Markus is a self-made multi-millionaire who was born in Germany. He came to the US in 2002 with $30,000 in his pocket and a dream to become a successful trader.

Over the past 20 years, he traded and invested his way to success in the stock and real estate market, making millions of dollars in the process.

Markus has written three best-selling books about trading and investing that have been translated into multiple languages. His youtube channel with over 4 million views is dedicated to his favorite topic — which is trading stocks and options.

Markus has connected with over 300,000 traders in more than 200 countries across the globe.

He lives in Austin, TX where he enjoys spending time on the lake watching his kids racing their sailboats.

I know that if you are reading this, you’re probably interested in trading options, or maybe you are already trading options, but are new. That’s why I want to show you, in this article, how to start trading options in 5 simple steps.

Step Number One — Learn The Basics

The first step is to learn the basics about options. So what are the things that I believe you need to know? For starters, you need to know the difference between calls and puts, because there is a huge difference between the two. If you’re trading the wrong instrument, then you might get results that you don’t want. Right?

Next is you want to know the difference between buying and sellingoptions. There are massive differences between the two, and I’ll talk about them in the next step when we talk about different strategies.

So the next thing that you should know is the basics of options assignment. It’s very important to understand when you can get assigned. If you’re selling puts, you need to know this.

It’s also a good idea to learn the basics about the Greeks, because depending on your strategy, the Greeks might be an important factor here. Now, the Greeks are the so-called Delta, Theta, Gamma, and Rho.

Step Number Two — Choosing Your Strategy

The second step is where you choose your options trading strategy. I recommend two very specific option trading strategies. The PowerX Strategy and The Wheel Strategy.

