I’m sure you’ve heard the term “Penny Stocks” before, but the question is, should you be trading penny stocks?

In this article, I’ll show you the pros and cons of trading penny stocks. This way, you can decide whether penny stock trading is for you, whether you can make money with penny stocks, and also, is it worth your time?

So let’s get started.

The Pros Of Trading Penny Stocks

Now, it’s very easy to find the pros of trading penny stocks because there are a lot of ‘Penny Stock Gurus’ constantly shining a spotlight on the few benefits they have.

1. You Can Start With As little as $1,000

One of the things that make penny stocks so popular is the fact is that you can start with very little capital. I would say at a minimum you could start with as little as $1,000.

Penny stocks by default are stocks that are worth less than $1. So most penny stocks are trading between $0.10 and $1.

So $1,000 would buy you 1,000 shares of stock, or if it is trading at $0.10 it is buying you 10,000 shares!

That’s quite a lot, right?

2. “Penny stocks can only go up”

So $1,000 would buy you 1,000 shares of stock, or if it is trading at $0.10 it is buying you 10,000 shares!

That’s quite a lot, right?

2. “Penny stocks can only go up”

Another pro is where they say, “It can only go up.”

And why is this? Well, think about it. If you can buy a penny stock for $0.10 or $0.20, what can happen?

I mean, it could possibly go to zero, but as you can see, the risk is limited because you’re buying this stock very cheap.

And this is where many people who promote penny stock trading say, “Well, you know what? It’s a good thing because, with so little room to the downside, it should only go up!”

3. “You can easily make 100x your investment”

I mean, it could possibly go to zero, but as you can see, the risk is limited because you’re buying this stock very cheap.

And this is where many people who promote penny stock trading say, “Well, you know what? It’s a good thing because, with so little room to the downside, it should only go up!”

3. “You can easily make 100x your investment”

Now, also talking about it can only go up, you can “easily”, based on what they say, make 100 times your investment.

Because think about it, if you’re buying it for $0.10 and it goes to $10 this would be 100 times your capital.

So if you start with $1,000 and you really catch one of the penny stocks that move from $0.10 to $10, you could make $100,000 out of $1,000.

I mean, this is what many people who promote penny stocks are leading you to believe. And it is true, right? If you catch one of these.

So that’s the other thing.

4. Small moves lead to big gains

Just in general, small moves in the penny stocks lead to big gains, and here’s why.

As I mentioned above, all penny stock is trading at or below $1. So even moving just a few cents can be big percentage gains.

For example, say the stock only moves from $0.10 to $0.50, you would 5x your money. And this is the kind of thing you hear a lot of the penny stock guys hyping up. The fact that these stocks are so cheap you can see massive percentage moves very quickly.

So as you can see, there is something that you could look at as pros to trading penny stocks. Or at least these are the common ones that the “gurus” are focusing on

The cons of trading penny stocks

Now, let’s talk about the cons.

What are the cons of trading penny stocks? Well, often when you’re trading penny stocks, it’s a pump and dump scheme.

Now, you might have heard about this, but I want to explain to you what that means, what a pump and dump scheme is.

And in order to do this, I want to actually show you some very specific examples. Let’s take a look at RobinTrack.

So RobinTrack is a website that actually tracks how many Robinhood users have a certain stock in their portfolio.

