How To Pick Stocks To Invest In

So you decided to invest in stocks.

That’s great!

Here’s the problem:

There are approx. 6,500 stocks traded at the New York Stock Exchange (NYSE) and another 3,500 stocks are traded on NASDAQ.

That’s a total of 10,000 stocks!

When I was new to trading, I didn’t know how to pick stocks to invest in.

Should you subscribe to a newsletter?

Or listen to the talking heads on TV?

Or should you try to develop your own trading system?

How Do You Decide What Stocks To Buy?

There are mainly 2 ways to pick stocks to invest in:

- Fundamental Analysis and

- Technical Analysis

In this article, I will explain both approaches and answer the question:

“Which is better: Fundamental Analysis or Technical Analysis?”

Let’s get started!

What Is Fundamental Analysis?

Here’s how to pick stocks to invest in using fundamental analysis:

Fundamental analysis means that you are analyzing the company’s “key performance indicators (KPIs)” to determine the true value of a company.

The most common used KPIs are:

- Revenue

- Profit

- Earnings per Share (EPS)

- Price to Earnings Ratio (PE Ratio)

- Market cap

… and many others.

In addition, you need to consider some other factors when using fundamental analysis to determine the fair value of a company, such as…

- The business model

- The competitive advantage

- The management team

- National or global opportunities and threats

… and the list goes on.

If you’re right now confused or feel overwhelmed – you’re not alone.

That’s why many investors listen to “analysts” on TV like Jim Cramer or Rick Santelli, just to name a few.

Or they rely on newsletters to pick stocks to invest in. The idea is that somebody else who is supposedly smarter is doing the analysis for them.

Here’s the problem with fundamental analysis:

YES, there are some formulas on how to calculate the “hard data” e.g. Earnings Per Share and the PE ratio.

But when it comes to other factors like the business model, opportunities and threats, everybody has a different opinion. And who decides which “opinion” is right? Only the market will tell.

And that’s why fundamental analysis is very difficult – and inaccurate.

Often the time horizon for fundamental analysis is YEARS – for a reason: If you wait long enough, eventually you will be right!

Here’s an example:

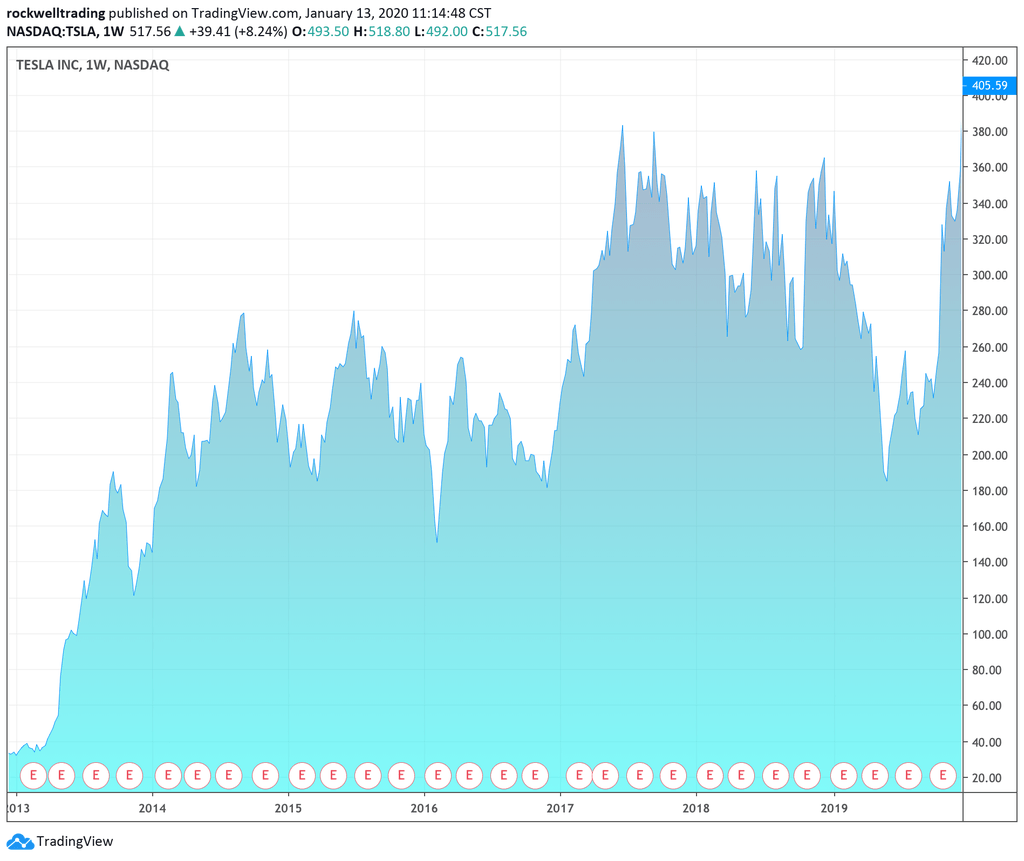

Below is a chart of Tesla (TSLA)

As you can see, TSLA has been trading between $100 and $350 for the past 5 years.