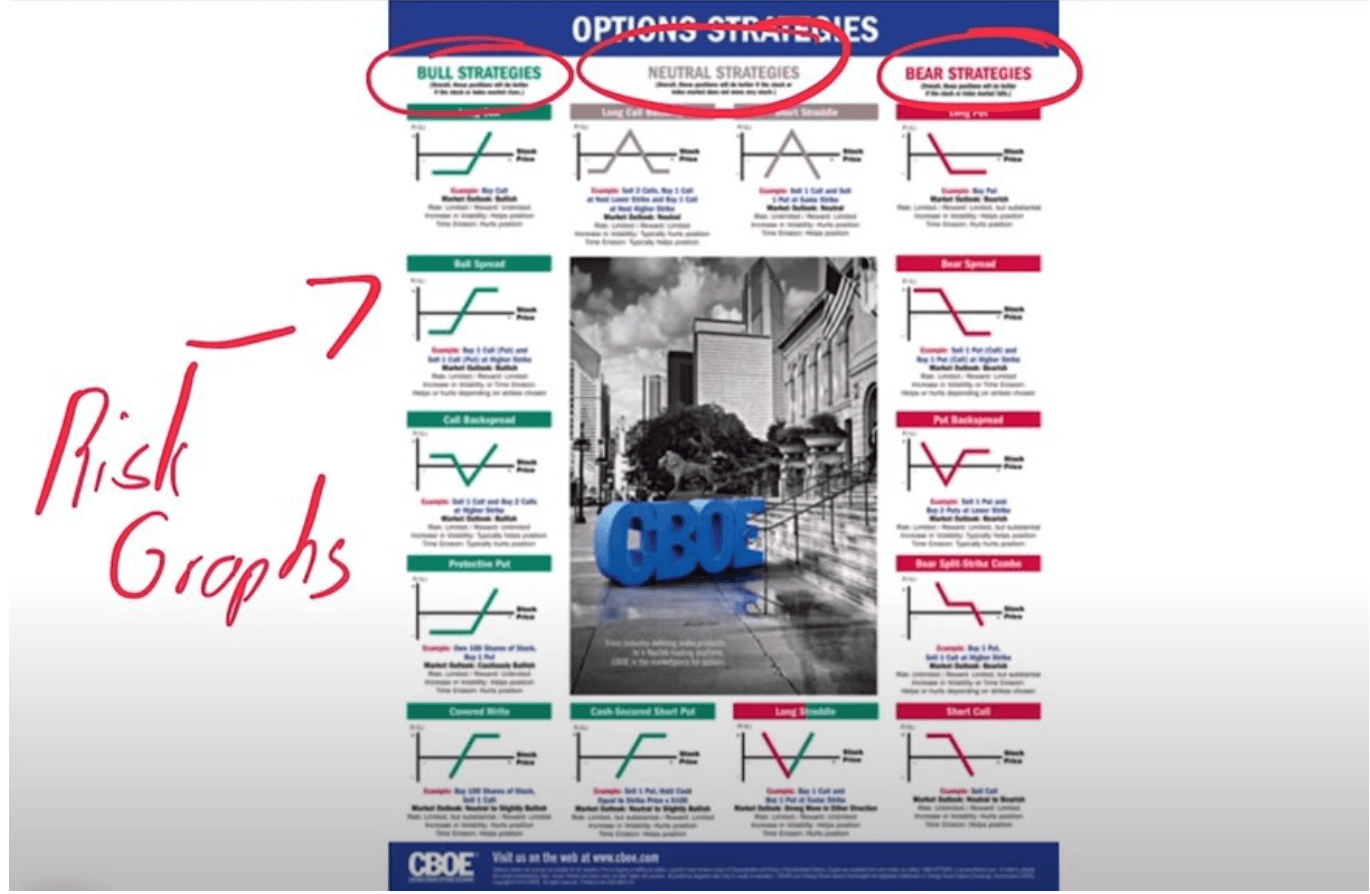

There are many options trading strategies. This is actually from the CBOE, the Chicago Board of Options Exchange, where they actually list quite a few of the strategies that are out there. As you can see, there are several strategies for a bullish market, several strategies for a bearish market, or neutral strategies. They all have so-called risk graphs because each of these options strategies has a different risk ratio. So you need to know what each strategy does.

So when it comes to best options trading strategies, here are a few things. First of all, you can either have a directional or a non-directional strategy.

A directional strategy means that you’re taking advantage of the market when it’s going up or when it is going down. So these would be bear strategies or bull strategies.

You could choose to trade non-directional strategies, which are when the market is rather neutral and just going sideways, as it has been doing for most of the year thus far.

Then you want to know, are you rather interested in buying or sellingoptions? Now, I like to do both. As I mentioned, there are two strategies that I personally like to use. So the first one is The Wheel Strategy.

The Wheel Strategy is a rather non-directional strategy. So what does The Wheel Strategy do? It is about selling options and collecting premium. It is perfect for a market that we have right now where the market is just diddling around. I know the Dow Jones made new all-time highs, 17 record highs in fact, this year.

But overall, the markets are rather choppy, and keep in mind, in the Dow we only have 30 stocks, the S&P and the NASDAQ that are more diddling around, and there are way more stocks in those. So this is where I like to use The Wheel Strategy.

Now, then I’m also trading the PowerX Strategy. So this is a strategy, on the other hand, that is a directional strategy, and with this directional strategy you are buying options and paying premium and you hope that the underlying stock, goes up or down.

So each of these strategies has pros and cons.

Step Number Three — Using The Right Tools

So step number three should be to get the right tools. Now, especially when you are trading options, options trading can be complex. Options trading can be complex, and especially when options trading, it is great to have two main tools that I like to use. The first one here that I like to use is a scanner, but what does a scanner do? A scanner finds the best options to trade.

If you look at an options chain you will see there are so many possibilities. So you need to know what is really the best option, right? Should you buy a call that has a strike price of 200 or 210? Is it in the money, or out of the money? At the money? What is the best option to trade?