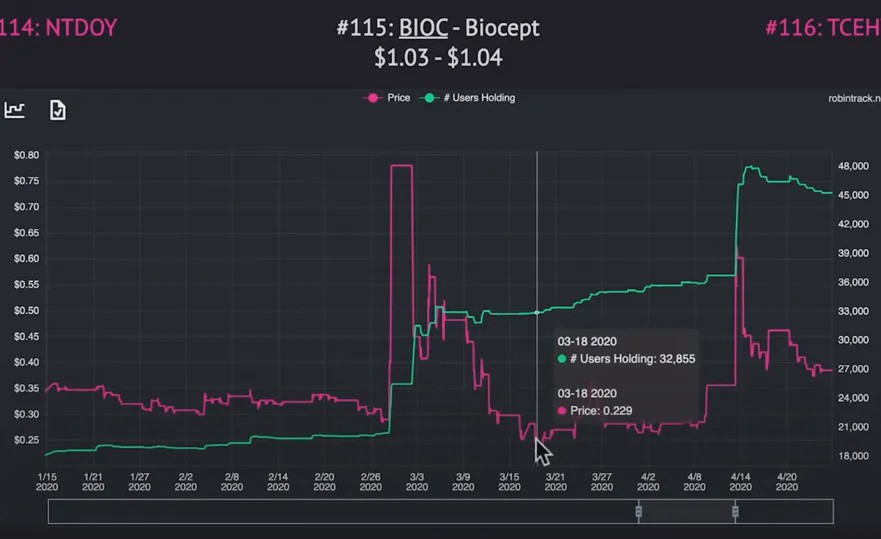

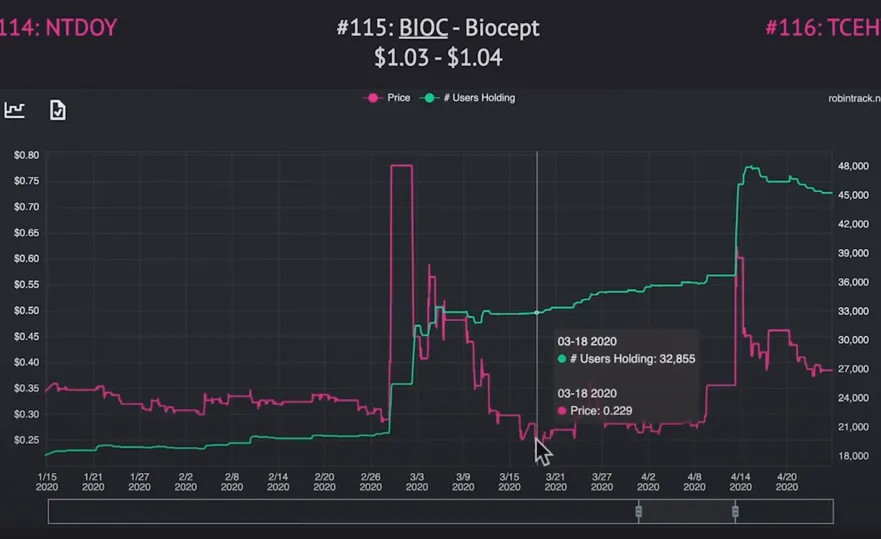

And one of the popular penny stocks that Robinhood users like to trade is BIOC, Biocept.

So you can see right now around 70,000 Robinhood users own BIOC (at the time the video was recorded).

More and more Robinhood users started putting Biocept into their portfolio.

Looking at the price, the red/pink line that you see is the current price, and the green line is the amount of Robinhood users who own this stock.

So I want to zoom in here, to earlier this year because I want to show you exactly what happened.

This stock was trading around $0.32. And so if it is trading around $0.32, again, it’s easy for the stock to double because all it needs to do is jump from $0.30 to $0.60 and it will be fine.

And as you can see, there is a day where this stock suddenly jumps up. It jumps from $0.28 all the way up there to $0.80.

So more than doubles. But here’s what happens, and this is why it is called a pump and dump scheme.

What does pump and dump scheme mean?

So obviously, some people said, “OK, you got to buy this.” I do believe that Biocept actually tweeted something around the coronavirus. Doesn’t really matter. This is when some people are jumping on it. But when do most people put this into their portfolio? After this initial jump is over.

You see right here, now that we have 32,000 Robinhood users having it in their portfolio, what happens afterward? The price goes back to this.

So why is this called a pump and dump scheme? Well, for a very simple reason. It is being pumped up.

These penny stocks are not traded at a regular exchange. These penny stocks are traded OTC, over the counter, so they are a little bit riskier. There are also fewer regulations for these penny stocks.

I don’t want to say that Biocept did it, I’m just using this as an example, but very often a company is actually paying people to send e-mails to thousands, and ten thousands, and hundreds of thousands of people and saying, “Hey, we have a stock that is really interesting.”

So what do you think? Do insiders buy the stock before they send the e-mail or after they sent the e-mail? Before the e-mail, of course, right? And this is why it’s called a pump. They’re pumping it up and then as soon as many users are buying it, then they’re dumping it, and this is where often users who are buying penny stocks are being caught buying it at the high.

