During a recent class a good question came up about identifying the front month contract in the Futures markets. The question was, “Is volume all I need to look at to determine when a contract is ready to roll over?”

All Futures contracts have an expiration date. During the life of all Futures contracts, usually the last couple of months before expiration they will be the most actively traded contract of all months listed for that Futures market. During this most actively traded period that contract month is referred to as the front month.

As futures contracts come near expiration speculators are forced out of that contract or face taking delivery of that Futures market. Taking delivery is having the physical product delivered to you. These deliveries are not just hard assets like Live Cattle or Corn, other markets like Interest Rate and Currency products are deliverable as well. To avoid these deliveries speculators usually liquidate their current positions in the soon to expire contract and then enter the same market in the next front month contract. This is referred to as a position roll over.

When the majority of the trading activity was done in the trading pits in Chicago and New York the trading pits had steps that went all the way around the pits and stepped down into the center of the pits. The top step of the pits was where traders trading in the front month contract stood. The next step down into the pit was the next contract month in the cycle. The actively traded contract was on the top step because that is where the most orders had to be traded and it was easier to get the paper (orders) to the brokers to fill the orders.

As contracts would come near expiration the traders would watch for volume and open interest to change. Once they noticed this change then the new front month was traded on the top step. Unfortunately contract roll overs do not occur at the same time for every roll over. They are usually +/- 1-3 days of when prior contracts rolled over.

Since there is no hard set rule for a contract to roll over on the same date each time we as speculators need to follow volume and open interest to tell us when to trade the next contract in the cycle.

Futures offer good leverage for little capital. This tends to attract a lot of day traders to the Futures markets, kind of like going to the casino and trying to get a seat at the $5 table, ever notice the long line to get a seat? Try walking over to the $100 per hand table and notice you can walk right up to that table and sit down. Often they will even come pull your chair out for you while serving you a drink.

A day trader needs liquidity (volume) to get their orders filled. If a trader is trading in a contract with very low liquidity they risk getting bad fills called slippage. For a day trader they need to monitor the volume that is being traded in a front month contract. The day there is more volume in the next contract in the cycle they must then begin to trade that contract to keep trading the most actively traded contract.

A swing trader needs a little more information. If a swing trader uses volume only to determine when to roll over his contract they might have to get in their position one day and the very next day exit it and go into the next contract month in the cycle. This is because they are holding positions overnight.

For swing traders it is good to understand open interest as well as volume to help identify which contract month they should be trading in. Open interest is simply the number of outstanding contracts that have not been offset or delivered yet. So anybody holding open positions overnight is increasing the open interest.

Large traders often roll over their contracts much sooner than other traders. They have such size (number of contracts) to roll over they could cause a distortion in price action if they waited until everybody else rolled over. One of these big traders is Goldman Sachs who also manages a Commodity Index Fund. This Fund rolls over contract positions on the 5-9th business day of the month preceding the expiring contract. Do you think Goldman Sachs is day trading or holding positions overnight in this Fund?

Most definitely holding positions overnight would be the correct answer. Just knowing how big Goldman Sachs is and there are several other Commodity Index Fund firms, what do you think this is doing to the open interest of a contract when they exit their positions?

The open interest has to be reduced significantly for that contract month. Where did the open interest go? To the next contract month in the cycle because of rules on how they must invest in the markets.

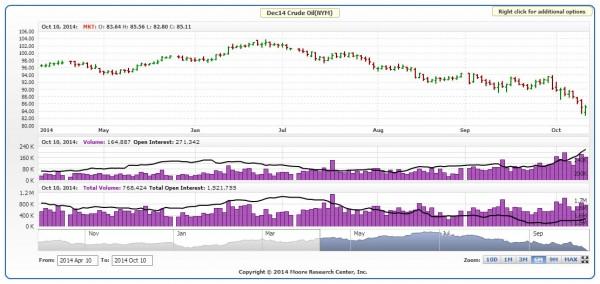

Figure 1 illustrates this example in the Crude Oil Market.

I would like to thank Moore Research (www.mrci.com) for allowing me to use their free daily Commodity price page for this article.

