Too often, we use to work too late at night. Thursday overnight, by one o'clock, was not an exception. Suddenly, in the Trading Room I manage, a lot of messages pop up: The cable !, The Cable.

At the beginning, what it really surprise me, was to find out so many Traders working at that time, but in fact, what it was really important, was that the fact that the pound was falling down a 6% in an unexpected move. It was really a Flash Crash !

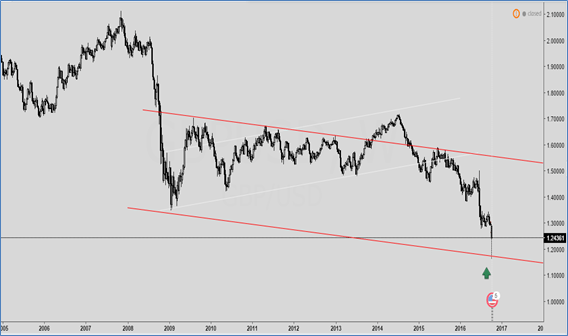

After checking that no news was being released at that time, and also, that no Stock Operator was pressing the wrong button -for sure, by that time, he was sleeping at home with his family-, I realise that, in fact, it was a Climatic Action at the bottom of a bear channel. One of the patterns that I use to buy.

To be honest, I truly believe that it was only a simple speculative move, that's all ! One more time, a test of a level done by the Algos, a move to test Liquidity at that price level, and at the same time, once more, a Stop Hunting strategy. Every day, I can see these moves quite often and often. I advice you to read the brochure from the Switzerland Trader Richard Olson: "How to Trade", a strategy that I have being using in my trading with a rate of success of 96% in this account http://bit.ly/2e5xahU

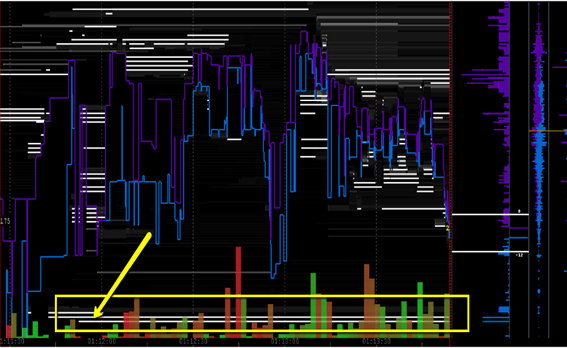

I wish you could accept my idea for a moment, so then, we can approach to this move from the Technical point of view. A Flash Crash will always pop up, for one simple reason, because there is no market. That's it, a small move in the Tape or Order Flow (looking at the market from the side of the Demand or aggression at the bit), succeeds in moving the prices just a dozen of points, but what happen if when the price gets there, there is "nothing". Well, it's easy to imagine, the price will drop until the first level where to meet paper or liquidity.

This move is what we call the Butterfly effect, a small move in the price is enough to trigger a Long Covering of buyers, which will accelerate the prices to the next level down of stops, which will move again the price in an avalanche effect to the next level, in a move, that could last for seconds, minutes, days, years.... This was not the case in the Pound, because of the Absorption, as we will try to explain below.

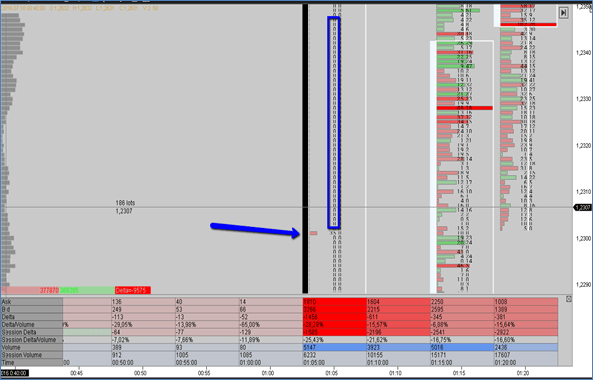

Let's see how was the auction at that moment:

Price was trading at 1,2610 when suddenly, "someone", spending not much, succeed in moving the price lower to a level where: What was there ? well, the fact is that there was nothing. As we can see in the Tape, full of 0, price keep on falling over the 35 lots traded at the bid until to meet an area of liquidity.

It was not, until the level of 1,2100 that we could found the first limit buying orders, pay attention to the big Trade at 1,2119. A "Smart Money" was loading a lot of paper at cheaper prices below Value. It's was just the low of the bracket below the Point of Control in the Market Profile Value Investing approach.

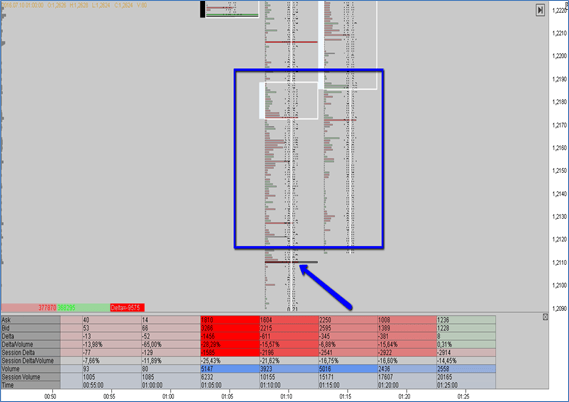

Looking at the side of the offer, let's see how in the Order Book, will pop us a Large amount of buying orders below the price, of course, that happened not long time ago after "them" loaded all they need to load. This forbidden practice, just read Rule 575 from CME, released on December 15th 2015, it's call Backfilling, in my opinion, it's like an Institutional Stop. I can't imagine an Institution using Stop. By doing this, they are telling us, if you wish, you can come and pass over me, but first, just look what's there, a large wall of concrete, so think it twice before.

In conclusion, in my opinion, this move is just the LLMTR (Lower Low Major Trend Reversal), the final Climax in a Reverse pattern of the Market after the Spike, Channel and Final Flag. It is in that moments where Top Traders need to be brave to buy that Panic, in a spot that could be the bottom of the market.

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.