Are you always trying to find the most accurate head and shoulders chart pattern or always looking for the correct way on how to draw the proper resistane line/ support line? Let me tell you a secret: the market has a lot of Market Makers or Instutional Traders who set up traps on the version of chart pattern that you are reading with, they know retail traders like reading chart pattern and draw trendlines, and they will force you to close at a price that that you do not want to (hunt for your stop-loss order), thus generally, you need to give extra buffer that the market might not be reacting the way that you think the market should.

Generally speaking, if you are looking for chart pattern to trade, the most consistent, and hence, the most profitable chart pattern is the Butterfly Harmonic Pattern or called Gartley 222 Pattern or ABCD Pattern as well.

There is one simple reason why the ABCD Pattern works better than the other chart pattern. whatever it is Double Top Pattern, Double/ Triple Bottom Pattern, U Shape Bottom, Cup and Handle, Ascending Triange, you name it.

The simple reason is there is a Mathmatics or golden ration guiding how you draw the trendlines in the Butterfly Harmonic Pattern. Yes each trendline/ Price Pattern is required to match the 0.236 0.383 or 0.628 ratio of previous movement, hence it is unlike Hands and Shoulder or Decending Triangle that you can connect whatever Bottoms you feel like as the market support line.

and yes, there are some Simple Math which works behind the market. so stop draw non-math backed resistant and support line that gives ambiguous signal, and follow us to learn how simple Math is workling implicitly in side the market so that you can consistently win from the market at www.gannexplained.com

