What Is Quadruple Witching Day?

Quadruple witching day is the last trading day for monthly stock options, monthly index options, single stock futures and many futures contracts. For 2019, this day fell during the week of Sept 15 – 21. Though the markets are always subject to some manipulation, on quadruple witching day, the level of stock market manipulation is typically greater than on any other day.

I happen to be teaching a class in Online Trading Academy’s Philadelphia center on quadruple witching day and explained to them that, to understand what is happening you must first understand the mindset of many of the professional traders in the major institutions. For example, when trading options, many pros would prefer to sell options instead of buying them, which makes sense when you think about it.

Buying vs. Selling Options on Quadruple Witching Day

Traders who buy options only make money when the price of the underlying security moves in their favor within the allotted time frame. In contrast, those who sell an option could profit from changes in volatility and time decay. In that case, they could make money if prices move in their favor, if prices move slightly against them, or if price does not move at all! There are three possibilities for profit when selling options versus only one for those who buy. This gives options traders a higher probability for reward when selling options than when buying them.

This is where quadruple witching day manipulation comes into play. The traders who have sold options want to gain from them expiring worthless. It is like your insurance company hoping that you drive safely and never file a claim. Your policy expires, they keep your premium, and you renew the policy and pay a new premium!

What Is Pinning?

To realize gains from large option or even futures positions, institutional traders will often buy or sell the underlying stocks to push prices to a point where the close will benefit them. This action, in which traders attempt to pin the price of the stock or the broad market to profit from a derivative position, is called pinning.

Pinning is illegal in most exchanges in the world and traders who participate in this high-volume trading to manipulate prices could face penalties. The problem is in catching the culprit in order for the authorities and the exchanges to punish them.

So, what should a retail trader do about this pinning? Recognize that it does happen and either stay out of the market or trade the momentum. Trading at quadruple witching day can be very risky, as traders need to be quick in their decision to enter and exit when the momentum is slowing, not reversing. It is not for everyone, but for those who are prepared, it is possible to participate in the market moves caused by pinning that occurs in the markets every expiration day.

Strategy for Trading at Expiration

Open interest can be used to identify where institutional traders are accumulating large positions. Open interest is a statistic unique to options and futures trading. It is the total number of contracts that are currently in existence that have not been offset by closing trades. This stat is different than volume, which is the number of contracts traded for the day.

To illustrate, if a trader were to buy an option to open a position and the person who sold the option is also opening a new position, volume would increase by one and open interest would increase by one. If they then sold the option to someone else who did not already have a position, then volume would increase but the open interest would not change because they transferred their interest to someone else.

In the case of selling an option, open interest would have decreased if they had sold the option to someone who had already sold an option and was buying to close their position. Since both of parties are closing positions, the option contract is not needed anymore, and open interest goes down even though the transaction increases the volume reported.

Understanding open interest can seem confusing at first, but our options and futures instructors at Online Trading Academy do an incredible job at making difficult concepts easy to understand in the classroom.

Open interest is important to stock traders and investors as well as option traders because it shows us where traders are putting their money. Open interest can also help as an odds enhancer when analyzing supply and demand zones. If there is high open interest at or just beyond a zones, the zone is more likely to hold as many traders sold options beyond it.

