In my last few articles I described the likely effects of interest rate rises in general, and in the bond market in particular.

This is relevant now, of course, because interest rates in the United States and elsewhere are beginning to rise after an eight-year period of historic low rates.

And when I say historic low rates, I don’t mean just recent history.

In January 2015, 10-year rates dropped to 1.88%, the lowest in history. Considering this, it appears that there is nowhere for rates to go but up.

We’ve already discussed bonds in those earlier articles. So, what about other asset classes, like stocks, precious metals and real estate? Are there clear relationships between their prices and interest rates?

In a word – no. There are logical arguments about how those assets should be affected by interest rates. But the actual long-term data doesn’t bear them out. Below I’ll show you what I mean.

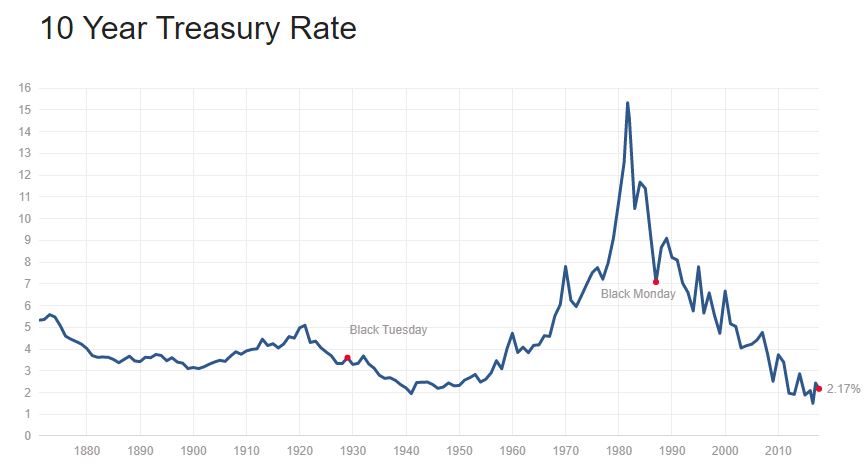

Below is a chart from multpl.com showing the rate on 10-year U.S. treasury notes from 1880 to date. This is a good gauge of U.S. interest rates.

Compare that to the comparable long-term chart of the stock market below, as represented by the S&P 500 (data prior to 1956 has been reconstructed since the S&P 500 Index did not exist before then).

Note, that while interest rates fell more or less steadily from 1980 (when they were over 15%) to 2016 (where they reached under 2%), the stock market had several bull and bear cycles during that 36-year period. The S&P chart is a logarithmic chart so steep declines in the 1987 bear market (down 35%), the 2000-2003 bear market (down 50%) and the 2008-2009 bear market (down 50% again) don’t appear quite as shocking as they were at the time.

Still, it’s pretty clear that the two long-term graphs don’t share any persistent correlation, whether positive or negative. When interest rates drop, stocks will – do whatever they do. Same thing when rates rise.

So the answer to the question, “What will higher interest rates do to stocks?” is, – nobody knows. History is no guide. All the logical arguments have no real predictive value.

OK then, what about precious metals? Is there anything history can tell us about that?

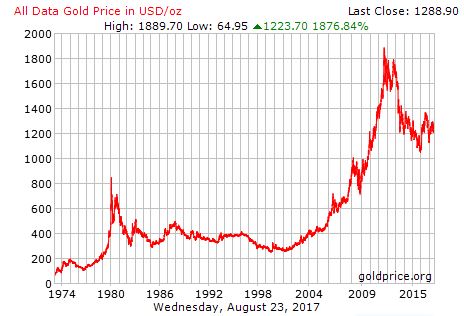

Well, what history tells us is that it has nothing to say on the matter. Here is the long-term price of gold. In this case, the data only goes back to 1974. It was only in 1971 that the price of gold was allowed to float from its officially-pegged price, so data before that is not meaningful anyway.

Gold peaked at over $800 an ounce in 1980 (a time of historically high interest rates). It then dropped for the next six years, as interest rates were falling. So far, that would indicate a positive correlation between interest rates and gold. But gold then fluctuated in a narrow range between $300 and $400 per ounce for over 20 years, as interest rates steadily fell. So – no correlation during that period. In 2001 gold began a run that went on mostly uninterrupted from 2001 ($400) through 2011 ($1800). It then dropped by 50% over the next few years and has treaded water ever since. All while rates steadily fell.

So, like stocks there is no reliable connection between gold and interest rates.

Finally, let’s take a look at real estate. Surely there is a connection there, isn’t there?

Well, for prices of housing anyway, not as much as you would think. After rising steadily from 1980 to 2005, housing prices then famously crashed and burned, before eventually bottoming out in 2012. Meanwhile, interest rates dropped for the whole period.

In the end, there is just no telling what the effect of interest rate changes will be on any assets, other than cash in the bank and, to a lesser extent, bonds.

As a long-term investor, the best policy in the face of rising interest rates is – the same as the best policy would be in any other rate environment. That is, to manage your bond investments with an eye on rates as previously outlined; and otherwise, to diversify across several non-correlated asset classes, which could include stocks and/or gold and/or real estate, as well as others. Since they all move to their own rhythms, at almost all times there are some that are doing well even if others are not. Each of those assets must then be managed on its own to its best advantage and according to its own characteristics.

Those principles are the foundation of the ProActive Investing method. We can describe some of the outlines of the program in these short articles. The full details are in the program itself. To investigate further, I invite you to contact your local center.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD tests nine-day EMA support near 1.1850

EUR/USD remains in the negative territory for the fourth successive session, trading around 1.1870 during the Asian hours on Friday. The 14-day Relative Strength Index momentum indicator at 56 stays above the midline, confirming steady momentum. RSI has eased but remains above 50, indicating momentum remains constructive for the bulls.

Gold recovers swiftly from weekly low, climbs back closer to $5,000 ahead of US CPI

Gold regains positive traction during the Asian session on Friday and recovers a part of the previous day's heavy losses to the $4,878-4,877 region, or the weekly low. The commodity has now moved back closer to the $5,000 psychological mark as traders keenly await the release of the US consumer inflation figures for more cues about the Federal Reserve's policy path.

GBP/USD consolidates around 1.3600 vs. USD; looks to US CPI for fresh impetus

The GBP/USD pair remains on the defensive through the Asian session on Friday, though it lacks bearish conviction and holds above the 1.3600 mark as traders await the release of the US consumer inflation figures before placing directional bets.

Solana: Mixed market sentiment caps recovery

Solana is trading at $79 as of Friday, following a correction of over 9% so far this week. On-chain and derivatives data indicates mixed sentiment among traders, further limiting the chances of a price recovery.

A tale of two labour markets: Headline strength masks underlying weakness

Undoubtedly, yesterday’s delayed US January jobs report delivered a strong headline – one that surpassed most estimates. However, optimism quickly faded amid sobering benchmark revisions.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.