My last article was called The Level One Blues. It described how to construct option positions in more than one way. This is useful if the option approval level assigned to you by your stockbroker is a low level. You can read more about what option approval levels are and what they mean in the last article. I’ll expand on the idea of synthetic options further here.

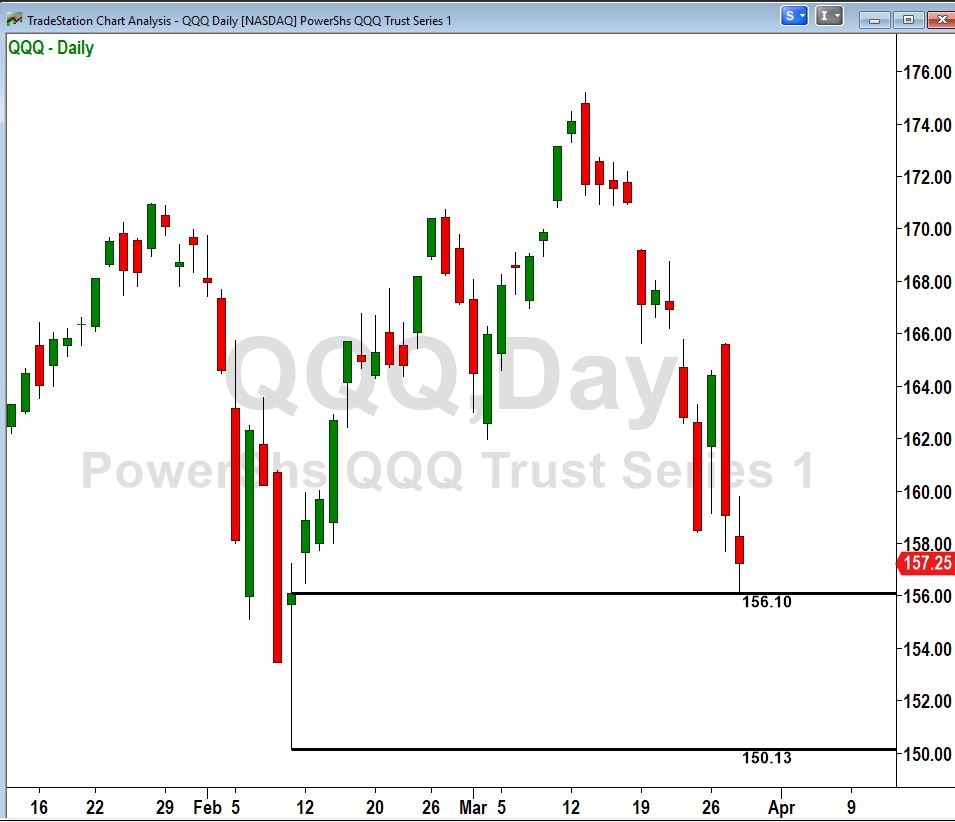

Below is today’s chart of QQQ, the exchange-traded fund for the NASDAQ 100 index. With multiple tech stocks having recent bad news, and other issues, the ETF had fallen quickly to around $157. There was an apparent demand zone just below, with a low around $150. Because of recent market price volatility, options were quite expensive.

Let’s say you believed that QQQ was not likely to drop below $150 in the next few weeks, and that you wanted to benefit from the current highly inflated option prices. A common strategy would be to sell (short) a put option at the $150 strike price. The 150 puts expiring in 22 days at that strike could be sold for $2.12 per share, or $212 per contract.

Each put option sold would obligate you to buy 100 shares of QQQ at $150 each, for a total of $15,000. But this obligation is only a contingent one. You would not actually be required to buy the stock unless it was below $150 when the options expired.

If you were correct about the price direction, and QQQ were to recover and remain above $150, then the put would not be exercised and it would be worth nothing when it expired. The $212 that you had received for selling it would be clear profit. On your $15,000 of cash tied up, this would be a profit of 212/15,000 or 1.41% in 22 days. This would be an annualized rate of return of 23.45%.

On the other hand, if the price of QQQ dropped below $150, and remained there at expiration, then you would be obligated to buy the shares of QQQ at $150 each, or $15,000 for the 100 shares. Your net cost per share would then be $150 paid, less the $2.12 received initially for selling the puts. $150 – $2.12 = $147.88 per share. If QQQ were anywhere above that price at expiration, you would have a profit. If not, you would have a loss.

Let’s say you liked these possible returns and decided to place the trade.

But your broker informed you that your brokerage account was only “approved for level 1.” You would not be allowed to place the trade, which requires a higher approval level (level 4 in this case).

This is where the idea of synthetic options comes in. Any option position can be synthesized by substituting a different type of option position.

In last week’s article, I gave the basic equation used when creating synthetic options positions. Quoting from that article:

These are the notations we will be using:

-

+S = Long 100 shares of the underlying Stock

-

-S = Short 100 shares of the underlying Stock

-

+C(x) = One long call option at strike X

-

-C(x) = One short call option at strike X

-

+P(x) = One long put option at strike X

-

-P(x) = One short put option at strike X

Here is a basic equation: +S + P(x) = C(x)

This translates to: 100 shares of stock plus one put at strike x equals one call at strike x.

In the above translation, equals means yields the same profit or loss in all conditions.

