Have you ever been caught up in should-ing on yourself? What I mean by that is, have you been thinking that the price action should (must) go up or down because of the trade you entered? That is just one example of the type of thinking that can throw a monkey wrench into your trading results. Let’s look a little closer at an illustration of this issue.

Karla frowned at her screen. The price action on the daily YM Emini chart had been in a mature symmetrical triangle price pattern, and it was not going up as she had expected or as she had outlined in her micro trade plan. In a few more minutes, the price action had dropped even further, very close to her stop. The anxiety and fear that she felt drove her to move that stop. It was almost as if she were in a fog or trance – a negative trader trance. The price action continued to fall and she moved her stop again saying to herself that it should go up and that it should do it soon. Unfortunately, she succumbed to her “certainty bias” and moved her stop twice more before the pain of the current loss overcame her fear of losing more by exiting, and she took herself out of the trade. “That was a high probability trade and it’s not supposed to do that,” she wailed. This was the fourth trade in a row that she had been either stopped out or had taken herself out; and, this last trade cost her dearly. It not only cost a significant amount of capital in her account, due to the fact that she had moved her stop three times; it cost her in emotional angst which hit hard in her self-esteem. Her head hung like an anvil was tied to her neck. She put her face in her hands as the room seemed to darken from the cloud of depression that was forming around her. She moaned through her fingers, “What is happening to me, it shouldn’t be like this.”

Actually, it couldn’t be any other way for Karla at that moment. It was true; she did have a high probability set-up according to her protocol and her trade plan analysis. But, high probabilities don’t ensure that the price action will do exactly as you expect. In fact, the phrase “high probability” by definition points to a lack of total predictability. So, even though Karla had a “certainty bias,” which prompted her to use the predetermined word “should” as in “it should break up” she still was operating from a limiting belief that the price action was going to definitely do what she had in her plan.

Let me digress for a moment to explain a little more of what a “certainty bias” is and why it is dangerous. There are two separate aspects of a thought, namely the actual thought, and an independent involuntary assessment of the accuracy of that thought.

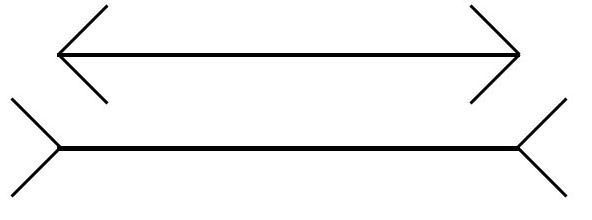

Look at the two horizontal lines below to get a feeling for this separation of the actual thought and the assessment of the accuracy of that thought; it is the Muller-Lyer optical illusion. If you were to measure the actual length of these two lines and therefore would empirically know that they were the same length; you would experience this optical illusion as the simultaneous disquieting sensation that this thought—the lines are of equal length—is not correct. This isn’t a feeling that we can easily overcome through logic and reason; it simply happens to us; (and just check it out…it’s really strange isn’t it, they look to be very different in length).

A separate category of mental activity is the genesis of this sensation; that is, unconscious calculations as to the accuracy of any given thought. On the positive side, such feelings can vary from a modest sense of being right, for instance, as an understanding that summer follows spring, to an epiphany or profound a-ha, a sense of spiritual knowingness. The spiritual knowingness, or as William James called “the mystical experience” referred to it as a “felt knowledge,” a mental sensation that isn’t a thought, but feels like a thought.

So, as we look at Karla’s assessment of her thoughts about what the price action “should” do, her certainty bias proved to be a limiting belief which prompted the initial distracting emotions of frustration, frazzlement, and fragmentation, which distorted her judgment as in what to do. What she did do was to violate her rules, which in turn, caused her to experience a significant loss. Additionally, let’s not forget that she also had a secondary emotional distraction, which caused its own damage; that is, her feelings of depression and self-loathing. These secondary emotions are not only painful, but also can cause further behavioral consequences to include things like revenge trading, inability to pull the trigger, or other reactions that produce additional unwanted results.