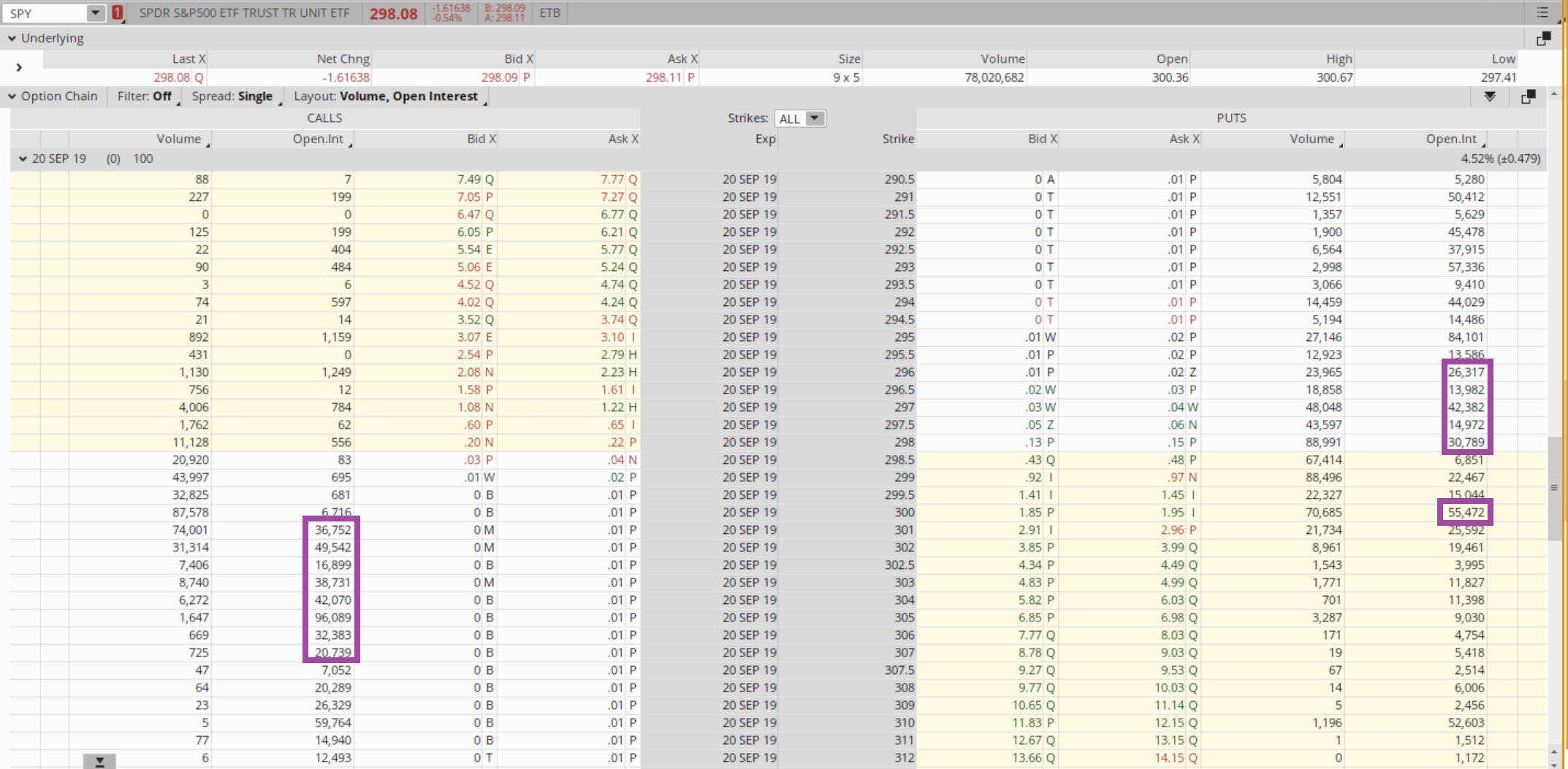

This week, I showed the students the open interest on the SPY and QQQ along with the zones we identified. In the SPY, you can see the huge open interest on both the calls above 300 and the puts below it. Even though prices were much higher on Thursday, on Friday, the markets opened near the $300 price point and tried to stay there for the day. Unfortunately for many traders, there was news about the trade war that caused a panic and the selloff that followed drove prices just above the $298 level where those puts expired worthless.