This equivalence is the result of a property of options that is called Put-Call Parity, as explained in the earlier article.

In today’s QQQ example, we would like to sell a put at the $150 strike. Our desired position, using the above notation, would be:

-P(150)

But we are not allowed to sell short puts. How else can this position be constructed?

We just need to do a little rearranging of the basic equation.

If it is true that: +S + P(x) = C(x)

then: -S -P(x) = -C(x)

Adding +S to both sides of the equation yields: -S +S -P(x) = +S – C(x)

Which simplifies to: -P(x) = +S – C(x)

Fine, but what is the point of all that algebra?

Well, +S -C(x) is a position that is long 100 shares of stock (+S), and also short one call (-C(x)). A position with long stock and a short call is a covered call, which is allowed in a level 1 option account.

In other words, if we buy 100 shares of QQQ at its current market price, and also sell one 150 call, that covered call position would yield the same profit or loss as simply selling a 150 put. In either case, the plan would be to hold the position until the April 20 expiration. At that time the position would be closed for its market value

These were the per-share market prices at the time of the example:

QQQ stock: $157.71

QQQ April 150 put: $2.12

QQQ April 150 call: $9.76

Here is the comparison of the two positions:

Capital Required to enter the position

Covered call: $15,771 to buy stock, less $976 received for the call, a net of $14,795.

Short put: $15,000 security required against the put, less $212 received for the put, net outlay of $14,788.

So, the two positions would require almost exactly the same capital ($14,795 vs $14,788).

Profit/Loss on the position

1. If the stock is flat at $157.71

Covered call: the stock will be called away and you will be paid $15,000. This is a $771 loss from your original stock price. But adding back the $976 originally received for the call, you have a net profit of $976 – 771 = $205.

Short put: The put is worthless. You keep the $212, which is your profit. This is $7.00, or just $.07 per share more than the profit on the covered call.

2. If the stock falls to $150 (or any price between $150 and $157.71)

Covered Call: your shares are not called away. You keep them with a value of $15,000. This is a loss of $771. But adding back the $976 originally received for the call, you have a profit of $976 – 771 = $205. This is the same as if the stock were flat.

Short put: The put is worthless. Again, you keep the $212, which is your profit, same as if the stock were flat.

3. If the stock rises to $160 (or any price above $157.71)

Covered call: the stock will be called away and you will be paid $15,000. This is a $771 loss from your original stock price. Adding back the $976 originally received for the call, you have a profit of $976 – 771 = $205. Same result as if the stock were flat.

Short put: The put is worthless. You keep the $212, which is your profit. Same result as if the stock were flat.

4. If the stock drops to $145 (or any price below $150)

Covered call: the stock will not be called away and you will still own it. Since your original cost was $14,795 and it is now worth $14,500, you have a loss of $295. In any case where the stock is at a price below your $147.95 per share net cost, you will have a commensurate loss.

Short put: The stock will be put to you, meaning that you will have to buy it and pay the $15,000 for it. Subtracting its current value of $14,500, that is a $500 loss. Adding back the $212 you were paid for the put, your net loss is $288. In any case where the stock is at a price below your $147.88 per share net cost, you will have a commensurate loss.

Note that in every case above, the net result of the covered call trade is the same as for the short put trade (except for the insignificant $.07 per share difference). This would be true no matter what the stock does.

So, if your desired position is either a short put or a covered call, they can be freely substituted for each other.

In this example, we wanted to do a short put and substituted a covered call. In other situations, it might be the other way around. For example, we might want to do a covered call on an underlying asset that can’t be owned, like a stock index. In this case, substituting a short put accomplishes the same thing as the desired covered call.

In these two articles, I’ve introduced the idea of synthetic option positions as a way to create desired positions in alternative ways. I hope you find them useful

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD hovers around nine-day EMA above 1.1800

EUR/USD remains in the positive territory after registering modest gains in the previous session, trading around 1.1820 during the Asian hours on Monday. The 14-day Relative Strength Index momentum indicator at 54 is edging higher, signaling improving momentum. RSI near mid-50s keeps momentum balanced. A sustained push above 60 would firm bullish control.

Gold sticks to gains above $5,000 as China's buying and Fed rate-cut bets drive demand

Gold surges past the $5,000 psychological mark during the Asian session on Monday in reaction to the weekend data, showing that the People's Bank of China extended its buying spree for a 15th month in January. Moreover, dovish US Federal Reserve expectations and concerns about the central bank's independence drag the US Dollar lower for the second straight day, providing an additional boost to the non-yielding yellow metal.

GBP/USD holds medium-term bullish bias above 1.3600

The GBP/USD pair trades on a softer note around 1.3605 during the early European session on Monday. Growing expectation of the Bank of England’s interest-rate cut weighs on the Pound Sterling against the Greenback.

Bitcoin, Ethereum and Ripple consolidate after massive sell-off

Bitcoin, Ethereum, and Ripple prices consolidated on Monday after correcting by nearly 9%, 8%, and 10% in the previous week, respectively. BTC is hovering around $70,000, while ETH and XRP are facing rejection at key levels.

Japan's Takaichi secures historic victory in snap election

In Japan, Prime Minister Sanae Takaichi's coalition secured a supermajority in the lower house, winning 328 out of 465 seats following a rare winter snap election. This provides her with a strong mandate to advance her legislative agenda.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.