What one thing stands out to you:

From all trades made between 11 and 3 on Monday?

Not sure?

You'll see in a sec.

But first some context...

I gained vital skills from training at a professional trading firm.

But the trading process I use today also evolved out of overcoming deficiencies.

You see:

I bet you're a bit like me.

Because this particular deficiency is also a significant obstacle for most people.

Yet no matter how much effort I put into analysis and trade idea generation — my timing was way off. Know the feeling?

What happens next?

When your timing is off you suffer any/all of the following:

-

Your trade goes into the red. Maybe deep into the red.

-

You take a loss. And another. But even if that trade eventually works — it doesn't offset the initial losses. Agree?

-

Or you're stopped out and miss out on the move when it finally happens.

-

And let's not forget the ubiquitous trap of adding to a loser to improve your average price. But you know how this turns out. Right? And It's responsible for more accounts blowing up than all other factors combined.

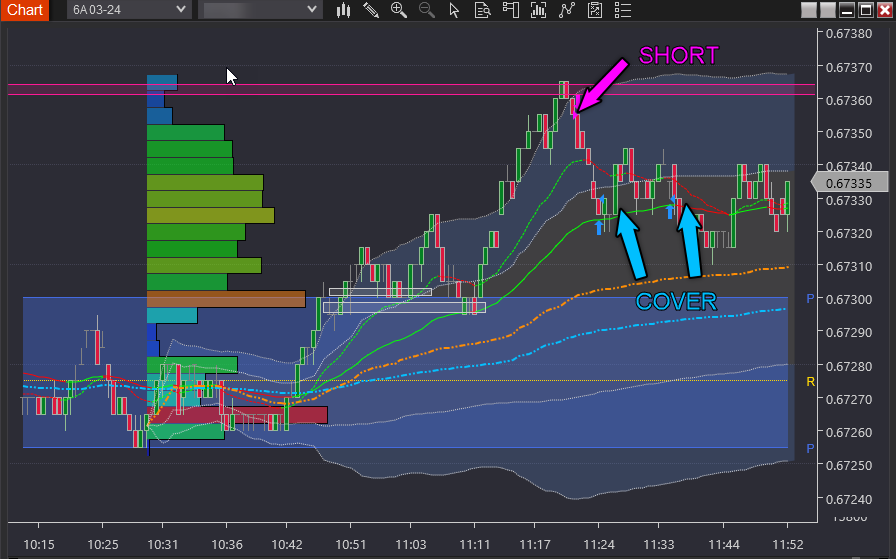

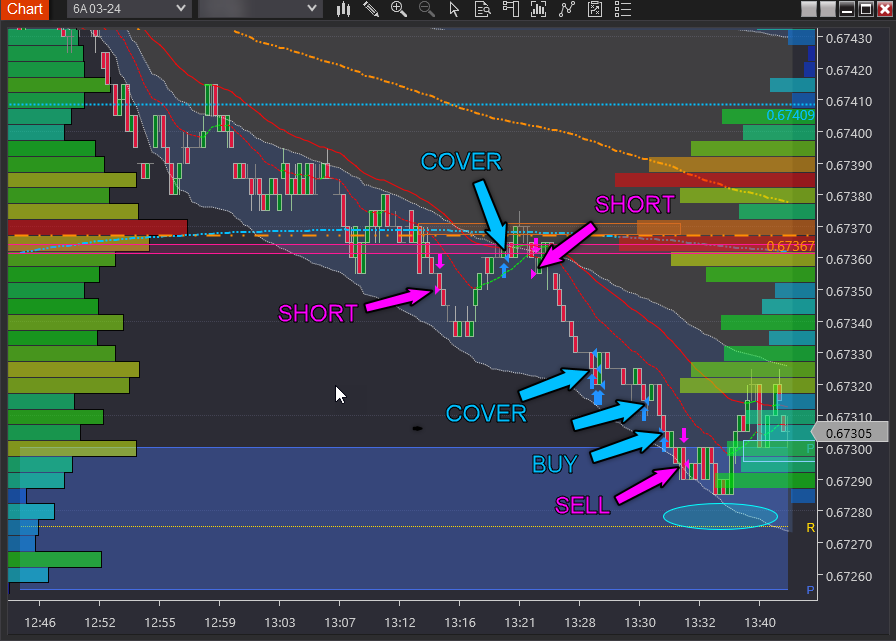

Now looking at the trades again — see how none of the winning entries move against you?

Even the losing trade goes your way to start with — so the actual loss is very small.

This is exactly how you want your trades to behave. True?

Because it's exactly how you overcome giving back your winners in the form of losers. Correct?

So how do you do it? Tell you in a minute.

But let's start with what it's not and bust some myths about trading.

-

It's NOT technical analysis.

-

It's NOT 'price action'

-

It is NOT having access to information or indicators that predict the future.

The answer is it boils down to these three components:

-

Game planning.

-

Playbook trades.

-

Multiple points of evidence.

Now:

To perform all three components requires proficiency in 20 trading skills.

But for professions — including trading — proficiency in 20 skills isn't excessive. Agree?

But here's the thing:

You won't find a YouTube video or free download teaching you these skills.

Why?

Because they belong to the realm of genuine professionals.

Take a moment to ask yourself...

Are you blind to your potential?

For most people, if they never get the chance to develop the necessary expertise — honing the skills listed above — they may never discover their true trading potential. Agree?

And what about you?

What's your trading potential? What's your potential if you could learn the expertise required to realise it?

You know:

In sports, if you haven't had a real opportunity to discover your potential at a young age — having had the benefit of first-class expertise and training — you're soon too old ever to know what could have been. Right?

But trading is a mental sport.

One which requires mental skills which improve with age — as scientific research proves.

So there's no reason to miss out on finding out your true potential. All it requires is training and guidance over a 9-12 month period from a market professional skilled at imparting these skills.

Discover the advantages of trading over the age of 50

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

EUR/USD Price Annual Forecast: Growth to displace central banks from the limelight in 2026 Premium

What a year! Donald Trump’s return to the United States (US) Presidency was no doubt what led financial markets throughout 2025. His not-always-unexpected or surprising decisions shaped investors’ sentiment, or better said, unprecedented uncertainty.

Gold Price Annual Forecast: 2026 could see new record-highs but a 2025-like rally is unlikely Premium

Gold hit multiple new record highs throughout 2025. Trade-war fears, geopolitical instability and monetary easing in major economies were the main drivers behind Gold’s rally.

GBP/USD Price Annual Forecast: Will 2026 be another bullish year for Pound Sterling? Premium

Having wrapped up 2025 on a positive note, the Pound Sterling (GBP) eyes another meaningful and upbeat year against the US Dollar (USD) at the start of 2026.

US Dollar Price Annual Forecast: 2026 set to be a year of transition, not capitulation Premium

The US Dollar (USD) enters the new year at a crossroads. After several years of sustained strength driven by US growth outperformance, aggressive Federal Reserve (Fed) tightening, and recurrent episodes of global risk aversion, the conditions that underpinned broad-based USD appreciation are beginning to erode, but not collapse.

Bitcoin Price Annual Forecast: BTC holds long-term bullish structure heading into 2026

Bitcoin (BTC) is wrapping up 2025 as one of its most eventful years, defined by unprecedented institutional participation, major regulatory developments, and extreme price volatility.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.