Figure 1 shows the Crude Oil market and the first 7 contract months in the cycle. Each contract month has its own volume and open interest. Notice the volume in the November contract is 373,752 contracts while the December contract is 182,842. For a day trader you would like to trade in the most actively traded contract. At this time you would want to be day trading the November contract until there is more daily volume in the December contract than the November contract. As a day trader you may wish to keep an eye on the open interest as well. While you will want to trade the most actively traded month you may want to be aware that since the open interest is higher in December than November that a roll over is imminent in the next few days.

For a swing trader (person holding positions overnight) you can view this page a little differently. By looking at the open interest we can see some of the larger traders have already left the November contract and are now positioned in the December contract even before the volume has rolled over.

Let’s say you have been waiting for price to come into a level where you wish to buy or sell. You place your order using the November contract. Now you are filled on your order and within the next day or two you will have to exit that November contract and roll over to the December contract to avoid delivery of 1,000 barrels of Crude Oil. Now you will have another transaction cost (commission) and possibly miss getting filled on your December contract if price does not come back to your level with your new order.

If you had been looking at the open interest you would have known that the larger traders had left November already and you would have placed your order in the December contract. This would allow you to keep your Crude Oil contract until the next expiration period instead of dealing with the one in just a few days.

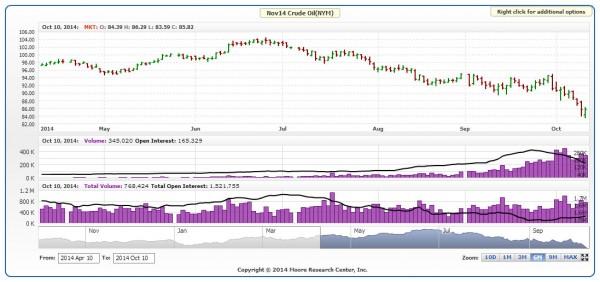

Figure 2 shows a chart with the open interest of the November contract (upper chart of volume with solid black line) with participants leaving this contract (black line turning down).

Figure 3 shows where the participants who left November went to and that would be December Crude Oil. Notice how the solid black line in the upper chart of volume is now turning up showing open interest increasing in the December contract.

Whether you are a day trader or a swing trader, understanding open interest and volume can help you select the contract you wish to trade. By reducing your transaction cost and possibility of missing your trade you can position yourself by skipping over rollovers.

Keep in mind that you can trade any contract month in the cycle, not just the first two contracts listed. As long as the contract month has sufficient volume you can trade it.

“Risk comes from not knowing what you’re doing.” Warren Buffett

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD weakens to near 1.1900 as traders eye US data

EUR/USD eases to near 1.1900 in Tuesday's European trading hours, snapping the two-day winning streak. Markets turn cautious, lifting the haven demand for the US Dollar ahead of the release of key US economic data, including Retail Sales and ADP Employment Change 4-week average.

GBP/USD stays in the red below 1.3700 on renewed USD demand

GBP/USD trades on a weaker note below 1.3700 in the European session on Tuesday. The pair faces challenges due to renewed US Dollar demand, UK political risks and rising expectations of a March Bank of England rate cut. The immediate focus is now on the US Retail Sales data.

Gold sticks to modest losses above $5,000 ahead of US data

Gold sticks to modest intraday losses through the first half of the European session, though it holds comfortably above the $5,000 psychological mark and the daily swing low. The outcome of Japan's snap election on Sunday removes political uncertainty, which along with signs of easing tensions in the Middle East, remains supportive of the upbeat market mood. This turns out to be a key factor exerting downward pressure on the safe-haven precious metal.

Bitcoin Cash trades lower, risks dead-cat bounce amid bearish signals

Bitcoin Cash trades in the red below $522 at the time of writing on Tuesday, after multiple rejections at key resistance. BCH’s derivatives and on-chain indicators point to growing bearish sentiment and raise the risk of a dead-cat bounce toward lower support levels.

Dollar drops and stocks rally: The week of reckoning for US economic data

Following a sizeable move lower in US technology Stocks last week, we have witnessed a meaningful recovery unfold. The USD Index is in a concerning position; the monthly price continues to hold the south channel support.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.