Behavioraleconomics and its principally related twin, behavioral finance, seeks to combine psychological theory with conventional economics and finance to provide explanations for why people make irrational financial decisions. This year, behavioral economist Richard Thaler won the Nobel Prize. His work in describing how we think about money is monumental and has large implications for currency traders who are looking for a psychological edge to beat the market. Thaler isn’t the first person to earn the highly coveted award for contributions toward the trendy sub-field of behavior economics. Daniel Kahneman an Israeli-American psychologist won the award in 2002 for his paradigm-shifting work onhuman judgment and decision-making under uncertainty. Along with Amos Tversky, Kahnemanoutlinedsome of these psychological processes in developing prospect theory - a description of how people choose between different options (or prospects) and how they estimate, many times in a biased or incorrect way, the perceived likelihood of each of these options.

Prospect theory should be considered mandatory reading for any serious currency trader with special attention given to understanding ‘loss aversion;’ a description of the concept where people prefer avoiding losses to acquiring equivalent gains: it's better to not lose $5 than to gain $5.When traders close winning trades early,but then patiently wait as long as necessary to avoid closing losing trades, this is known as the disposition effect and it is a form of loss aversion. From novice to experienced traders,the disposition effect is probably the most ruinous anomaly and to avoid this effect from negatively affecting performance, behavioral economists recommend periodically selling underperforming assets or placing stringent time limits forallowing positionsto remain open.

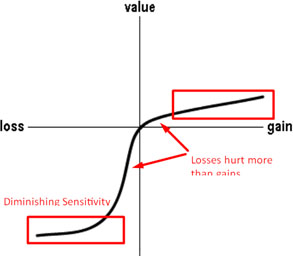

Within prospect theory, another described effect applicable to currency traders is a diminished sensitivity to gains and losses. The effect can be measured through a ‘value function’ given to gains and losses accrued from starting reference point (please see diagram below). Diminishing sensitivity means that people's sensitivity to further changes in gains/losses is smaller for accrued profit/loss positions that are further away from the reference point. For example, if a currency trader over the course of a year accrues $50,000 profit from a starting balance of $10,000, the next $1000 profitable trade will not be ‘felt’ to be worth as much as the profitable $1000 earned at the beginning. In addition to overconfidence, this effect may explain why successful traders get sloppy over time and deviate from refined and lucrative strategies. Periodically renewing a commitment to a strategy and adjusting it as necessary is a way to mitigate the bias of diminished sensitivity for gains/losses.

Basic knowledge of behavioral economics can contribute to your success as a trader in numerous ways. As noted above, Kahneman and Tversky’s prospect theory can contribute to better trading psychology and applicableconceptsthat can be tacked on to existing strategies relatively easily. In part 2, I will describe how some of Thaler’s award-winning findings can benefit even the most rookie of traders.

All essays, research and information found above represent the analysis and opinion of Leverate only. As such it may prove wrong and be a subject to change without notice. Opinions and analysis were based on data available to the author of the respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Leverate does not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Leverate is not a Registered Securities Advisor. By reading Leverate’s reports you fully agree that they will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investment trading and speculation in any financial markets may involve risk of loss.e risk of loss.

Editors’ Picks

AUD/USD defends gains below 0.7100 amid the Fed-RBA divergence

AUD/USD attracts some dip-buyers near mid-0.7000s during the Asian session on Monday, stalling last week's modest pullback from a three-year peak. The US Dollar continues with its struggle to attract any meaningful buyers amid bets for further rate cuts by the Fed, bolstered by the softer US CPI report on Friday. In contrast, the Australian Dollar retains a bullish bias on the back of the RBA's hawkish stance, which further acts as a tailwind for the currency pair.

USD/JPY stays firm around 153.00 after Japan's Q4 GDP miss

USD/JPY kicks off the new week on a positive note as Japan's weak Q4 GDP growth tempers bets for an immediate BoJ rate hike and undermines the Japanese Yen. Investors, however, seem convinced that the BoJ will stick to its policy normalization path amid hopes that PM Takaichi's policies will boost the Japanese economy. In contrast, cooling US consumer inflation reaffirmed bets for more Fed rate cuts in 2026, which acts as a headwind for the US Dollar and should cap the currency pair.

Gold buyers hesitate amid holiday-thinned trading

Gold trades volatile, but within range, as US, China holidays-led thin trading exaggerates moves. The US Dollar extends range play into the US GDP week, with markets pricing at least two Fed rate cuts this year. Technically, Gold tests key support at $5,000; daily RSI still remains bullish.

Top Crypto Losers: Dogecoin, Zcash, Bonk – Meme and Privacy coins under pressure

Meme coins such as Dogecoin and Bonk, alongside the privacy coin Zcash (ZEC), are leading the broader market losses over the last 24 hours. DOGE, ZEC, and BONK ended their three consecutive days of recovery with a sudden decline on Sunday, as crucial resistance levels capped the gains. Technically, the altcoins show downside risk, starting the week under pressure.

Global inflation watch: Signs of cooling services inflation

Realized inflation landed close to expectations in January, as negative base effects weighed on the annual rates. Remaining sticky inflation is largely explained by services, while tariff-driven goods inflation remains limited even in the US.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.