It’s important to be careful about using words like should, shouldn’t, must, can’t, and gonna because they are the harbingers of the “certainty bias” when related to the price action and your trade. What you want to remember is to resonate with objective reality. One of the laws of the Universe is that of “cause and effect.” When a cause is set in motion, there is going to be an effect as in “you will reap what you sow” unless there is an intervention by some means and the conditions and circumstances change. In other words, the markets are going to reflect the conditions and circumstances that are present in the order flow; and, you’ll want to accept the reality of the charts rather than assume that the reality will change merely because you want it to. The price action should do exactly what it does, based upon the market conditions and circumstances present. So it is also with your results. You are going to get the results that you “should” get, based upon the personal conditions and circumstances present in your trade. In other words you executed your trade in just the right place, based upon just the right assumptions; and followed your rules – or not – in just the right way, in order for you to get the exact results that you did. And if you lost you “should” have lost, based upon the personal conditions and circumstances of your trade. As soon as you can “accept” the reality of the market and the reality of your causal behavior, you’ll be able to accept that you are getting the results that you “should” get. With this acceptance you’ll be in a better position to pay more attention to the conditions and circumstances that you are setting in motion at the time of the execution. You’ll be better able to focus on what matters most in the trade without the distorted judgment caused by a certainty bias. Additionally, with an acceptance of reality, you’ll be in a better position to avoid the secondary emotions, (like depression and self-loathing) that come from the limiting beliefs associated with thinking that you should have gotten a different result than you did. And, you can avoid the ineffective behaviors that these secondary emotions kick off … therefore you’ll be on target to plan the trade and trade the plan effectively, remaining on task and on target to get the results that you want.

Avoid the shoulds and the accompanying certainty bias, they can be smelly and really clog your system. When you are engaging your A-Game, you are less likely to be hampered by limiting beliefs and internal biases…at least you will be more self-aware and open to discovering them and when you do you can address them through mental and emotional tools. We teach A-Game mental and emotional tools in Mastering the Mental Game XLT, Online and On-location courses. We show you how to remain focused on what-matters-most in your trading in order to get the results that you want…consistently. Ask your Online Trading Academy representative for more information. Also, get my book; “From Pain to Profit: Secrets of the Peak Performance Trader.”

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD trims gains, hovers around 1.1900 post-US data

EUR/USD trades slightly on the back foot around the 1.1900 region in a context dominated by the resurgence of some buying interest around the US Dollar on turnaround Tuesday. Looking at the US docket, Retail Sales disappointed expectations in December, while the ADP 4-Week Average came in at 6.5K.

GBP/USD comes under pressure near 1.3680

The better tone in the Greenback hurts the risk-linked complex on Tuesday, prompting GBP/USD to set aside two consecutive days of gains and trade slightly on the defensive below the 1.3700 mark. Investors, in the meantime, keep their attention on key UK data due later in the week.

Gold loses some traction, still above $5,000

Gold faces some selling pressure on Tuesday, surrendering part of its recent two-day advance although managing to keep the trade above the $5,000 mark per troy ounce. The daily pullback in the precious metal comes in response to the modest rebound in the US Dollar, while declining US Treasury yields across the curve seem to limit the downside.

Bitcoin Cash trades lower, risks dead-cat bounce amid bearish signals

Bitcoin Cash trades in the red below $522 at the time of writing on Tuesday, after multiple rejections at key resistance. BCH’s derivatives and on-chain indicators point to growing bearish sentiment and raise the risk of a dead-cat bounce toward lower support levels.

Dollar drops and stocks rally: The week of reckoning for US economic data

Following a sizeable move lower in US technology Stocks last week, we have witnessed a meaningful recovery unfold. The USD Index is in a concerning position; the monthly price continues to hold the south channel support.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.