I want to talk about what to do when a trade goes against you.

This is the second part, already in the previous article, I talked about a trade that went against me.

I talked about the plan, and right now, I want to show you exactly what I did today, which is the next trading day in order to hopefully rescue this trade.

Managing Losing Trades Recap

First of all, let me briefly recap the trade. I sold puts on Hertz. The idea was that Hertz stays above $3.50.

If Hertz would stay above $3.50 until May 15th I would collect $875 in premium.

Now, since this is only a few days away, it will be a little bit more than $100 a day.

And this is what I’m looking for, this is my goal with this account that I use here for trading put options.

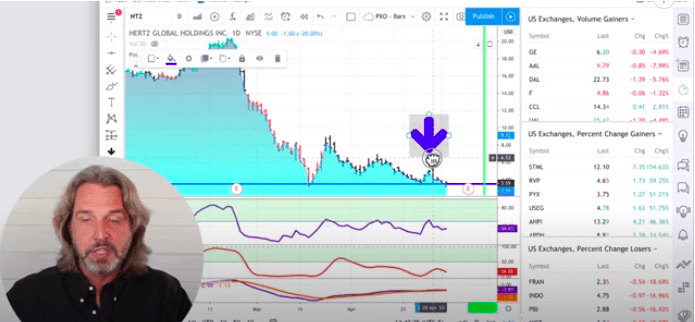

I want to show you exactly where I entered this trade on this day right here where you see this huge bar down.

Now, here’s what happened.

I entered this trade shortly before it went way down. When I entered the trade everything looked great.

But then 10 minutes later, all hell broke loose. Ten minutes later, there were rumors of bankruptcy that Hertz might go bankrupt.

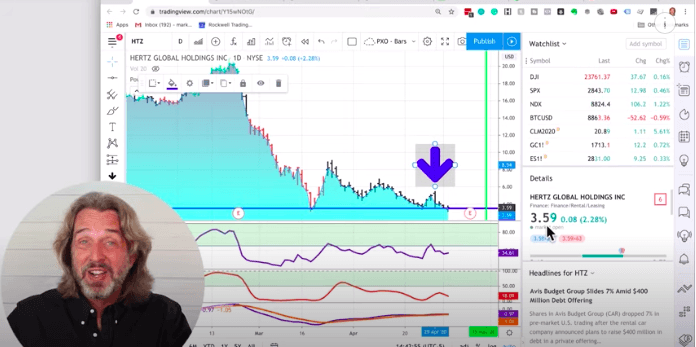

And right now, as you can see, Hertz is trading at $3.59 right at my strike price.

Now, if Hertz closes below $3.50, I’ll lose money.

In the previous article, this is where I told you exactly my plan and what I’m going to do. And now I’ll show you what I did here today.

The Steps I Took To Manage This Trade

Here is where you see my trades.

- I’m in an American Airlines trade right now going against me, but really not a big deal

- We talked about this Hertz trade

- NYOK, this trade is still going okay

- SPCE, this trade is doing really well

- …and now you see a second Hertz Trade

What is this, what happened, and what did I do? So here’s what happened.

As you know, Hertz dropped, and today I decided to buy buy the contracts I sold.

Looking at the account you’ll see exactly what I’m doing so if you find yourself in this situation, you’ll know what to do.

I want you to see how I think, and I hope that helps you in managing losing trades because the losses are happening.

So to get out of the trade, I had to pay $1.30/contract, and since I had 25 of these, this was a loss of $3,250.

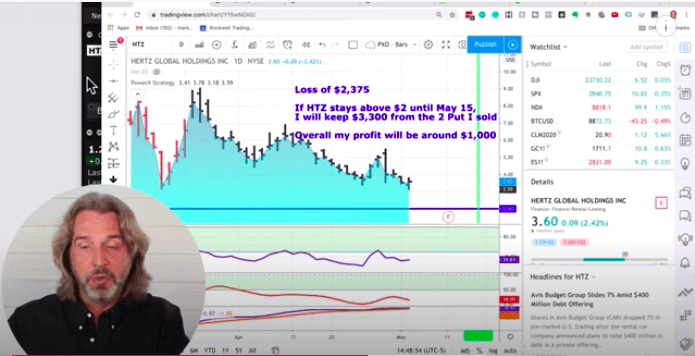

Now, keep in mind, earlier I already received the premium of $875 so this means that today I would sit at a loss of $2,375.

That’s not nice. I mean, come on, I do not want to sit on a loss of $2,375.

Now admitted, it’s not a big deal. This account that I’m trading here has $35,000 in it so this is not really a big deal.

However, I want to show you exactly what I did instead to hopefully salvage the trade.

Next, I sold the $2 put and I sold it at $0.60. And I traded 55 contracts. So today I received a premium of $3,300.

