What’s the Worst that Could Happen?

While global Central Banks are not cutting rates yet, their synchronized rate-hike-hiatus has made it a very real possibility heading into 2020. If that happens, the beloved carry trade will fade off into the sunset as the market punishes traders that didn’t protect their downside. Some would argue that there is still room to run in this cycle (and they may be right), but the increasing risks of implosion certainly warrant a more prudent approach to the carry trade.

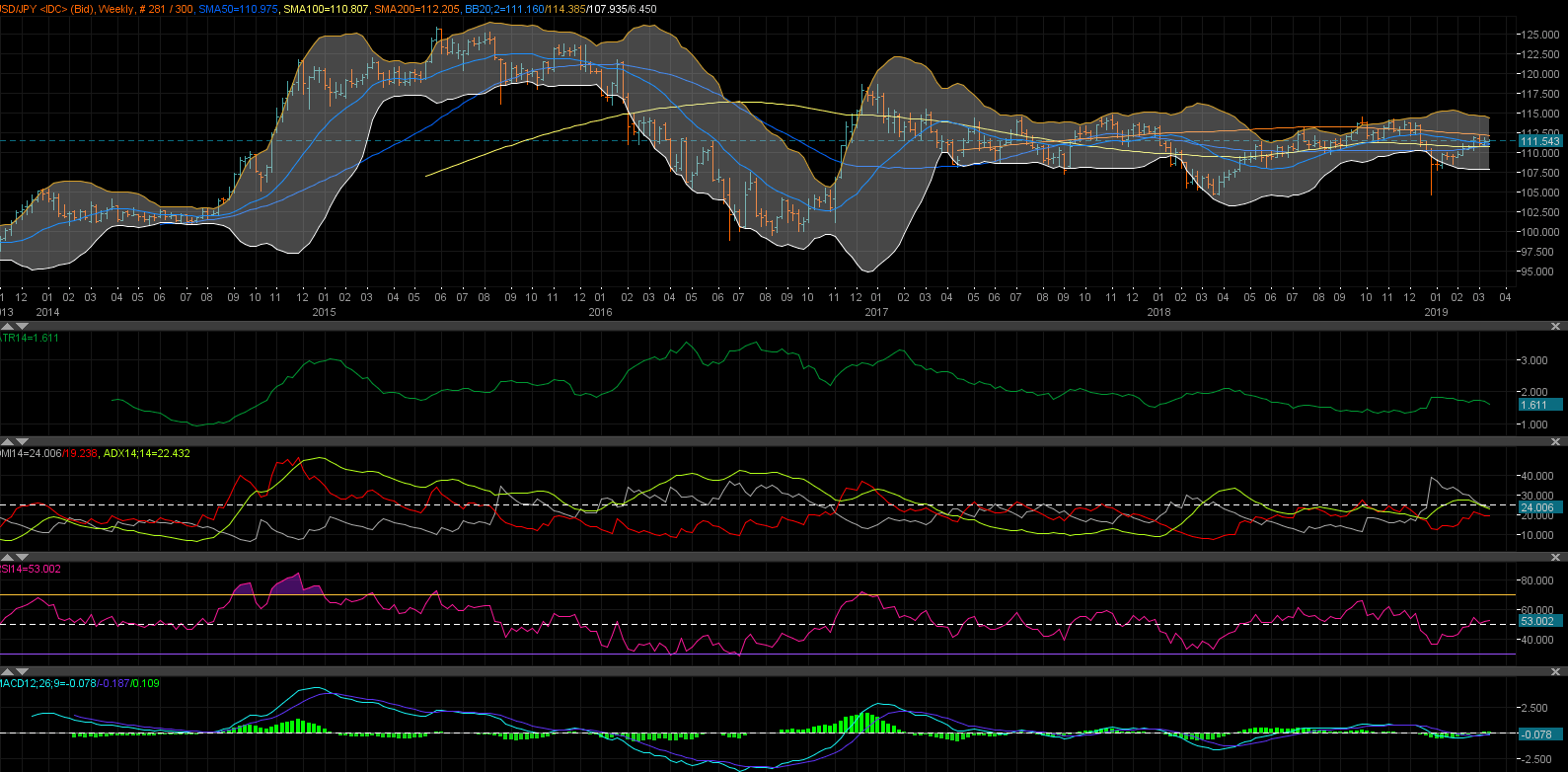

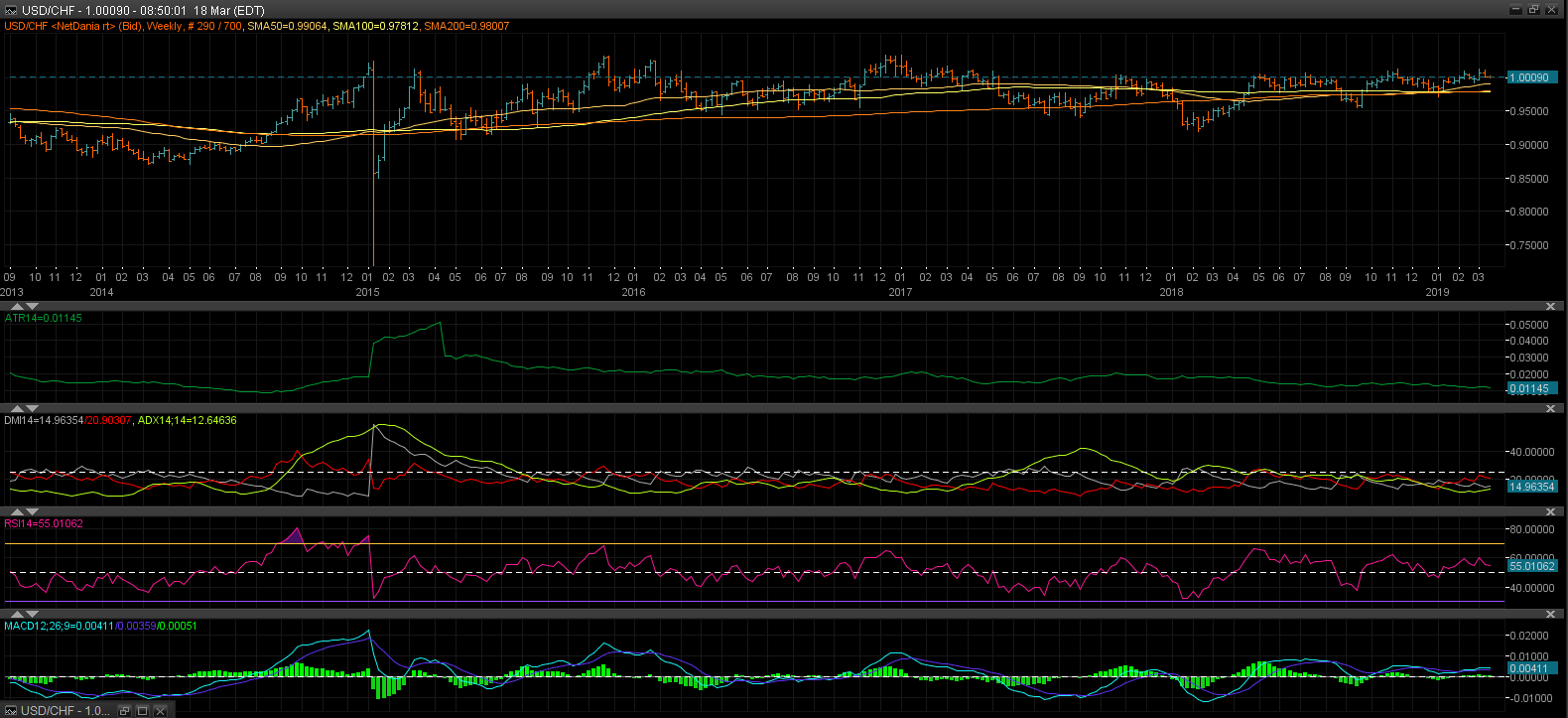

Long USD/JPY and Long USD/CHF have been the most popular carry trades during the most recent tightening cycle and should remain that way if US Dollar strength and low FX volatility persists. But what happens if that changes?

If we do see the end of the tightening cycle, you will likely see liquidation begin in these positions. As most of the early exiting will come from hedge funds and other large traders, the crash could be fast and furious. The implosion is further exacerbated by the high degree of leverage in FX markets, and those who are late to the party will be in a world of pain. Once the loss on the position exceeds the average annual yield from the carry, the trade is toast.

Figure 1 - USD/JPY Weekly Chart (NetDania)

Figure 2 - USD/CHF Weekly Chart (NetDania)

Protecting the DownsideThose who are not ready to take money off the table should at least be looking to protect it. Novice traders often find themselves in a single carry trade without being hedged, which is how trouble starts. Experienced traders instead own a portfolio of carry trade positions that lowers risk through diversification. This is great if you see a drop in just a single pair, but the others move in your favour. But this alone won’t insulate you from downside risks of a broad USD selloff. This is where options come in.

calls are worth a look. The trick is finding an OTM option with a low enough premium that it doesn’t eat up your carry profits, but not to far OTM that the protection is insufficient against devastating spikes in JPY or CHF.

