If one thing is glaringly obvious when it comes to investing, it is that a majority of retail speculators limit themselves greatly when it comes to what markets they participate in. Most people I speak to are mainly invested in mutual and equity Funds and maybe the odd stock here and there. Even if they are more heavily focused on a diverse portfolio of stocks in the broad market indices, they are still lacking depth when it comes to being truly diversified. No matter how diverse one tries to be, when you are limiting yourself to positions in stocks alone, you are always reliant on the overall SP 500 to perform.

What Is True Diversification?

True diversity comes from embracing different asset classes which have opposing relationships with each other, not anchoring yourself to just the stock market alone when you are on the ride for both the up moves and the down moves as well. However, the average retail investor has probably not even heard of markets like Forex, let alone ever thought of using it as an alternate investment vehicle.

It can also be daunting to think of opening a new account and having to learn the nuances of a new market that you have little or no experience trading in. This is why some many people stick to what they know, even if what they know is holding them back from achieving their long term goals. It doesn’t have to stay this way though. There are always alternatives and I’d like to discuss some of them further.

Diversifying Investments Using Forex Without Opening a Forex Account

When I first stared trading Forex, my only goal was to generate monthly income from it. I came from a previous career in a low paying environment and needed to get ahead. Growing and preserving wealth was the last thing on my mind, as I simply didn’t have any to worry about. I, like the majority of Forex traders, started in the Spot market currency world, trading through a broker and dealing with the majors: Euro, British Pound, US and Canadian Dollars, Australian and New Zealand Dollars, Swiss Franc and Japanese Yen.

As you may already know, the major FX currencies are traded in pairings through the Global Forex markets like EUR/USD or AUD/JPY for example. When we trade Forex, we are buying one currency in an exchange for the other in the pair, meaning that we are speculating that one will rise against the other. If I buy the pair of GBP/USD it is because I believe the Pound is going to appreciate against the US Dollar. Similarly, if I were shorting the pair, I would be hoping to see the opposite, with the Dollar rising against the Pound.

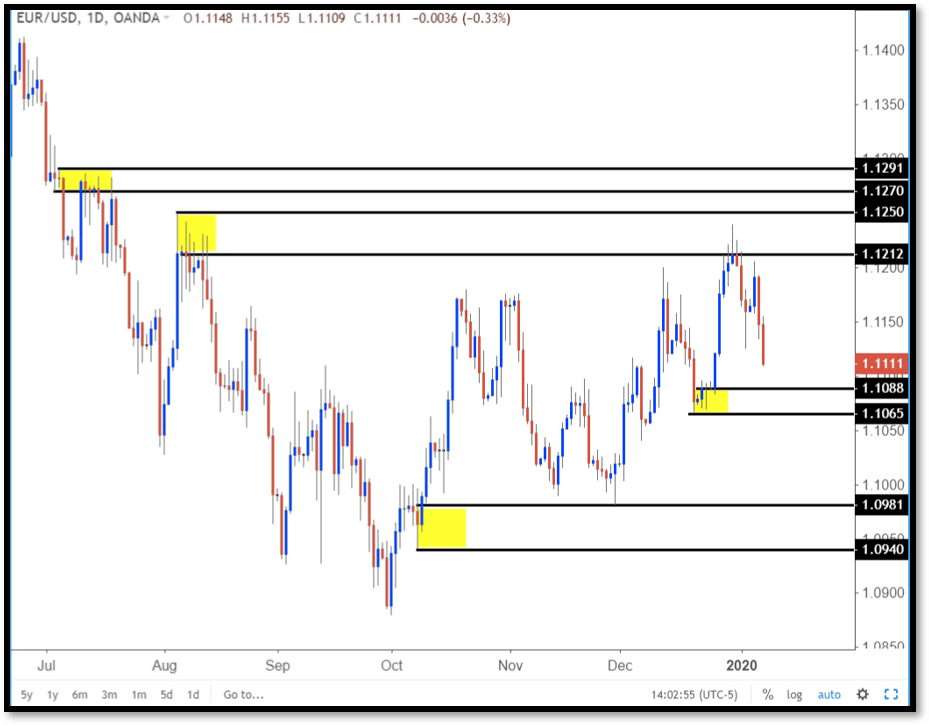

Here is a chart of some recent price activity on one of the most popular pairings in the markets, EUR/USD:

I have marked off a number of key Supply and Demand zones which indicated major imbalances between the willing buyers and sellers. The footprints, as I like to call them, are evidence of major institutional buy and sell activity, marked by the drops and the rallies in the yellow box areas. These areas represent trading and investing opportunities and make up what we call our Core Strategy at Online Trading Academy. The zones give us potential buying and selling areas for low risk and high potential reward setups.

As an active trader in Forex, we can look to take advantage of these areas but we can also use these zones on a derivative of the currency markets as investors too. One of the most popular tools we can use for investing is the ETF (exchange traded fund).