So here is what’s happening right now. As long as Hertz stays above $2, I will now keep the whole premium of $3,300.

Let me show you exactly on the chart what this looks like.

I lowered my threshold where I said, “Ah, Hertz cannot, or should not go below $3.50.” Now I got rid of this and I moved it down to $2.

By doing so, temporarily today, I had a loss of $2,375, but if Hertz stays above $2 until May 15, I will keep $3,300 from the $2 put I sold.

So this means that, yes, I did lose some money, but I’m trying to keep the $3,300, so overall, my profit will be around $1,000.

You get the idea, right?

So right now, switching back to the account, you see I closed out this trade and the realized loss is $2,400.

Why is it $2,400 didn’t I just say it is $2,375? Yes, the broker is rounding it.

But you see, this is what happened right now.

At the same time, you see here I sold 55 of the $2 put, and right now I received $3,300 in premium.

So as long as Hertz stays above the $2, I’m fine.

Here Is The Important Thing

Why did I do this?

So there are two main reasons why I did it.

Reason number one, I still believe that even though they’re talking about bankruptcy in Hertz, that Hertz will have a quick pop.

When they do this, the trade will be fine. And I also lowered my break-even from $3.50 To $2, right?

I also sold enough contracts so that I am able to cover the loss that I realized today and possibly even turn this into a gain.

It seems that possibly even turn this into a larger gain than I originally anticipated.

Because originally I thought I would only make $875 on this trade.

Right now it seems that I can make over $1,000 on the trade, and all that Hertz needs to do is stay above $2 before and on May 15th.

3 Days Later

Now, for the past three days, Hertz was nicely staying above $2.

And here’s what happened today.

So today I saw that I had an opportunity to realize $2,700 in profits.

Now as you recall, I lost on Monday $2,375. So when today I saw, oh, my gosh, I can get out of this trade before it gets worse, I’ll do this.

So the question now is, why wouldn’t I wait until expiration? Let’s go back to this. So expiration of this particular trade is on May 15th.

Today is May 7th so we have another whole week of trading before the contracts expires.

Now during this time a lot of things can happen. Hertz is right now talking with creditors and is trying to avoid bankruptcy.

But if these talks go sour, this stock might plummet below $2.

So at this point, I don’t want to stay in this stock. This is something that I didn’t want to be in.

Again, I entered the trade, and shortly after I entered, 10 minutes later, Hertz said, “All right, we’re missing payments and we are considering bankruptcy.”

So this was a rescue mission. And at this point, I’m not getting greedy because what could happen? Yes, I could potentially make another $600.

But, hey, as you can see, I already made some money. I made a little bit over $300 on this trade that just a few days ago was a heavy loss of $2,700.

So turning a loss, a potential loss, of $2,375 into a gain of a little bit over $300. You know what? That’s good enough for me.

So I closed out the trade today, I bought back the put that I sold, and now I can get rid of the trade and I don’t have to worry about it anymore.

Trading Futures, options on futures and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. The lower the day trade margin, the higher the leverage and riskier the trade. Leverage can work for you as well as against you; it magnifies gains as well as losses. Past performance is not necessarily indicative of future results.

Editors’ Picks

AUD/USD looks well bid, retargets 0.7150

AUD/USD adds to Tuesday’s advance and clock strong gains past the 0.7100 hurdle ahead of the opening bell in Asia. Hotter-than-expected Australian inflation data in combination with the RBA’s hawkish stance continue to underpin the move higher in the pair.

EUR/USD shifts its attention to 1.1900 and above

EUR/USD has shaken off Tuesday’s dip, pushing back beyond the 1.1800 mark amid decent gains as Wednesday’s session draws to a close. The rebound is largely driven by a modest pullback in the US Dollar, as markets digest the aftermath of President Trump’s SOTU speech and continue to monitor trade-related headlines and signals from the White House.

Gold remains bid and close to $5,200

Gold buyers are returning to the fold on Wednesday, targeting the $5,200 area and possibly beyond, after Tuesday’s corrective dip from monthly highs. The rebound in the precious metal comes as the US Dollar loses traction, with Trump’s SOTU speech offering little fresh direction and AI-related nerves continuing to ease.

UK financial watchdog advances stablecoin oversight as four firms pilot issuance

The Financial Conduct Authority (FCA) in the United Kingdom (UK) is advancing toward the final stablecoin regulatory framework with a pilot program involving four companies, including Monee, Financial Technologies ReStabilise, Revolut and VVTX.

Nvidia earnings to influence AI trade and broader market sentiment Premium

For the last three years, Nvidia has been the engine of the AI boom, and now Wall Street is watching to see whether that momentum can keep going. High-growth stocks have been struggling to maintain their bullish trend in 2026.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.