Many people compare a lot of current price action in the markets with that of the great market crash and depression in the 1920’s. There may be some good reasons for that as price patterns do seem to repeat often. Another thing that can be useful from that era of trading is one of the technical analysis techniques, Elliott Wave.

I have received several emails requesting me to explain Elliott Wave Theory. While I do not use it for determining my entries and exits for trades, (I stick to Online Trading Academy’s Core Strategy), the theory can be useful for identifying trends and potential changes in those trends.

Ralph Nelson Elliot analyzed the Dow’s price action during the Great Depression and identified that the markets are fractal in nature and that they are comprised of rhythmic waves in price movement. He theorized that these waves could be predicted and measured. These price patterns work in all markets and in multiple timeframes.

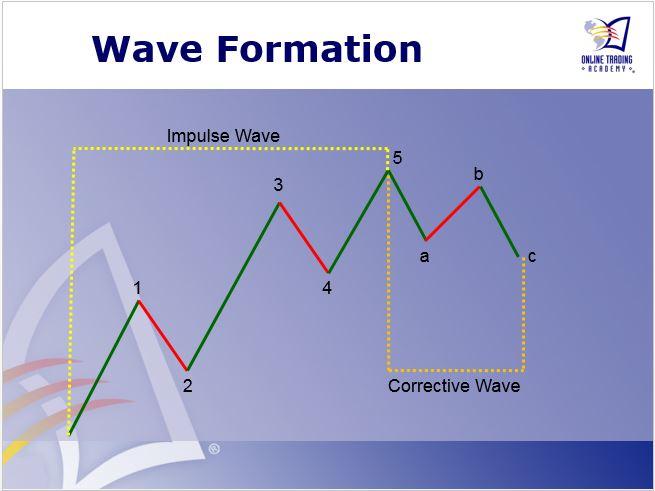

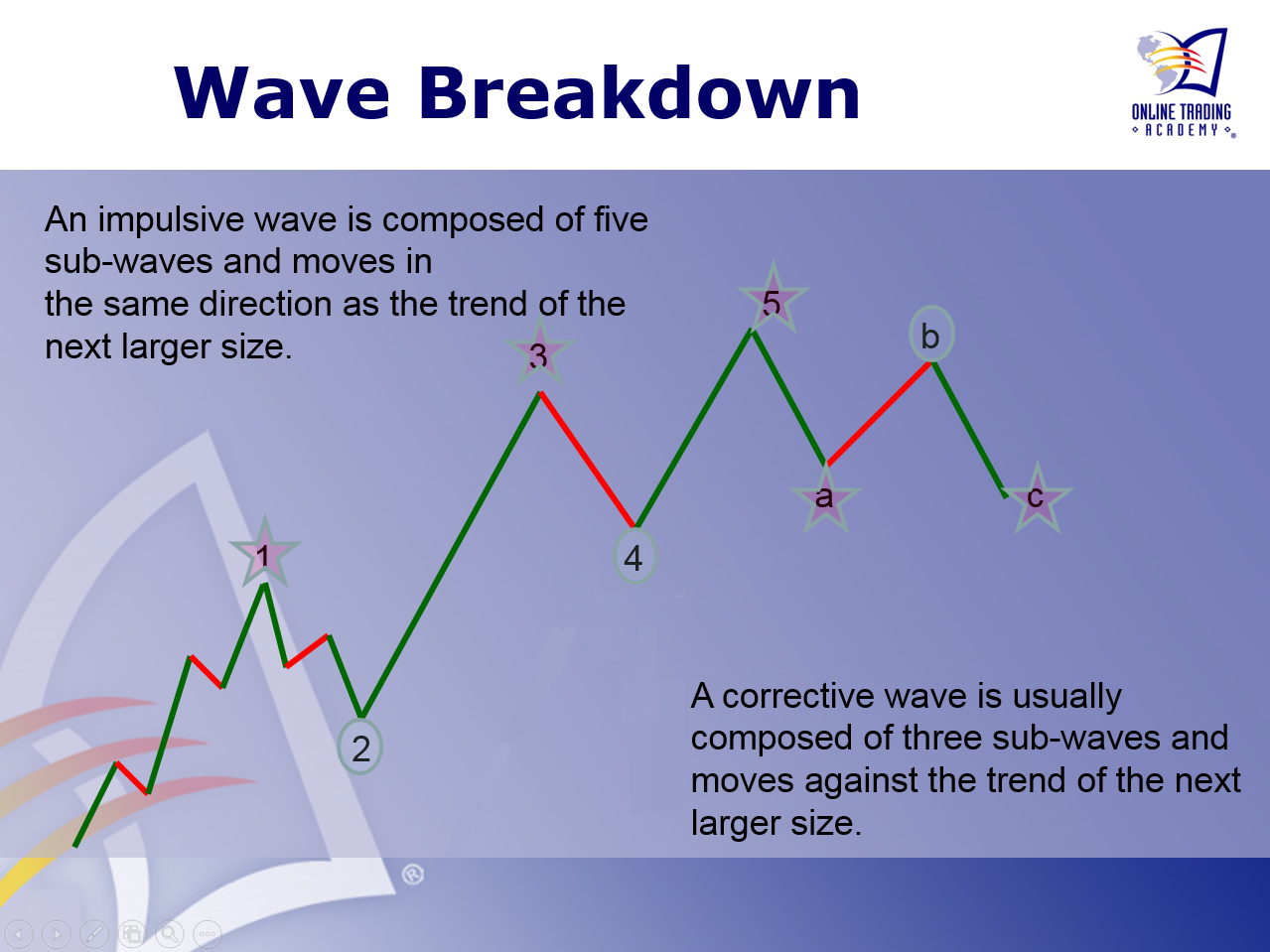

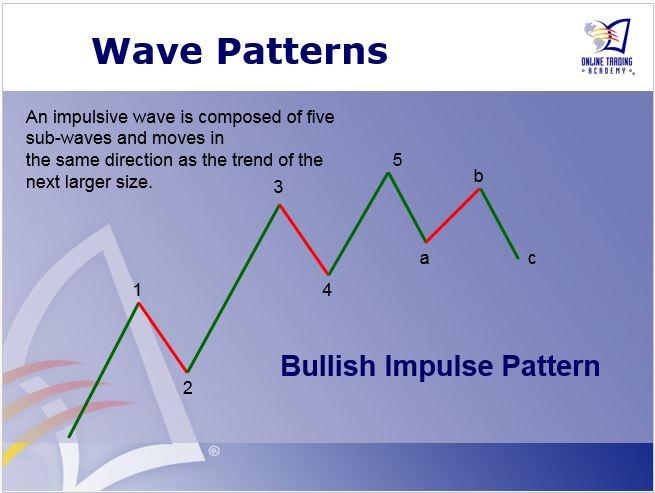

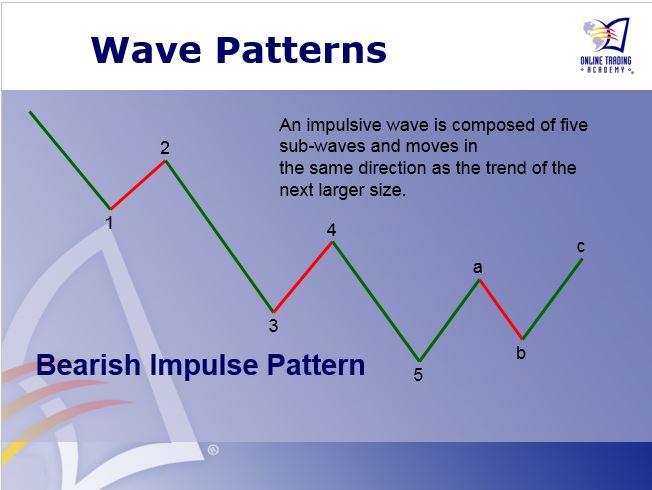

The main principle of the Elliott Wave Theory is that prices move in a five wave pattern within the direction of the larger timeframe trend. Once those five waves have been completed, then prices start a three wave correction in the opposite direction before beginning another five wave pattern.

