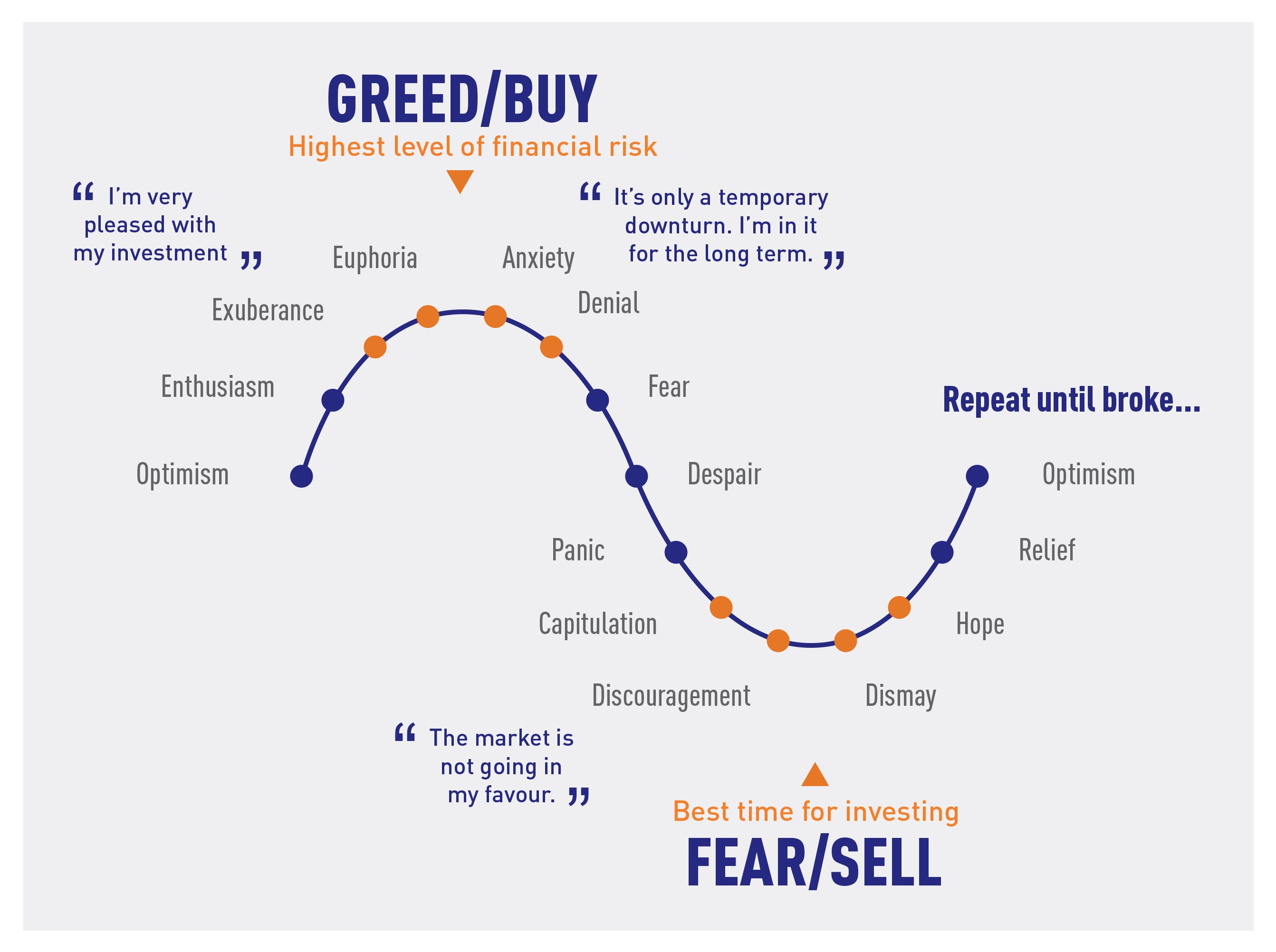

Financial Markets go through different cycles that produce different psychological effects on those that choose to participate. At market peaks of an investment cycle, traders and investors feel satisfied about the returns they’ve realized and believe that the favorable market environment will remain in place for an extended period of time. In other words, they become complacent and tend to dismiss any red flags that begin to emerge. This good feeling is usually followed by a sense of nervousness when the markets slowly start turning lower.

Unfortunately, this occurrence is the result of those traders and investors not having a plan in place to properly manage risk, thus they are subject to their emotions. Moreover, they also don’t have a strategy that helps them time the markets, meaning they don’t know when to get in (buy low) and get out (sell high). As you might imagine, this poses a big challenge for inexperienced traders and investors.

In order to deal with some of these challenges a trader/investor must understand the various stages of trading psychology.