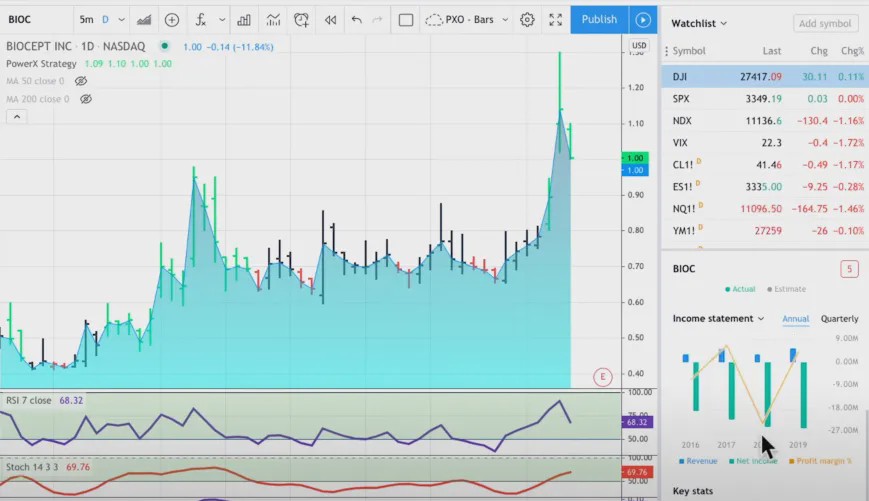

I want to talk a little bit more about Biocept here. So let’s take a look at this stock.

As you can see, BIOC right now is trading at $1. It just recently, just a few days ago, jumped dramatically up again. So it’s being pumped up and as you can see then being dumped.

Now, let’s take a look at their earnings. Here is their annual income statement. You see it right here. So for the past four years, they have failed to make a profit.

So why would you buy a stock that has been losing and losing and losing and losing? I know, now you might say, “Hey, Tesla did the same thing and it is worth a lot right now.” Hey, every now and then it works. But most of the time when you see this here, you can look at the last four quarters.

The losses are accelerating. They are making a loss between six and nine million dollars every quarter, so it’s probably not worth a whole lot. So this is where you see the pump and dump scheme here at its best.

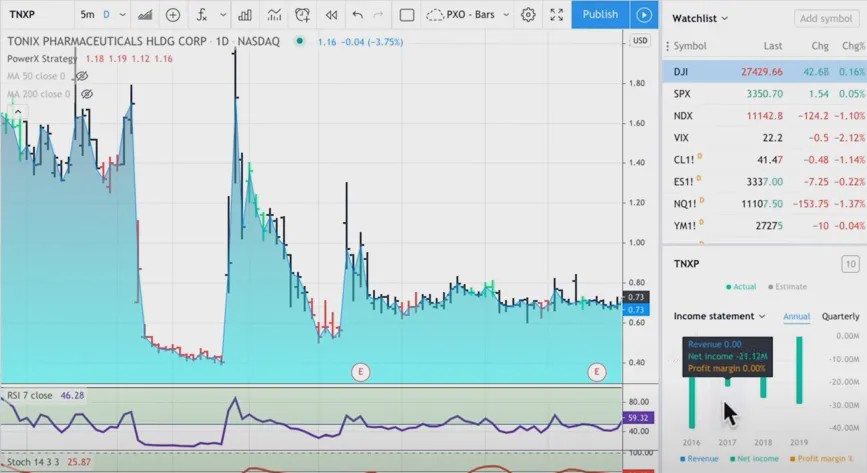

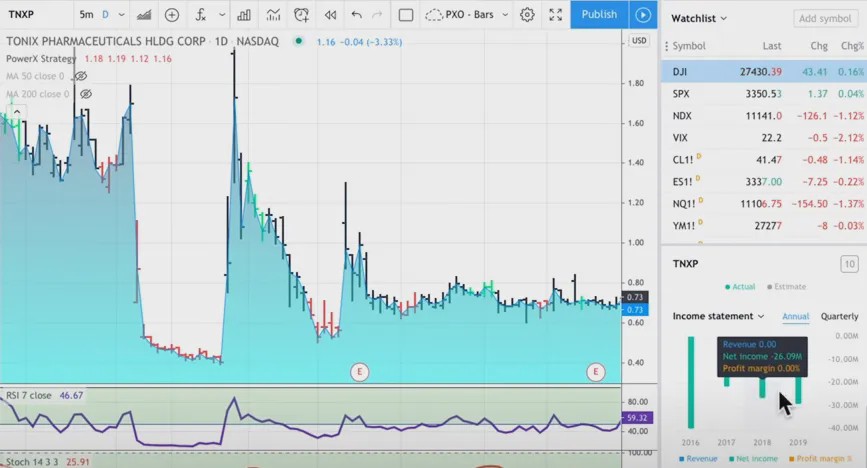

Now, let me show you another penny stock that’s very popular also amongst Robinhood users. It is TNXP. You can already see on the chart how the pump and dump works.

