who gets paid the same way he does. I use a simple logical mind and set of simple and logical rules to get paid from those who make decisions based on emotion in the financial markets.

At Online Trading Academy, we teach people how to do this to attain short term income and long term wealth to ultimately live the life they want to live. Once you understand the supply/demand concept I write about so often, start applying it to many other parts of your life and enjoy the fruits of logical decisions.

Hope this was helpful. Have a great day.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.