A struggle many traders tend to have, and one that makes it hard to be a good trader, is overthinking. Whenever I teach a class with Online Trading Academy, right off the bat I ask my students is one simple question: Have you ever been emotional about money at some point in your life? Without doubt, every hand in the room is raised. Obviously, I already knew the answer; but I ask the question because most of us never think about this simple dynamic and its impact on our trading goals.

From a young age we have been taught that it is good to be right in work and in play, like our grades at school, during sports and in day to day business. The problem is, you take this attitude to the market and you will inevitably fail. You can be right nine times out of ten, take just one big loss and your account is down. The flip side is that with a good starting risk to reward ratio, you can be wrong more than right and still be profitable, a concept we’ve discussed in previous articles. This is tough for the newer trader to get their head around as they have not made the shift in thinking that being right most of the time does not always make you money. There are times you can even be right on a trade or investment, have a profit developing and then still see it turn into a loser because of a lack of planning ahead of time.

With a well put together plan and by understanding the power of an objective, rules-based approach to the markets, we can often make profitable choices in the Forex Market, even though our analysis may be a little off. When I first got into trading, I was always looking for the big moves, attempting to hit the haymaker trades which ran forever. Sure, I got some now and then, but I also had plenty of losses too, and the more frustrating ones typically turned from a decent profit into a loss because I had no idea how to set realistic profit targets. Fast forward many years later and I have learned a few things since then.

I’ve learned that sometimes, you’ll be in the trend at exactly the right time to enjoy massive upside and other times you will join it too late and only get the last few dregs from it. Nobody really knows how it’s going to turn out but if you have a set of rules and can follow what the price is showing you, there is no reason why you still can’t make some decent returns along the way.