You see, here is where some insiders are buying it before they’re hyping it up. So they’re buying it here around $0.50, maybe $0.60. Then it is being hyped up often by spreading fake news or sending out hundreds of thousands or millions of e-mail.

It’s quickly jumping up from $0.58, all the way to $2.40. This is when the smart people who bought it before they sent the e-mails dump it when they quadrupled or quintupled their money. Then, as you can see, it comes quickly down.

Here’s another example. You see these spikes? Often when you see these, they are very typical for a pump and dump scheme. Some people are buying it before, then they’re spreading fake news or they pay people to send out hundreds of thousands of emails.

This is where it quickly jumps from $0.40 to what? Almost $2 here and then quickly comes back. Another e-mail blast. Boom. Pump and dump.

So let’s take a look at the financials here and then I’ll give you a summary of what I think you should do and how you could possibly make money trading penny stocks here.

Taking a look at the financials, you will see very similar results here. So the net income, what you see in green is actually negative.

It’s minus 40 million in 2016.

Minus 21 million in 2017.

Minus 26 million in 2018, and if you look at the quarterly, you see it’s not getting better. They’re also burning through 6 to 9 million dollars every single quarter. So be aware when you are trading penny stocks that often you could fall for a pump and dump scheme.

Summary

So first of all, when trading penny stocks most of the time, keep this in mind, you are gambling.

And this is where most people just say, “Yeah, you know what? I put $500 into this or $1,000 and if it works out, then I’m 5x, 10x, 100x my money here.”

So the approach that most people who are trading penny stocks are using is the so-called spray and pray approach.

This means they’re buying a lot of them and all that needs to happen is that one of them is actually taking off here.

Now, take a look at the financials, because you will see that most penny stocks are junk.

You see, if they have been producing losses over the past four years I doubt that this would be the year where it suddenly turns around.

Anyhow, every now and then, absolutely, you can catch a winner, but I think the odds are against you.

Now, you know me, I’m a big fan of that especially if you want to trade a small account, so if you don’t have a lot of money, consider trading options.

Trade options on regular stocks, because options also often only cost $0.50, $0.75, $1 so you can trade options and trade regular stocks.

Has this been helpful so that you know a little bit more of what is behind penny stocks, or should you be trading penny stocks?

If you enjoyed this, feel free to leave a comment below.

Trading Futures, options on futures and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. The lower the day trade margin, the higher the leverage and riskier the trade. Leverage can work for you as well as against you; it magnifies gains as well as losses. Past performance is not necessarily indicative of future results.

Editors’ Picks

EUR/USD looks sidelined around 1.1850

EUR/USD remains on the back foot, extending its bearish tone and sliding towards the 1.1850 area to print fresh daily lows on Monday. The move lower comes as the US Dollar gathers modest traction, with thin liquidity and subdued volatility amplifying price swings amid the US market holiday.

GBP/USD flirts with daily lows near 1.3630

GBP/USD has quickly given back Friday’s solid gains, turning lower at the start of the week and drifting back towards the 1.3630 area. The focus now shifts squarely to Tuesday’s UK labour market report, which is likely to keep the quid firmly in the spotlight and could set the tone for Cable’s next move.

Gold loses momentum, eases below $5,000

Gold is giving back part of Friday’s sharp rebound, deflating below the key $5,000 mark per troy ounce as the new week gets underway. Modest gains in the US Dollar are keeping the metal in check, while thin trading conditions, due to the Presidents Day holiday in the US, are adding to the choppy and hesitant tone across markets.

Bitcoin consolidates as on-chain data show mixed signals

Bitcoin price has consolidated between $65,700 and $72,000 over the past nine days, with no clear directional bias. US-listed spot ETFs recorded a $359.91 million weekly outflow, marking the fourth consecutive week of withdrawals.

The week ahead: Key inflation readings and why the AI trade could be overdone

It is likely to be a quiet start to the week, with US markets closed on Monday for Presidents Day. European markets are higher across the board and gold is clinging to the $5,000 level after the tamer than expected CPI report in the US reduced haven flows to precious metals.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.