Just as the large impulse wave is broken into five components, the impulse waves, (labeled as “1,” “3,” and “5”), can be divided into five smaller waves themselves. The corrections, (labeled 2, 4 and b), subdivide into three small waves.

It is helpful to know what trend you are looking at when making your analysis. The traditional timeframes for the waves are below.

There are certain rules that apply to using Elliott Wave analysis on price charts. This will help with properly identifying the waves:

Wave 2 (a correction) cannot retrace 100% of Wave 1

Wave 3 cannot be the shortest wave, it is often the longest or can be at least the same length as Wave 1 or Wave 5

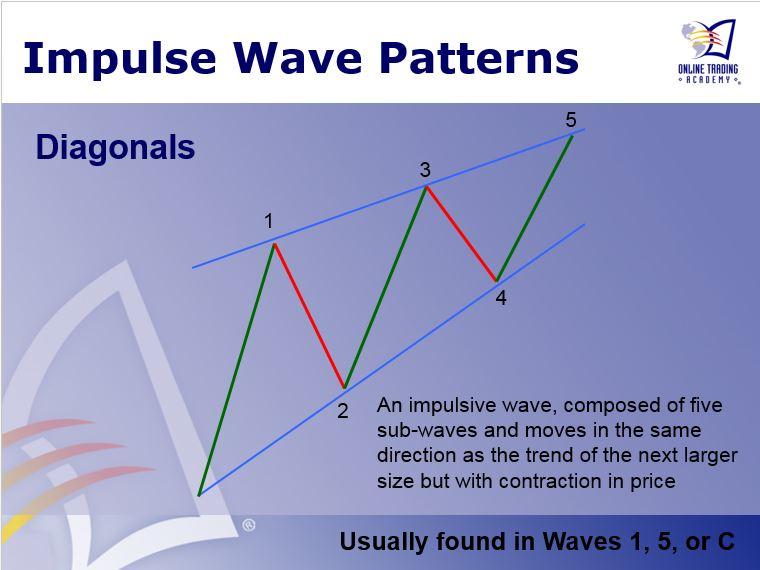

Wave 4 cannot enter the price action of Wave 1, however, there is one exception to this

The exception for when Wave 4 can enter into the price action of Wave 1 is when the impulse wave is forming what is called a diagonal. The diagonal is when prices are narrowing in the impulsive direction. It is usually seen in waves 1, 5 or C.