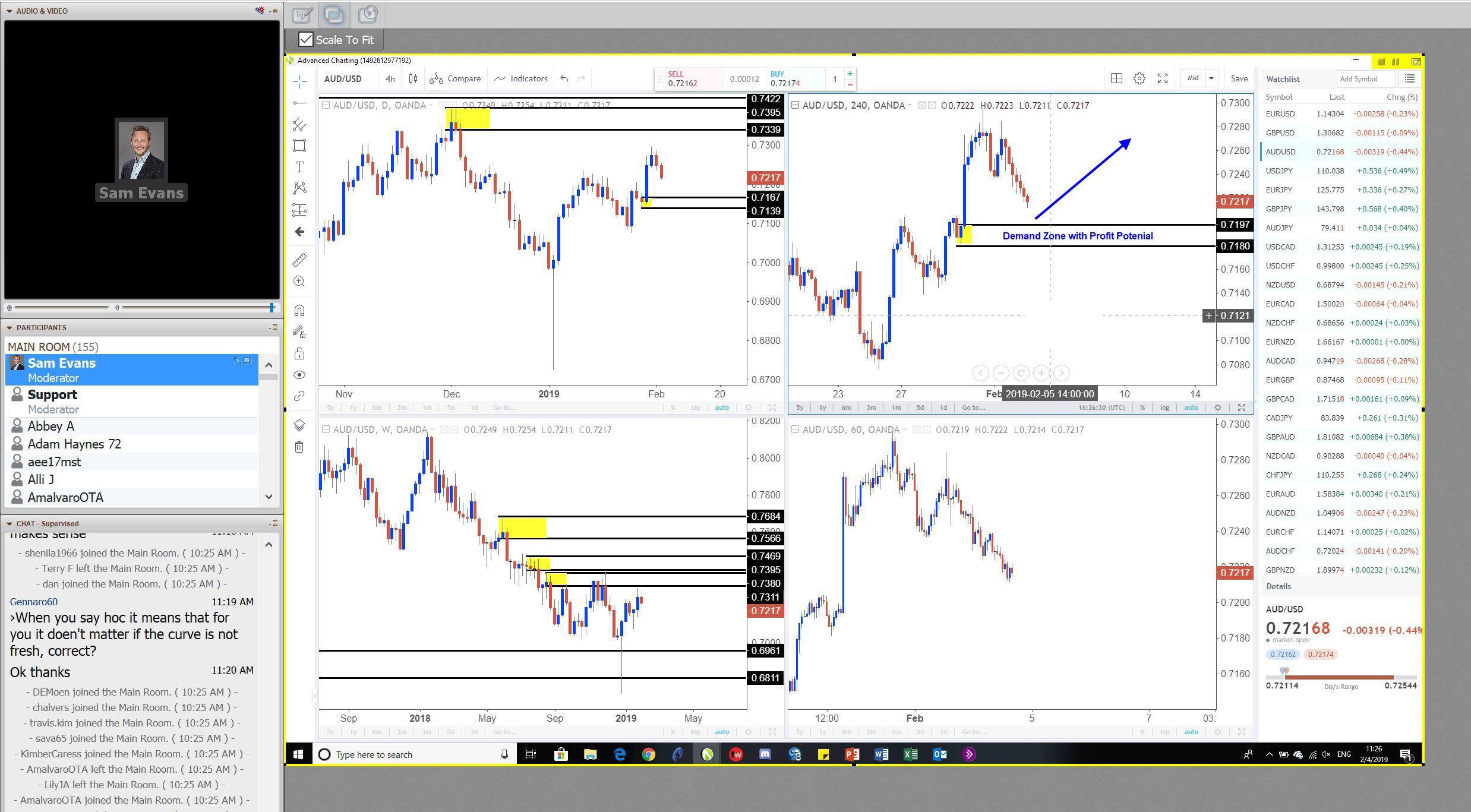

Here is a screenshot of a recent Live XLT session I was leading in the FX room, where we were analysing setups and opportunities on the AUDUSD. This is what the charts looked like from multiple perspectives at the time:

Look at the upper right chart. We have a clean and established level of price demand on the 4hr chart, signalling a decent low risk buying opportunity. We have been in a short-term upwards trend which suggested there was also probability for a bounce on our side as well. There was also overhead price supply around 0.7280 giving us at least a 1:3 risk to reward ratio, which is a good minimum to look for. At this stage in the setup of the trade, it looks like a pure go with the trend trade, but we also recognized that there was some strong institutional supply above current price which indicated some weakness in the upside momentum. Taking this into account, a 1:3 was safe a target to use. Remember that if the price goes higher, we can always take another trade.

This is how the trade ended up working out for us:

Looks like we got that one wrong! Well in the longer term anyhow…because we managed to hit the 1:3 target on the buy at demand trade, even though prices then dropped from the overhead supply and broke down into a longer downside move. You may be asking, was this the right trade to take? Well, if it was profitable then sure, but you had to see that there was a profit in the first place, as this may have ended up being a loser if we had gotten greedy and gone for more profit.

I like to assume that I never know what price is going to do next. I focus on buying near areas of demand and selling near areas of supply which offer us solid risk to reward ratios. This way, we are always giving ourselves room to find a profit, even if we get into the trend late or maybe too early. After all, price is truly the only leading indicator we have, so what could be better to focus on as a primary decision-making tool? I hope this was helpful. See you next time.

Read the original article here - Making Money in Forex When You Are Wrong

The information provided is for informational purposes only. It does not constitute any form of advice or recommendation to buy or sell any securities or adopt any investment strategy mentioned. It is intended only to provide observations and views of the author(s) or hosts at the time of writing or presenting, both of which are subject to change at any time without prior notice. The information provided does not have regard to specific investment objectives, financial situation, or specific needs of any specific person who may read it. Investors should determine for themselves whether a particular service or product is suitable for their investment needs or should seek such professional advice for their particular situation. Please see our website for more information: https://bustamanteco.com/privacy-policy/

Editors’ Picks

EUR/USD hovers around nine-day EMA above 1.1800

EUR/USD remains in the positive territory after registering modest gains in the previous session, trading around 1.1820 during the Asian hours on Monday. The 14-day Relative Strength Index momentum indicator at 54 is edging higher, signaling improving momentum. RSI near mid-50s keeps momentum balanced. A sustained push above 60 would firm bullish control.

Gold sticks to gains above $5,000 as China's buying and Fed rate-cut bets drive demand

Gold surges past the $5,000 psychological mark during the Asian session on Monday in reaction to the weekend data, showing that the People's Bank of China extended its buying spree for a 15th month in January. Moreover, dovish US Federal Reserve expectations and concerns about the central bank's independence drag the US Dollar lower for the second straight day, providing an additional boost to the non-yielding yellow metal.

GBP/USD holds medium-term bullish bias above 1.3600

The GBP/USD pair trades on a softer note around 1.3605 during the early European session on Monday. Growing expectation of the Bank of England’s interest-rate cut weighs on the Pound Sterling against the Greenback.

Bitcoin, Ethereum and Ripple consolidate after massive sell-off

Bitcoin, Ethereum, and Ripple prices consolidated on Monday after correcting by nearly 9%, 8%, and 10% in the previous week, respectively. BTC is hovering around $70,000, while ETH and XRP are facing rejection at key levels.

Weekly column: Saturn-Neptune and the end of the Dollar’s 15-year bull cycle

Tariffs are not only inflationary for a nation but also risk undermining the trust and credibility that go hand in hand with the responsibility of being the leading nation in the free world and controlling the world’s reserve currency.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.