Stages of Trading Psychology

Emotional Stages of an Up Trend in the Market

Optimism

Traders experience optimism when the market has been in a sustained uptrend for several months and the prospects for earnings and the economy are in the recovery phase. In this stage of the market traders feel comfortable buying as they see little reason to not put some money into the market because they perceive risk to be low. As the market continues higher, optimism turns into excitement as early buyers are starting to garner nice profits and every pullback is seen as another buying opportunity. In this phase, buyers are rewarded for purchasing every pullback, and like Pavlov’s dog, will continue until they are no longer rewarded for their actions.

Enthusiasm & Exuberance

As the market accelerates to the upside the thrill phase begins. Enthusiasm sets in as profits increase substantially, transitioning to exuberance as investor confidence goes through the roof.

Euphoria

Then comes the last and final uptrend stage, Euphoria, which is when profits come so easy that most traders and investors feel that they must take on leverage and begin to ignore simple risk management principles. Although on the surface it seems like nothing can go wrong, the reality is that this is the point of maximum risk in the cycle. This easy money phase of the market makes many blind with greed. This period is where institutional investors take advantage of that greed as there are plenty of willing buyers which produces tons of liquidity allowing them to unload (sell) a lot of stocks.

Emotional Stages of a Down Trend in the Market

Anxiety

As the new pool of buyers begins to diminish the market starts to rollover. Initially it looks like another garden-variety pullback, that is, until the market fails to take out the prior high watermark and the prior lows are breached. This kicks off the anxiety phase of the cycle as some of those easy profits begin to not be so easy anymore. In addition, some of the earlier gains begin to slowly evaporate.

Denial & Fear

The denial phase begins as investors start to rationalize their decisions for holding on to losing trades. They feel that they are invested in good companies and profits will come back if they hold on long enough. As the market continues lower and the losses continue to mount, denial turns into fear that causes paralysis and confuses traders and investors into doing nothing (like a deer in the headlights).

Despair & Panic

The persistent selling produces a sense of desperation among traders and investors as their resolve to hold on for the long term starts to crack. It doesn’t take that much time for panic to set in, as the terrible reality of what the losses mean for every trader becomes too much to bear. This is the most emotional phase as the pain becomes overwhelming.

Capitulation

With this intensified selling, traders and investors reach their breaking point. This is referred to as the capitulation or give-up phase in which traders and investors have to sell simply to relieve the excruciating pain they’re in. This is the point of maximum financial opportunity as the institutions are again having a field day because sellers are rampant as the they begin accumulating shares and buying futures as a recovery is likely forthcoming.

Discouragement & Dismay

Invariably, the market does recover after the majority have given up and that causes investors to become despondent and depressed as they realize that they have made a terrible mistake in selling near the lows. This phase is where many question whether they should be traders or in the markets altogether.

Hope

Finally, as the market slowly recovers, investors slowly become hopeful again and begin dipping their toes into the water. This happens only after a sustained rally is underway, of course, and the cycle begins again.

As of October 25, 2019, the S&P 500 is crossing all-time highs. Some would think that presently the market is in the euphoria phase but in actuality, a primary reason we’re moving higher is the fact that many market participants are actually under-invested. This is due to concerns over the China trade talks, Europe slowing and all of the negative factors affecting the economy. This puts us nowhere close to being in a euphoric state. However, sentiment can shift quickly and with the rising market, investors may start to feel like they’re missing out. This could lead to them putting money into the market.

If we succumb to the emotional roller coaster of investing and trading as pictured in the illustration, we’ll likely never reach our financial goals. Instead, implementing a low-risk, high probability strategy that helps us time the market and navigate through this emotional cycle is the best course of action. What do you think?

Until next time I hope everyone has a great week.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

Gold Price Annual Forecast: 2026 could see new record-highs but a 2025-like rally is unlikely Premium

Gold hit multiple new record highs throughout 2025. Trade-war fears, geopolitical instability and monetary easing in major economies were the main drivers behind Gold’s rally.

AUD/USD Price Annual Forecast: Is 2026 the year the Aussie breaks above 0.70? Premium

In a context where AUD/USD rate differentials, institutional credibility, and geopolitical dynamics are once again central, 2026 could mark a new phase in the balance of power between the Australian Dollar and the US Dollar.

USD/INR Price Annual Forecast: Indian Rupee could disappoint both optimists and pessimists alike in 2026 Premium

The Indian Rupee (INR) has seen a consistent depreciation against the US Dollar (USD) for the last several years and turned out to be the worst-performing Asian currency in 2025.

Top 10 crypto predictions for 2026: Institutional demand and big banks could lift Bitcoin

Bitcoin’s (BTC) adoption story is unraveling and the king crypto could see institutional demand return in 2026. Crypto asset managers like Grayscale are betting on Bitcoin’s rally to a new all-time high next year, and themes like Bitcoin as a reserve asset are emerging.

S&P 500 Price Annual Forecast: 2026 to benefit from decent growth as Trump runs it hot Premium

BlackRock, the world's largest asset manager, ran an online survey in early December asking respondents whether attractive returns for risk assets would continue for a fourth straight year in 2026.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.