Another strategy that has gained traction is selling puts rather than buying calls. When Put sales are combined with a carry trade, you get additional yield from the premium. This is great in low volatility environments, but if central banks stop tightening there will be downside risks. It is more prudent to hedge these with a collar strategy to reduce costs of hedging, but you will be forgoing some upside.

Figure 3 - USD/JPY Forecast Poll (FXStreet)

Figure 4 - USD/CHF Forecast Poll (FXStreet)

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD: Fed calm, ECB steady, but the Dollar still leads Premium

EUR/USD is still struggling to find real traction. The pair has tried to stabilise, but momentum keeps fading, leaving the door open to further weakness.

Gold: Falling US yields, geopolitics help XAU/USD hold ground Premium

Gold (XAU/USD) gained traction and climbed above $5,200, ending the fourth consecutive week in positive territory. The next round of US-Iran talks and crucial macroeconomic data releases from the US will be watched closely by market participants in the short term.

GBP/USD: Will Pound Sterling defend key 1.3450 support ahead of US jobs data? Premium

The Pound Sterling (GBP) entered a bearish consolidation phase against the US Dollar (USD), after having tested critical support near the 1.3450 level on several occasions.

Bitcoin: Another month of losses, and it’s been five

Bitcoin (BTC) price is stabilizing around $68,000 at the time of writing on Friday, but the Crypto King is poised to close February on a fragile footing, marking its fifth consecutive month of losses since October and a rare start to the year with back-to-back monthly corrections.

US Dollar: At a crossroads; Fed steady, tariffs in flux Premium

The US Dollar’s (USD) upward momentum from the previous week seems to have encountered a tough nut to crack in the 98.00 region, as measured by the US Dollar Index (DXY).

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.