Most investors desire diversification. It only makes sense not to put all your eggs in one basket.

One of the boons of the age of exchange-traded funds (ETFs) is that it’s now easy to diversify among many asset classes within a regular stock brokerage account. Besides funds based on combinations of stock, there are ETFs that follow the prices of bonds, real estate, precious metals, foreign currencies and more.

One category that should be of interest to all investors is the energy market. We all know that the price of oil and gas fluctuates. These may eventually be replaced by renewable energy sources, but for the foreseeable future they will be a vital part of the global economy. Like all commodities, an investment in oil provides a hedge against inflation. And since the price of oil is only loosely connected to the prices of most other things we invest in, it could provide additional diversification.

How to Invest in Oil

You probably know that there are ETFs that track the price of another key commodity, which is gold. Buying shares of the ETF known as GLD is similar to buying bars of gold in that the fund actually owns one ounce of gold for every ten shares it issues. When you own shares of GLD, you indirectly own that physical gold.

It would be nice if there were such a straightforward way to own oil. Unfortunately, oil is not valuable enough in relation to its volume to make it economical to store indefinitely. There is no way to “buy and hold” oil physically since its storage costs would eat up its value in a few years. That’s why no such ETF exists.

So how do you invest in oil? The closest thing to an oil ETF is the fund known as USO, the US Oil fund. That fund owns futures contracts on West Texas Intermediate crude oil (WTI). Over short periods of time, the price of USO very precisely tracks the price of WTI itself. The key there is “over short periods of time,” meaning hours to days. USO is a very good day-trading or overnight hedging vehicle, which is what it was designed for.

Over longer periods, the costs of storing and transporting oil eat into the value of USO, just as they would if you owned the oil physically. If the price of oil remained stationary for a year, the price of USO would decline at a rate roughly equal to those carrying costs.

From January 2007 to January 2017, the price of crude oil went from $58.17 per barrel to $52.25, with excursions along the way between $140 and $28. Over that ten-year period, the net change was a drop of about 10%, as shown on this chart:

Ten-year Historic Price of West Texas Intermediate Crude Oil

Meanwhile, the value of USO went from $51.60 to $11.36, a drop of over 75%. So, no cigar for USO as a long-term investment.

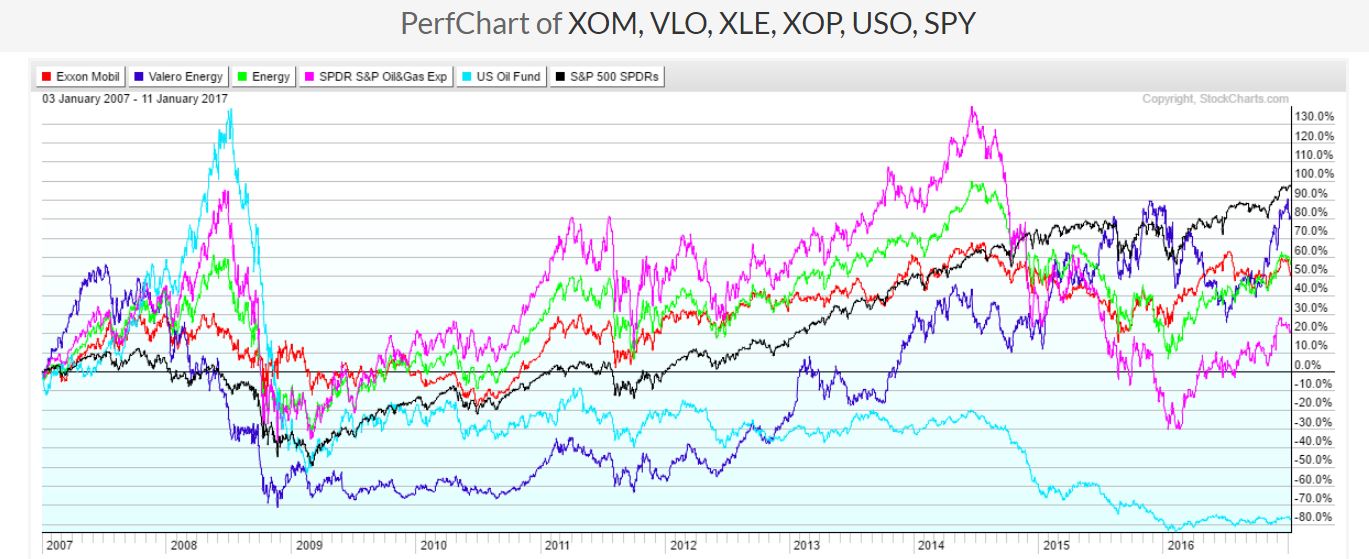

Fortunately, there are other choices. Note the chart below, which compares not just prices but total return including price change and dividends over that ten-year period.

Energy Investments 10-Year Comparison

In the chart above, the approximate cumulative 10-year returns are shown for:

-

XOM +53% (red) Exxon Mobil, a global vertically integrated energy company

-

VLO +87% (dark blue) – Valero, a refining company. It doesn’t drill; it buys, refines and sells

-

XLE + 60% (green) – the Select Energy SPDR fund, a diversified mix of oil company stocks

-

XOP +22% (Magenta) – the SPDR S&P Oil & Gas Exploration Fund. It includes stocks of companies that drill and produce, not refiners

-

USO -75% (light blue) – the US Oil Fund constructed of WTI futures, for comparison.

-

SPY +95% (black) – The S&P 500 index, for a comparison to the US stock market

As you can see, the returns of all of these alternatives have had their ups and downs over the years. Each one of them has spent some time at the top of the heap and some time at the bottom. Yet all (except USO) have had a positive net return over a ten-year period when crude oil itself declined by 10%. Also note, the black line which represents the stock market and how often it has been the case that it was not performing as well as these specialized energy investments.

All of the above ETFs have available options, so covered call strategies can be used on them which could boost returns further.

So when considering investing in oil, depending on your appetite for risk you could choose to ride the big waves with XOP or have a little less drama with one or more of the other choices. In any case, think about adding one or more investments in energy to your portfolio.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

US Dollar struggles as Trump tariff uncertainty grows

The US Dollar struggles to stay resilient against its rivals to start the new week as investors assess the headlines surrounding the US trade regime. After the Supreme Court ruled against US President Trump's tariffs, Trump announced that he will hike global tariff rates to 15%.

Gold pops above $5,200, four-week highs

Gold is holding onto its bullish tone on Monday, reaching new multi-week highs just past the $5,200 mark per troy ounce. Fresh trade-war concerns, coupled with rising geopolitical tensions in the Middle East, are keeping demand for the yellow metal well on the rise.

EUR/USD keeps the bid bias just over 1.1800

EUR/USD has started the week on a positive foot, hovering around the 1.1800 region in the latter part of Monday’s session. The pair’s recovery comes on the back of a decent decline in the US Dollar, as investors keep their attention on the evolving US–EU trade relationship after President Trump’s announcement of sweeping global tariff hikes.

Crypto Today: Bitcoin, Ethereum, XRP intensify sell-off as tariff uncertainty weighs

Bitcoin, Ethereum and Ripple are trading amid increasing selling pressure at the time of writing on Monday, as investors react to fresh trade uncertainty over US President Donald Trump’s push for more tariffs.

Supreme Court nixes tariffs, Trump teases 15% global tariff

On February 20th, the Supreme Court ruled that Trump’s global tariffs under IEEPA authority were unconstitutional, effectively nullifying the framework. However, the relief was short-lived. Within hours, Trump floated a 15% blanket tariff under an alternative legal authority.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.