There are many critics, who say that Tesla’s business model and management style doesn’t work. They are criticizing the CEO Elon Musk.

And when the stock went from $360 to $180 within a few months, they said: “See? We’re right!”

On the other hand, you have “analysts” who are bullish on Tesla. They love what the company does!

And when the stock bounced back from $180 to over $400, they said: “See? We’re right!”

As you can see, BOTH of them were right. If you wait long enough, most analysts will eventually be right.

But in my opinion, this is too vague to make money with it.

So let’s take a look at “technical analysis” now:

What Is Technical Analysis?

Technical analysts use charts and past price movements to predict the next move of a stock.

Here’s how to pick stocks to invest in using technical analysis.

When using technical analysis, there are two main approaches:

- Chart Patterns and

- Indicators

Let’s talk about chart patterns first.

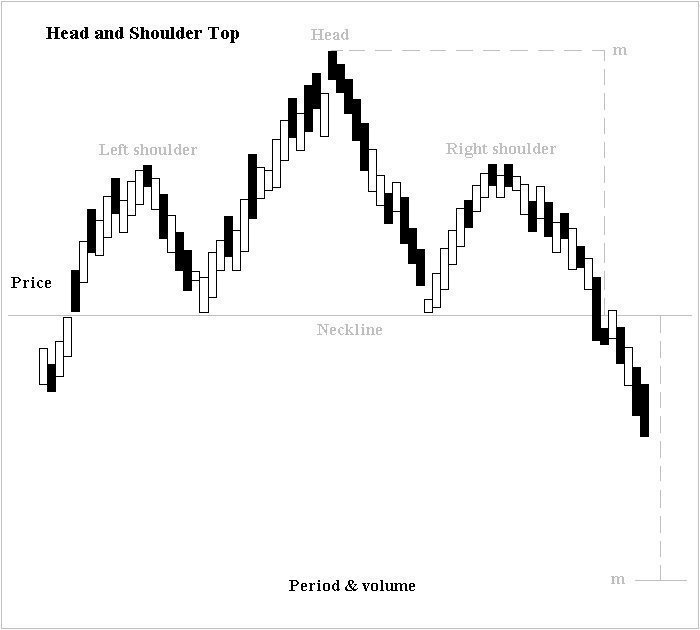

The most popular chart pattern is a so-called “head and shoulder formation.”

Here’s an example:

There are many others:

- Flags

- Pennants

- Triangle

- Cup and Handle

- Double tops and bottoms

… just to name a few.

Here’s my problem with chart patterns:

I see them in hindsight, but NOT while they are forming!

If you show me a chart right now, I can show you every single chart pattern that occurred in the past. But I could not tell you what chart pattern is forming right now, because there’s a lot of room for interpretation.

So what’s the solution?

I personally like indicators!

One of the most popular trading indicators is a moving average.