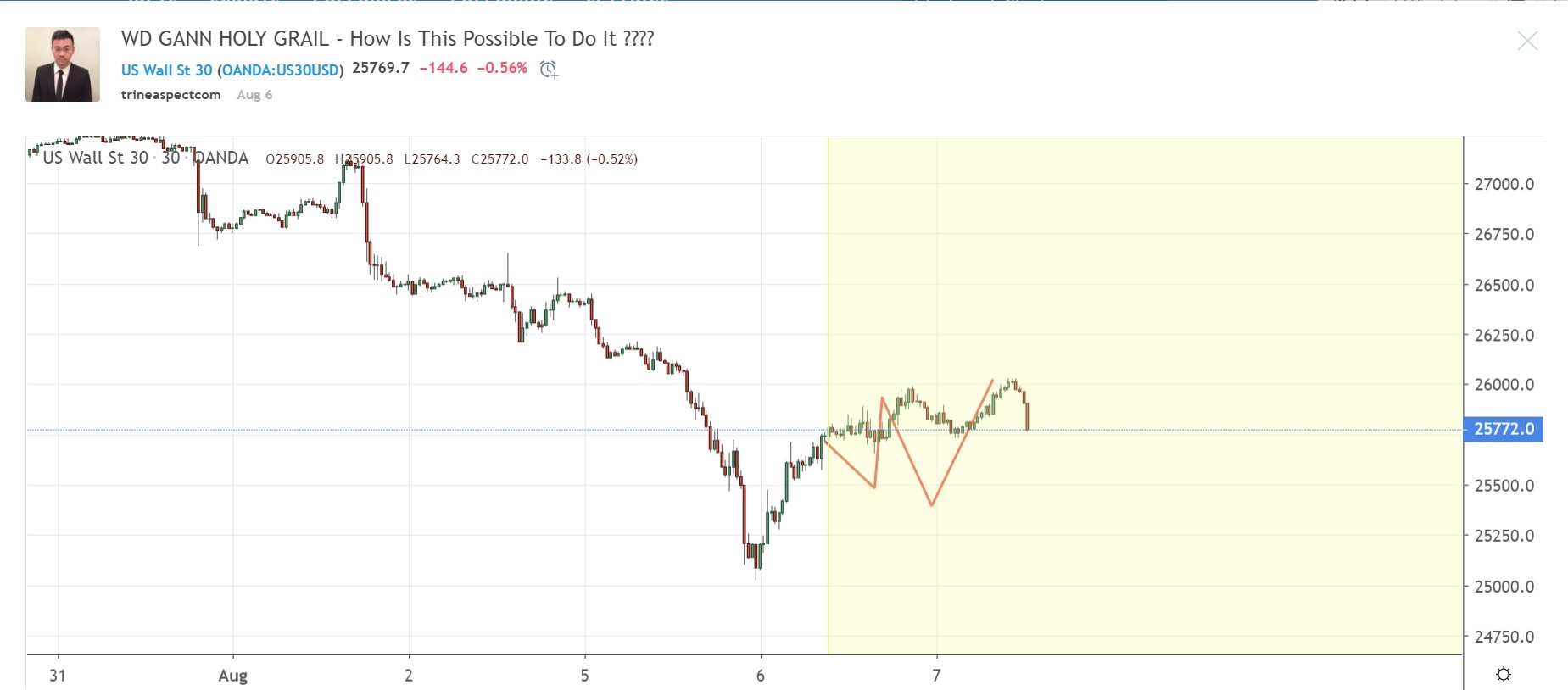

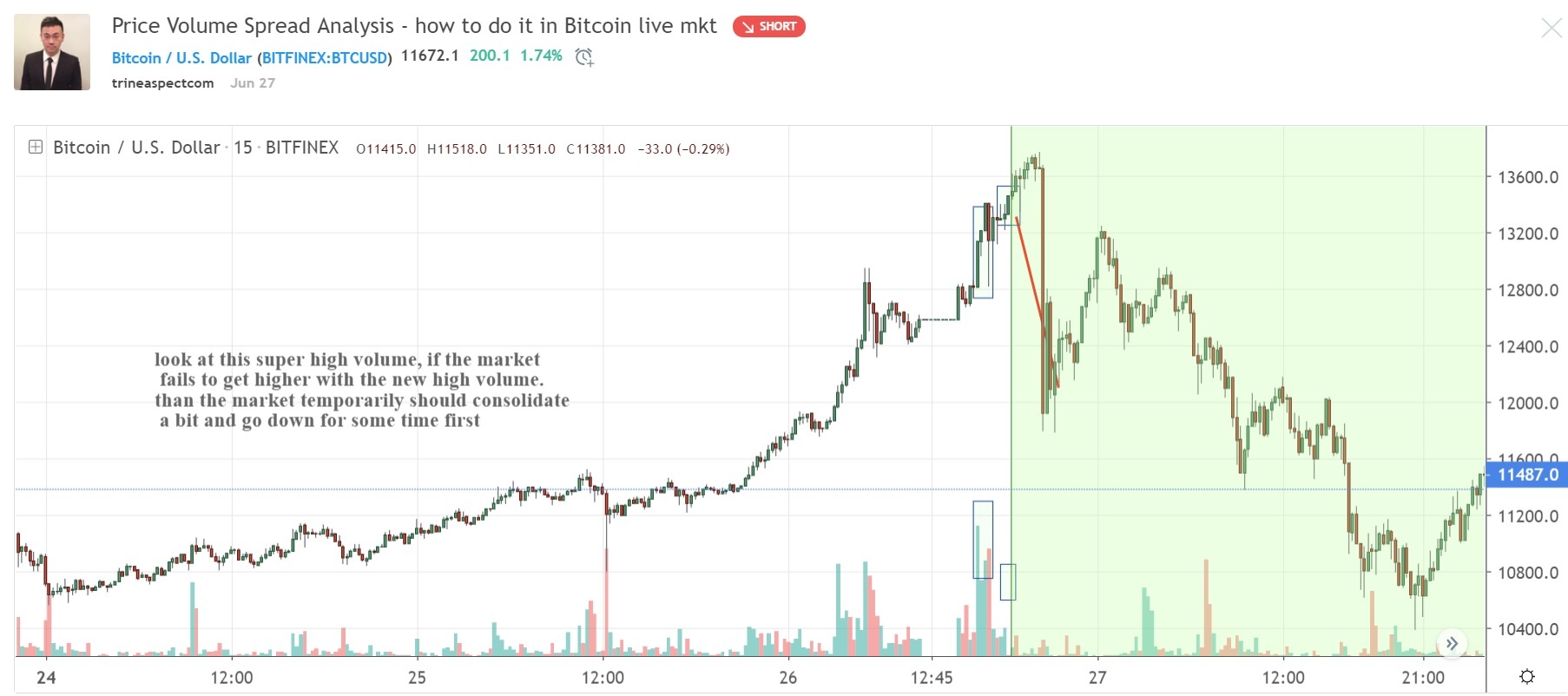

There are some of the real time wd gann math predictions that we have done in the last quarter. the red line being the forecast we suggested, the green section is the real time market reaction after the forecast was posted.

SEND an email with subject "Math Trading FXT" to [email protected] to learn how this market actaully implicitly reacts to the market (it is not golden ratio & fibonacci, wd gann mathematics sequences not every trader already knew!)

which every trader already knows!)

Khit Wong and all members of Gann Explained LLC are NOT financial advisors, and nothing they say is meant to be a recommendation to buy or sell any financial instrument. All information is strictly educational and/or opinion. By reading this, you agree to all of the following: You understand this to be an expression of opinions and not professional advice. Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and education and does not constitute advice. The brand name of Gann Explained LLC will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information. You are solely responsible for the use of any content and hold Khit Wong, Gann Explained LLC all members harmless in any event or claim. FTC DISCLOSURE: Any income claims shared by myself, students, friends, or clients are understood to be true and accurate but are not verified in any way. Always do your own due diligence and use your own judgment when making buying decisions and investments in your business.

Editors’ Picks

EUR/USD stays weak near 1.1850 after dismal German ZEW data

EUR/USD remains in the red near 1.1850 in the European session on Tuesday. A broad US Dollar bullish consolidation combined with a softer risk tone keep the pair undermined alongside downbeat German ZEW sentiment readings for February.

GBP/USD holds losees near 1.3600 after weak UK jobs report

GBP/USD is holding moderate losses near the 1.3600 level in Tuesday's European trading. The United Kingdom employment data suggested worsening labor market conditions, bolstering bets for a BoE interest rate cut next month. This narrative keeps the Pound Sterling under bearish pressure.

Gold pares intraday losses; keeps the red above $4,900 amid receding safe-haven demand

Gold (XAU/USD) attracts some follow-through selling for the second straight day and dives to over a one-week low, around the $4,858 area, heading into the European session on Tuesday.

Canada CPI expected to show sticky inflation in January, still above BoC’s target

Economists see the headline CPI rising by 2.4% in a year to January, still above the BoC’s target and matching December’s increase. On a monthly basis, prices are expected to rise by 0.1%.

UK jobs market weakens, bolstering rate cut hopes

In the UK, the latest jobs report made for difficult reading. Nonetheless, this represents yet another reminder for the Bank of England that they need to act swiftly given the collapse in inflation expected over the coming months.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.