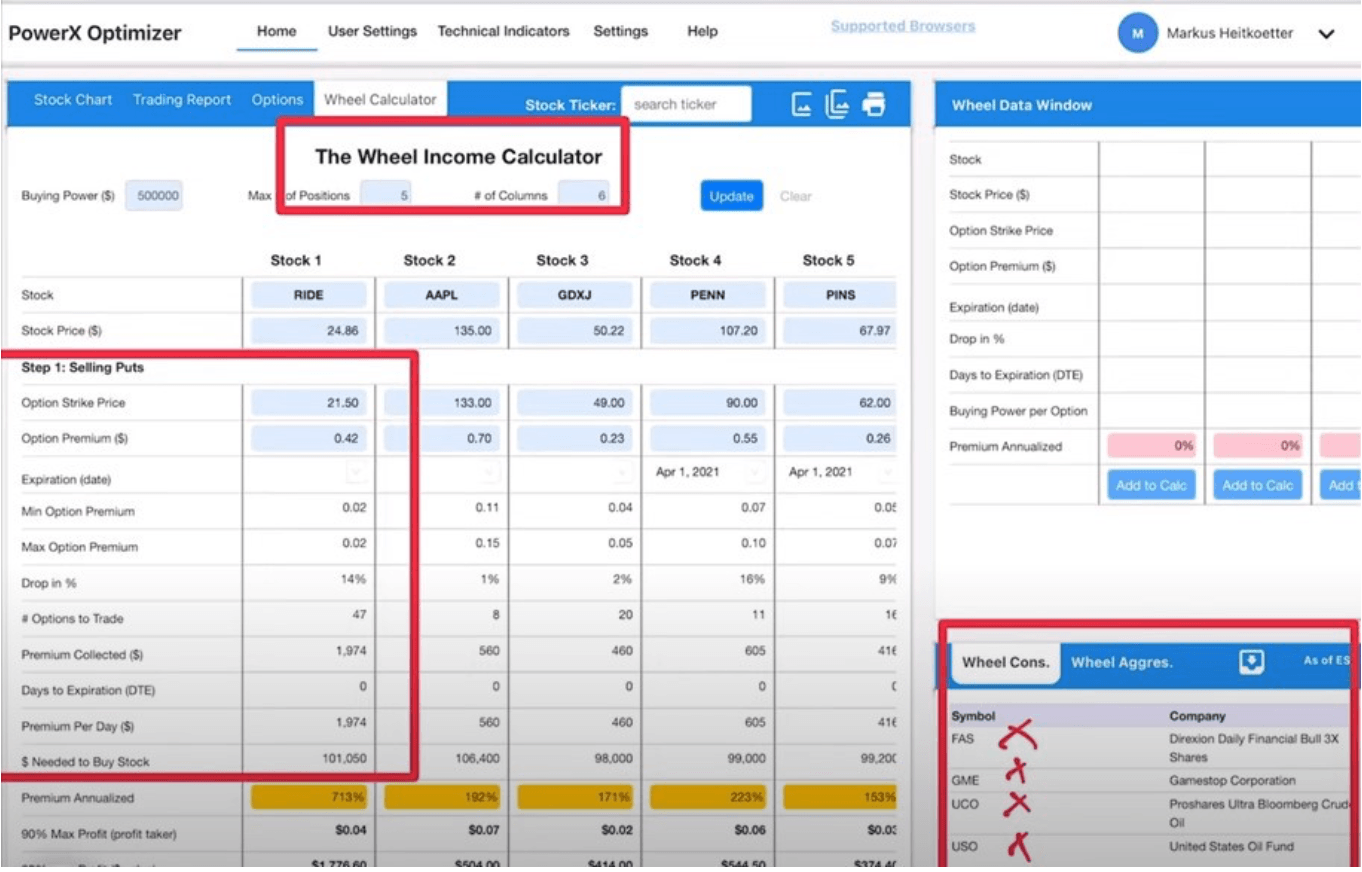

Or when I’m trading the other strategy, The Wheel Strategy, this is where right here, as you can see, I again have a Wheel Scanner right here that is super important for me to find the right stocks or options to trade right now. So there are a few right here.

Then I have the powerful calculator that helps me to get the key performance indicators that I need here. For example, what is the drop in percent that I can afford in this particular stock? How many options should I trade? What is the premium that I’m collecting? How many days to expiration do I have? What is my premium per day? Also, how much money is needed to buy the stock?

So as you can see, these are, it’s not really that complex it’s rather simple calculations, but it definitely helps to have a calculator and a scanner because otherwise, it will be challenging. So this is where I believe that you need to have the right tools.

Step Number Four — Trade On A Simulated Account

Step number four is to test your strategy on a simulated account, and this is a step that is often overlooked by traders because it’s kind of boring. I mean, this is when you’re not making real money, right? You are playing with fake money. So this means this is just simulated money and if you’re making money, it’s not transferred into your account, but the good news is you’re also not losing any money.

So why should you do this? Well, there are two main reasons why you should trade on a simulator, and here’s the first reason. First, you want to make sure your strategy actually works.

I mean, some of you might have seen me trading my accounts on my YouTube channel, and you might have seen that I make thousands and ten thousands of dollars. But you see, just because I can do it doesn’t necessarily mean that you can do it. So you want to make sure that your strategy actually works and that you understand the strategy. Right?

Secondly, you want to make sure you understand the rules of the strategy. Because you see, a trading strategy will fail if you misunderstand the rules. So it is super important because if you don’t understand the rules, you will lose money even though the strategy is a profitable trading strategy. Right? So this is why I feel this is super important.