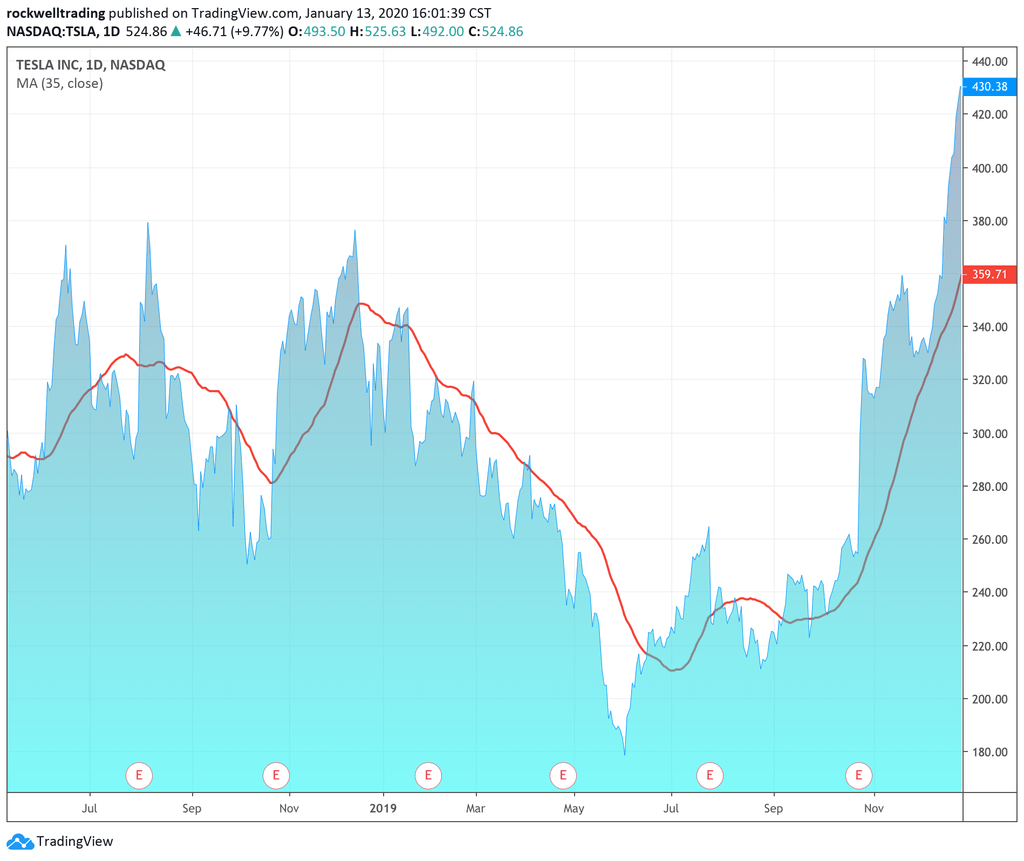

Here’s an example:

The red line is a Moving Average.

The idea is that prices are more likely to go up when they remain ABOVE the moving average and that prices are more likely to go down when they are BELOW the moving average.

Of course, this example is very simple. There are dozens of indicators, and based on my experience, there’s no such thing as a “best” indicator.

I personally found that a combination of THREE indicators is very powerful, and I’ll tell you more about this in a minute.

What Is The Difference Between Fundamental And Technical Analysis?

When using fundamental analysis, you have to dig through balance sheets, profit and loss statements and analyze the cash flow and assets of a company.

In addition, you have to look at the business model, the competitive advantage, the management team as well as national or global opportunities and threats.

As you can see, fundamental analysis is difficult and time-consuming.

And it leaves a lot of room for interpretation.

Therefore, it’s almost impossible for the private trader to conduct a thorough financial analysis to pick the best stock to invest in.

On the other hand, technical analysis is quite easy, because these days, every charting software has already all indicators available to you.

So you can use technical analysis to pick the right stock in a matter of hours!

What Is Better: Fundamental Or Technical Analysis

How to pick stocks to invest in?

Should you use fundamental analysis or technical analysis?

For me, technical analysis is way easier than fundamental analysis.

I love indicators, and here’s why:

- Indicators are scientific and based on statistical analysis.

- They are easy to understand and use.

- They are “black and white.” Either the prices are below the moving average or they are above. You don’t have to guess.

- You can use indicators without any prior experience. It’s perfect for beginners.

- And the best: These days, you have powerful software packages that do the work for you!

Now you know the different ways how to pick stocks to invest in. And you know the difference between fundamental analysis vs. technical analysis.

And you know which one is better.

Next steps: Check out my video and then try to for yourself.

You’re going to love it!

Trading Futures, options on futures and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. The lower the day trade margin, the higher the leverage and riskier the trade. Leverage can work for you as well as against you; it magnifies gains as well as losses. Past performance is not necessarily indicative of future results.

Editors’ Picks

AUD/USD bounces back toward 0.6950 after RBA Bullock's comments

AUD/USD is seeing a sharp turnaround toward 0.6950 in the Asian session on Friday, following the hawkish commentary from RBA Governor Michele Bullock. A pause in the US Dollar advance also underpins the Aussie's recovery. However, the further upside appears limited amid a risk-off market environment.

Gold dip buyers emerge once again near $4,650

Gold bounces off $4,650 demand area yet again amid broad risk aversion. The US Dollar retreats from ten-day highs as buyers take a breather after the recent uptrend. Technically, Gold’s bullish trend remains intact, with dip-buying a key trading strategy.

USD/JPY drops back below 157.00, as focus shifts to Japan snap election

USD/JPY is back in the red below 157.00 in the Asian session on Friday. The Japanese Yen recovers ground against the US Dollar amid some profit-taking ahead of Japan's snap general election on Sunday. The preliminary reading of the Michigan Consumer Sentiment Index report for February will be released later on Friday.

Bitcoin, Ethereum and Ripple sink to multi-month lows

Bitcoin, Ethereum and Ripple slip to multi-month lows, erasing all gains since crypto-friendly candidate Donald Trump won the US presidential election in November 2024. BTC hits a low of $60,000 on Friday, while ETH nosedives to $1,750 and XRP to $1.11.

The AI mirror just turned on tech and nobody likes the reflection

Tech just got hit with a different kind of selloff. Not the usual rates tantrum, not a recession whisper, not even an earnings miss in the classic sense. This was the market staring into an AI mirror and recoiling at its reflection.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.