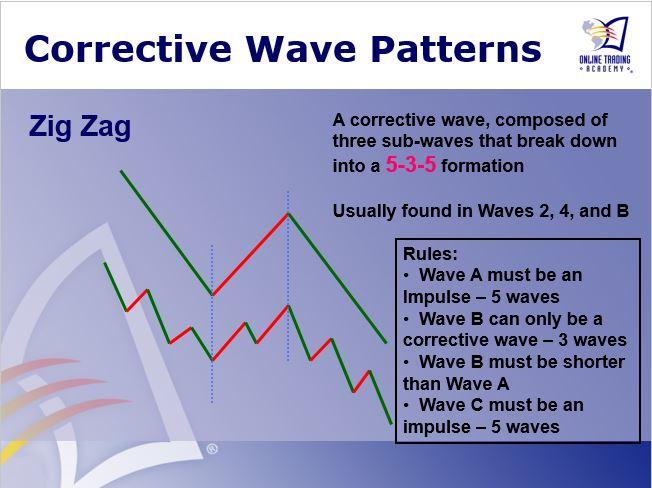

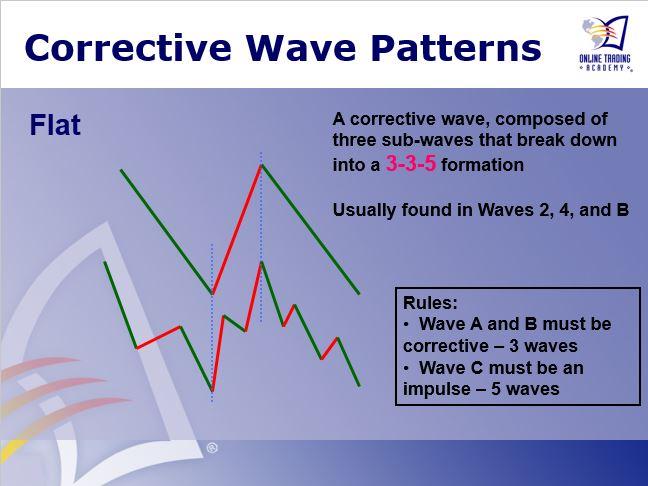

As mentioned earlier, the corrective waves also have distinctive patterns and can be divided into three sub-waves that all together move against the trend of the larger size. There are two patterns that the corrective waves usually fit into, the zig zag and the flat.

Although the zig zag is a corrective pattern, the smaller waves that move with the correction divide into five sub-wave impulses. Overall this creates a 5-3-5 waver formation in the A-B-C.

The flat pattern is a 3-3-5 sub-wave formation. The overall correction’s price action usually moves sideways instead of moving sharply against the larger trend as the zig zag does.

A useful bit of information when trying to predict the potential shape of the newest correction, note the shape of the preceding one. Due to alternation, Wave 4 will usually take on the opposite shape of Wave 2 in the same impulse. So if Wave 2 was a flat, expect a zig zag for Wave 4 and vice versa.

The Elliott Wave theory should only be applied to liquid and heavily traded stocks. It can also be applied successfully to the indexes. Looking at the chart below, you can see how the SPY rise and crash from 2003 to 2009 fit the pattern.

In the following chart, I applied the wave pattern to the current bullish market run that started in 2009.

It can start to get a little confusing, but if you practice and stick to the simple rules the theory starts to make sense of the seemingly random markets. Next week, I will dive deeper into the Elliott Wave Theory including how to measure and trade the waves. Until then, trade safe and trade well!

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

EUR/USD hovers around nine-day EMA above 1.1800

EUR/USD remains in the positive territory after registering modest gains in the previous session, trading around 1.1820 during the Asian hours on Monday. The 14-day Relative Strength Index momentum indicator at 54 is edging higher, signaling improving momentum. RSI near mid-50s keeps momentum balanced. A sustained push above 60 would firm bullish control.

Gold sticks to gains above $5,000 as China's buying and Fed rate-cut bets drive demand

Gold surges past the $5,000 psychological mark during the Asian session on Monday in reaction to the weekend data, showing that the People's Bank of China extended its buying spree for a 15th month in January. Moreover, dovish US Federal Reserve expectations and concerns about the central bank's independence drag the US Dollar lower for the second straight day, providing an additional boost to the non-yielding yellow metal.

GBP/USD holds medium-term bullish bias above 1.3600

The GBP/USD pair trades on a softer note around 1.3605 during the early European session on Monday. Growing expectation of the Bank of England’s interest-rate cut weighs on the Pound Sterling against the Greenback.

Bitcoin, Ethereum and Ripple consolidate after massive sell-off

Bitcoin, Ethereum, and Ripple prices consolidated on Monday after correcting by nearly 9%, 8%, and 10% in the previous week, respectively. BTC is hovering around $70,000, while ETH and XRP are facing rejection at key levels.

Weekly column: Saturn-Neptune and the end of the Dollar’s 15-year bull cycle

Tariffs are not only inflationary for a nation but also risk undermining the trust and credibility that go hand in hand with the responsibility of being the leading nation in the free world and controlling the world’s reserve currency.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.