Keep reading to discover trading methods to avoid psychological hurdles using recent trading to illustrate...

We've all experienced the difficulty of piecing together a jigsaw puzzle.

Now imagine attempting that puzzle without ever seeing the final picture. It becomes daunting lacking the guiding vision necessary to piece it together.

When executed properly your game plan projects a vision of the market's future movements—eliminating the daunting prospect of trading blindly.

It's not some 'black-box' approach you can glean from a book or video. Accurate game planning takes a problem-solving approach.

Vital for trading success did you know this skill is well-suited to mature individuals as the brain excels at problem-solving in later stages of life?

Just as surgeons refine their skills by following evidence-based practices, your game plan succeeds by following evidence-based processes.

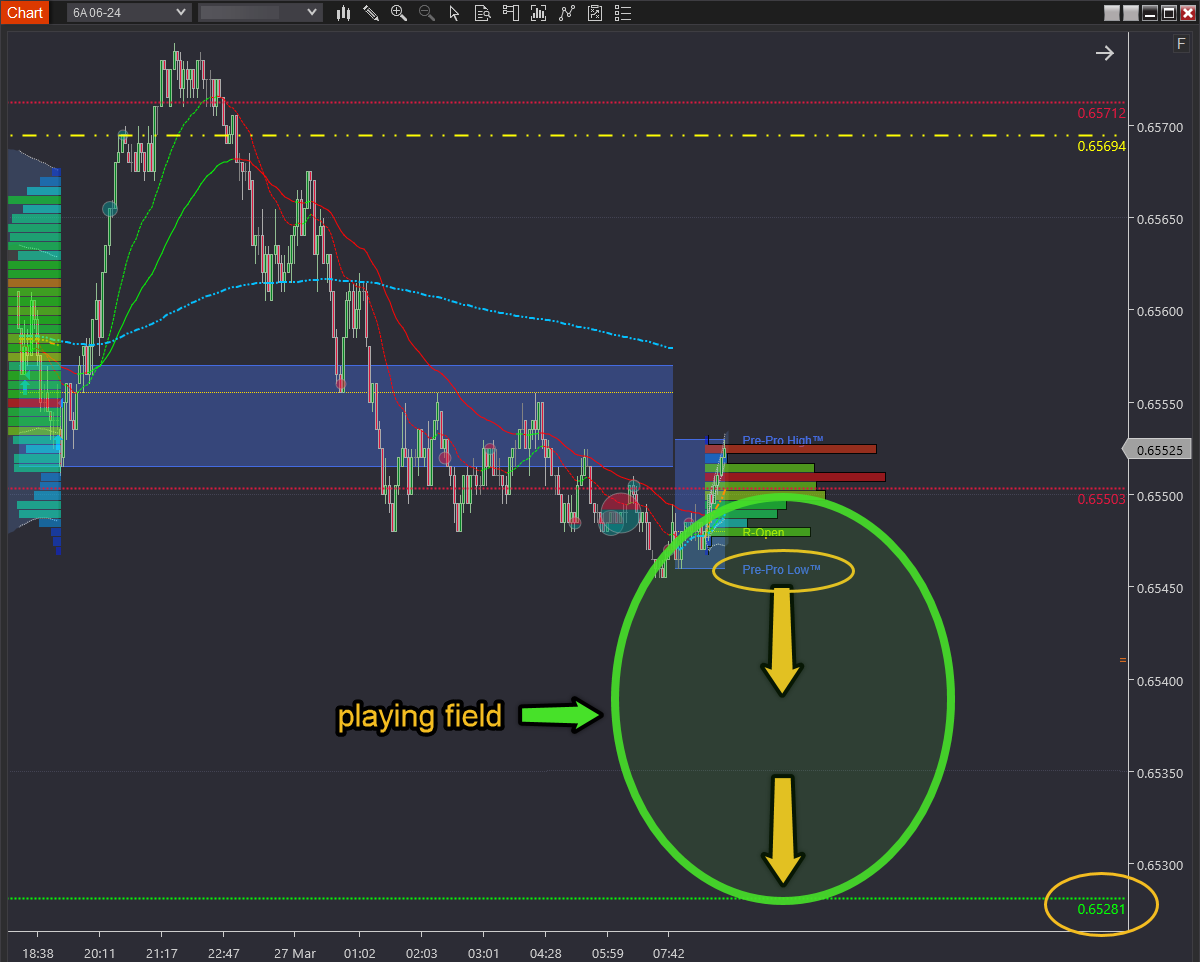

The game plan indicated the market would move from the Pre-Pro-Low to the 'transition' at 0.6528, so we'll trade this scenario.