I recommend at least 40 trades on a simulator. Now you might say,

“40 trades? Can’t I just do two or three and then I got it?”

No, trust me, you want 40 trades, and here’s why. First of all, with 40 trades you get statistically relevant information. Secondly, when you’re trading over 40 trades, you’re trading probably for a month or two. So you’re experiencing different market conditions.

You’re experiencing market conditions when the market is volatile, and when it is quiet. You’re experiencing market conditions when the market is going up, when it is going down, and when it is going sideways, and you will make mistakes, right?

You will make mistakes, especially when you’re new to trading, so you want to make sure that you’re really making all the mistakes on a simulator so that you don’t make them with real money. Because trust me, once you make mistakes with real money, it’s usually very expensive.

Step Number Five — Keep a Trading Log

[00:15:03] Now, let’s talk about the last step, and step number five. Step number five is you need to keep a trading log and evaluate your results, and this is why.

It’s so important whether you’re trading live, or whether you’re trading on a simulator, write down every single trade. You want to write down every single trade, and you want to analyze what’s working and what’s not working.

So what does it mean when you’re analyzing these two things, what’s working and what’s not working? You want to find out, right, I mean, what is your biggest loss? What is your biggest win? What can you expect on average?

What is your average win or loss? What is your winning percentage? You want to know your overall profit, of course, but you want to see this overall profit is it coming from one big win, or is it coming from a lot of small trades, right? And if you want to get advanced, you can also calculate your profit factor if you want.

Summary

Trust me, if you’re new to options trading and you’re doing these five steps, you will be way ahead of everybody else. So let’s recap.

So number one, you want to learn the basics about options trading. You really don’t have to spend hours and hours learning the basics. What you should rather spend more time on is choosing the right options strategy, and before you can choose the right options strategy, you need to understand what does this options trading strategy does and is this a good fit for you.

This is what I always say, there is no “best” strategy. There’s only the best strategy that fits your personality, that fits your criteria, that fits your account size, that fits your risk tolerance, and that fits your availability to trade.

Then moving on to step number three, you need to have the right tools. It will make your life so much easier. Without the right tools trading can be super frustrating. With the right tools, it can be super rewarding and it can be super fun.

It is also very important to test your strategy on a simulated account. Please do not skip this step. This is really the difference between traders who are making it and traders who are losing money. Most traders are jumping into trading without testing the strategy.

Again, trading on a simulator serves two main purposes. Make sure that the strategy that you selected is actually working, and also make sure that you understand the rules of the strategy.

Finally, step number five, keep a trading log, evaluate the results, and see is it working for you or is not?

Trading Futures, options on futures and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. The lower the day trade margin, the higher the leverage and riskier the trade. Leverage can work for you as well as against you; it magnifies gains as well as losses. Past performance is not necessarily indicative of future results.

Editors’ Picks

EUR/USD holds near 1.1900 ahead of US data

EUR/USD struggles to build on Monday's gains and fluctuates near 1.1900 on Tuesday. Markets turn cautious, lifting the haven demand for the US Dollar ahead of the release of key US economic data, including Retail Sales and ADP Employment Change 4-week average.

GBP/USD declines toward 1.3650 on renewed USD strength

GBP/USD stays on the back foot and declines to the 1.3650 region on Tuesday. The negative shift seen in risk mood helps the US Dollar (USD) gather strength and makes it difficult for the pair to find a foothold. The immediate focus is now on the US Retail Sales data.

Gold stabilizes above $5,000 ahead of US data

Gold enters a consolidation phase after posting strong gains on Monday but stays above the $5,000 psychological mark and the daily swing low. US Treasury bond yields continue to edge lower on news of Chinese regulators advising financial institutions to curb holdings of US Treasuries, helping XAU/USD hold its its ground.

Bitcoin Cash trades lower, risks dead-cat bounce amid bearish signals

Bitcoin Cash trades in the red below $522 at the time of writing on Tuesday, after multiple rejections at key resistance. BCH’s derivatives and on-chain indicators point to growing bearish sentiment and raise the risk of a dead-cat bounce toward lower support levels.

Dollar drops and stocks rally: The week of reckoning for US economic data

Following a sizeable move lower in US technology Stocks last week, we have witnessed a meaningful recovery unfold. The USD Index is in a concerning position; the monthly price continues to hold the south channel support.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.