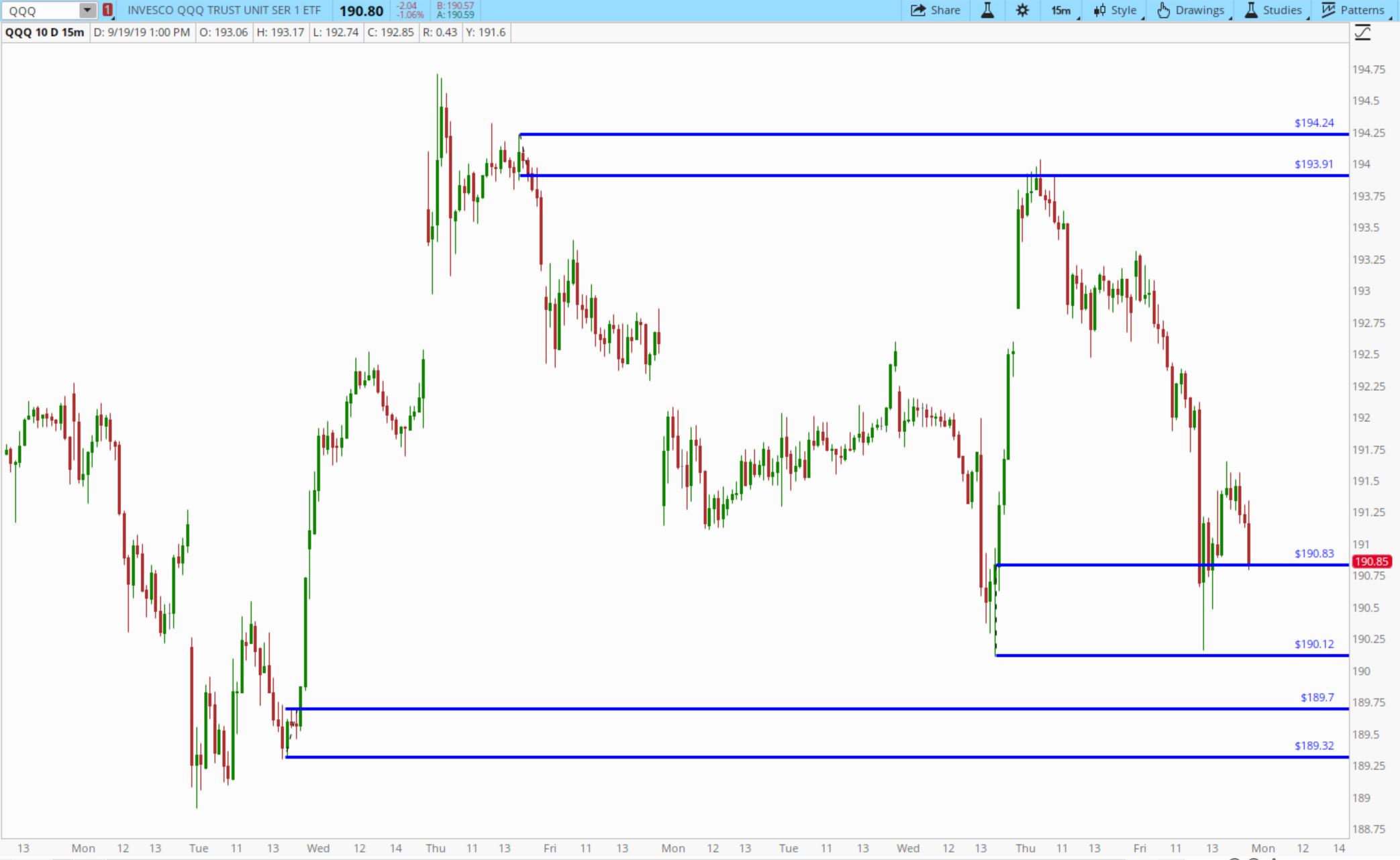

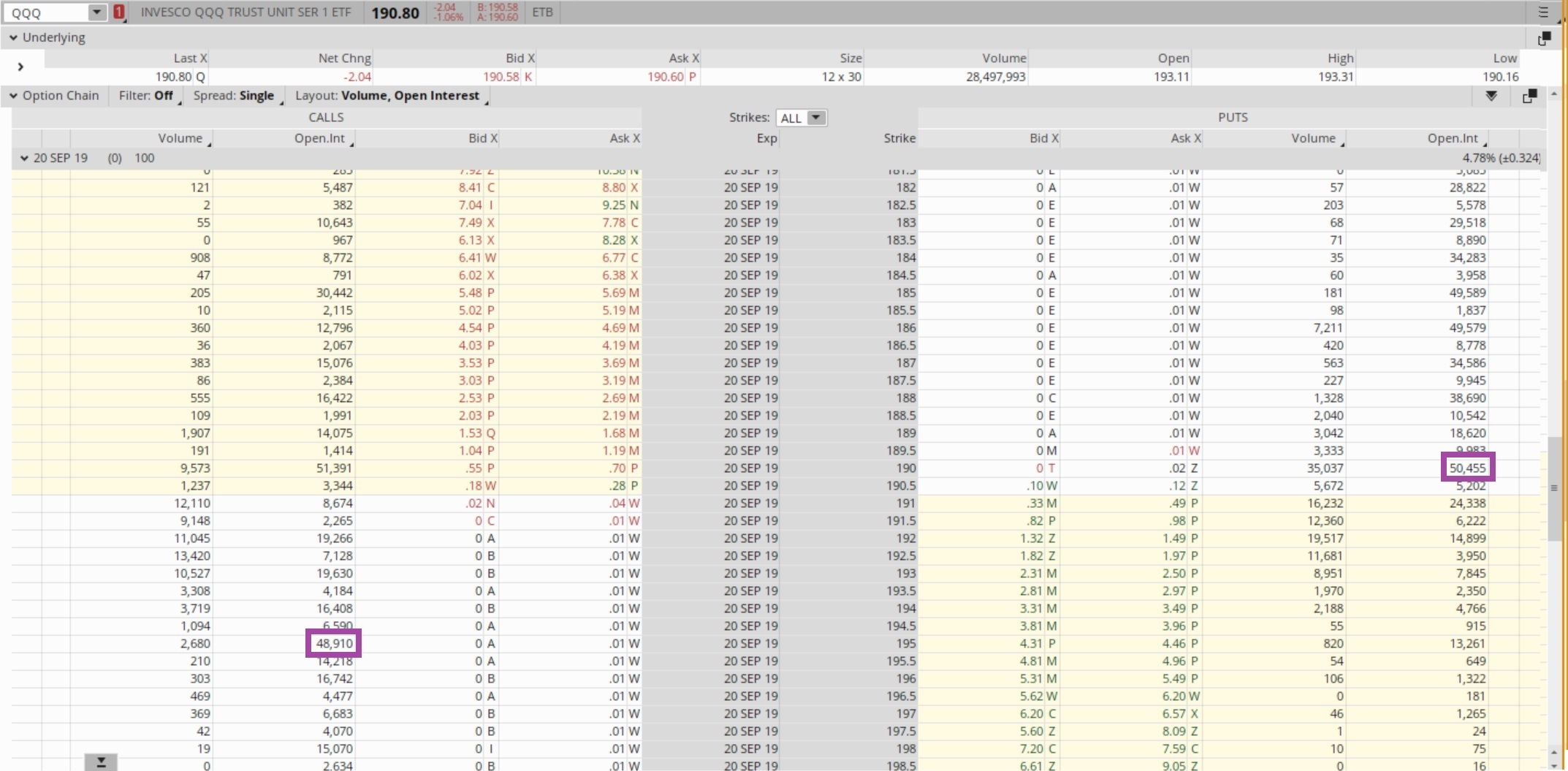

For the QQQ, the Nasdaq ETF, there was a similar move. Prices shied away from the $195 price where there was high open interest on the calls. After the major selloff, the prices closed just above the $190 put open interest of over 50,000 contracts.

Watching the potential pinning activity in the week before option expiration and the open interest on the weekly options can also assist those traders looking to make profits on short-term swing trades as well.

Trades should only be entered based on supply and demand zones. The open interest information provided here is only a decision support tool. To learn how to identify the zones accurately and efficiently, visit your local Online Trading Academy office today.

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

AUD/USD bulls pause amid post-NFP USD rebound

AUD/USD is trading with a mild negative bias during the Asian session on Thursday, below a three-year high set the previous day. The US Dollar looks to build on Wednesday's upbeat US NFP-inspired bounce from an over one-week low, acting as a headwind for spot prices. However, the divergent Fed-RBA expectations, along with the underlying bullish sentiment, should help limit any meaningful corrective fall for the risk-sensitive Aussie.

USD/JPY strengthens above 153.00 despite stronger US jobs data

The USD/JPY pair attracts some sellers to around 153.20 during the early Asian session on Thursday. The Japanese Yen strengthens against the US Dollar in the aftermath of Prime Minister Sanae Takaichi's landslide election victory. The attention will shift to the US Consumer Price Index inflation report, which is due later on Friday.

Gold posts modest gains above $5,050 as US-Iran tensions persist despite strong labor data

Gold price trades in positive territory near $5,060 during the early Asian session on Thursday. The precious metal edges higher despite stronger-than-expected US employment data. The release of the US Consumer Price Index inflation report will take center stage later on Friday.

Bitcoin holds steady despite strong US labour market

Bitcoin briefly bounced from $66,000 to above $68,000 but slightly reversed those gains following Wednesday's US January jobs report. The top crypto is hovering around $67,000, down 2% over the past 24 hours as of writing on Wednesday.

The market trades the path not the past

The payroll number did not just beat. It reset the tone. 130,000 vs. 65,000 expected, with a 35,000 whisper. 79 of 80 economists leaning the wrong way. Unemployment and underemployment are edging lower. For all the statistical fog around birth-death adjustments and seasonal quirks, the core message was unmistakable. The labour market is not cracking.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.