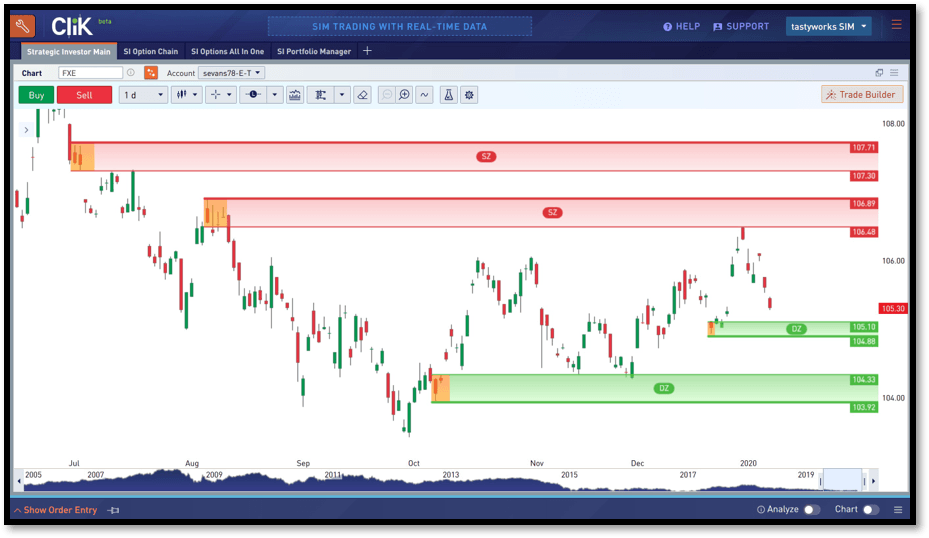

An ETF is an investment fund traded on the Stock Exchange and gives investors an opportunity to buy into the fund which tracks an underlying stock, commodity, bond or other asset. In this case, let me introduce you to the FXE, which is an ETF based upon the value of the Euro against the Dollar. We can effectively trade the Euro like a stock, without needing to open a specific Forex account. Here is a screenshot of the FXE:

As you can see, the FXE moves in a similar price fashion to the EURUSD and as such, I have highlighted the corresponding Supply and Demand zones found on the EURUSD currency pair, to the FXE. The areas in green and red were literally hit and respected at the same time as their counterparts on the currency pair. This is because the FXE is a fund which allows investors to access the Euro with holdings of physical Euros in a deposit account, and these Euros are then tracked in value against the US Dollar giving it a direct correlation to the EURUSD pair.

With its near-identical price action to the EURUSD, the FXE offers both long and short-term investors the ability to expand their reach with a more diversified portfolio and bring in a much needed alternative to the equity markets, but through the ease and simplicity of a regular investment account. Using an ETF like this also has key tax benefits, such as being able to trade it through an IRA account and even employ further risk management practices as well, such as using options to protect our exposure and potentially increase our rate of return, if the right conditions present themselves. This will be an ideal subject for discussion in a future article.

The information provided is for informational purposes only. It does not constitute any form of advice or recommendation to buy or sell any securities or adopt any investment strategy mentioned. It is intended only to provide observations and views of the author(s) or hosts at the time of writing or presenting, both of which are subject to change at any time without prior notice. The information provided does not have regard to specific investment objectives, financial situation, or specific needs of any specific person who may read it. Investors should determine for themselves whether a particular service or product is suitable for their investment needs or should seek such professional advice for their particular situation. Please see our website for more information: https://bustamanteco.com/privacy-policy/

Editors’ Picks

EUR/USD looks sidelined around 1.1850

EUR/USD remains on the back foot, extending its bearish tone and sliding towards the 1.1850 area to print fresh daily lows on Monday. The move lower comes as the US Dollar gathers modest traction, with thin liquidity and subdued volatility amplifying price swings amid the US market holiday.

GBP/USD flirts with daily lows near 1.3630

GBP/USD has quickly given back Friday’s solid gains, turning lower at the start of the week and drifting back towards the 1.3630 area. The focus now shifts squarely to Tuesday’s UK labour market report, which is likely to keep the quid firmly in the spotlight and could set the tone for Cable’s next move.

Gold battle around $5,000 continues

Gold is giving back part of Friday’s sharp rebound, deflating below the key $5,000 mark per troy ounce as the new week gets underway. Modest gains in the US Dollar are keeping the metal in check, while thin trading conditions, due to the Presidents Day holiday in the US, are adding to the choppy and hesitant tone across markets.

Bitcoin consolidates as on-chain data show mixed signals

Bitcoin price has consolidated between $65,700 and $72,000 over the past nine days, with no clear directional bias. US-listed spot ETFs recorded a $359.91 million weekly outflow, marking the fourth consecutive week of withdrawals.

The week ahead: Key inflation readings and why the AI trade could be overdone

It is likely to be a quiet start to the week, with US markets closed on Monday for Presidents Day. European markets are higher across the board and gold is clinging to the $5,000 level after the tamer than expected CPI report in the US reduced haven flows to precious metals.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.