Why not enter now?

On the surface it seems straightforward. Trading a movement like the one described is often depicted as entering the market, setting a stop loss and profit target, and ensuring a favourable risk-to-reward ratio like 1:3 or 1:5. Then you're all set.

But when you attempt this method, you discover that rewards are few while losses are common—hence the saying, "You win some you lose more." Sound familiar?

If there were a simplified version of trading akin to Monopoly that even grade schoolers could understand, it might look something like this.

However, trading is highly competitive, like Premier League competition, where profitable strategies are closely guarded.

What else comes to mind when you imagine a surgeon practising their craft. Precision. Agree?

Surgical precision also applies to timing your trades. Of the many ways prices move, only specific 'price personalities' enable precise and timely trade execution—much like a skilled surgeon performing a meticulous procedure. But before we dive in:

Let's play a game

Consider your trade size is 20 lots. For each basis point movement in price, your account fluctuates by USD 200. For instance, a 10-basis point shift translates to a USD 2000 change in your account balance. Looking at the chart below, would you enter short now?

How about now?

Or should you go short now?

If you'd held your short from the pink arrow, you'd be down approximately USD 1000, a little better than the USD 1600 you were down minutes earlier.

But it could get much worse from here. Correct? You'll see what happened in a minute.

But before you see the trades, in fairness, that was a 'loaded' game.

Merely showing you a chart gave you as much chance of winning as you have of winning a call of "tails" on the flip of a double-headed coin.

In the trading below the chart shows the execution precision only in hindsight. But using charts alone it's impossible to replicate precise entries in real time. I should know—the trades below are mine.

What observations can you make about the following trades?

-

The first short attempt initially moved in my favour before being closed for a minimal loss (1 bps).

-

The second trade is a long position—half closed for a small profit and half exited at the same entry price.

-

The third trade involves two entries at different prices. When there is no risk of the overall trade losing money, the trade size increases through additional positions.

Did you notice none of the trades initially moved into the red zone? How much more confident would you be if your trading followed a similar pattern?

Why use the approach I do?

I employ an approach that avoids common challenges traders face including:

-

It's consistently effective not just during specific market cycles.

-

It mitigates significant drawdowns.

-

It caps losses to 'papercuts'—easy to execute, unlike deer-in-the-headlights-sized losses.

-

It allows you to increase your payout without taking more risk (similar to the trade above).

-

It relies on evidence-based processes that you can reliably follow.

-

It demands a continuous state of engagement, reducing the chance of psychological sabotage.

-

Through its repetitive nature, it fosters self-regulation while organically building your confidence.

As for the 'how,' that's where investing in professional mentoring and ongoing reviews comes in to avoid the frustration and aggravation of years of experiencing the challenges mentioned earlier.

Trading that has your back

Amid market uncertainties facing fewer challenges naturally fosters a cool and calm disposition.

With an evidence-based approach staying engaged and connected to the market becomes second nature.

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

EUR/USD Price Annual Forecast: Growth to displace central banks from the limelight in 2026 Premium

What a year! Donald Trump’s return to the United States (US) Presidency was no doubt what led financial markets throughout 2025. His not-always-unexpected or surprising decisions shaped investors’ sentiment, or better said, unprecedented uncertainty.

Gold Price Annual Forecast: 2026 could see new record-highs but a 2025-like rally is unlikely Premium

Gold hit multiple new record highs throughout 2025. Trade-war fears, geopolitical instability and monetary easing in major economies were the main drivers behind Gold’s rally.

GBP/USD Price Annual Forecast: Will 2026 be another bullish year for Pound Sterling? Premium

Having wrapped up 2025 on a positive note, the Pound Sterling (GBP) eyes another meaningful and upbeat year against the US Dollar (USD) at the start of 2026.

US Dollar Price Annual Forecast: 2026 set to be a year of transition, not capitulation Premium

The US Dollar (USD) enters the new year at a crossroads. After several years of sustained strength driven by US growth outperformance, aggressive Federal Reserve (Fed) tightening, and recurrent episodes of global risk aversion, the conditions that underpinned broad-based USD appreciation are beginning to erode, but not collapse.

Bitcoin Price Annual Forecast: BTC holds long-term bullish structure heading into 2026

Bitcoin (BTC) is wrapping up 2025 as one of its most eventful years, defined by unprecedented institutional participation, major regulatory developments, and extreme price volatility.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.