Many people try to solve the wrong problem.

They think they have:

-

A psychological problem.

-

A patience problem.

-

A discipline problem.

But if you're more disciplined working on how most people trade, you're more consistent in achieving poor performance.

You see:

Above are consequences of an incomplete understanding of the game, sound expertise and refined execution.

So let's start with understanding the game

"Having worked with many traders and trading firms over the years--and especially having participated in the recruitment of traders at those firms--I can say with confidence that distinctively successful traders view markets in distinctively unique ways." Dr Brett Steenbarger

Why is that?

Because trading's a competition in which the overwhelming majority lose. But...

You give yourself a real chance when:

-

You look where the competition isn't looking, or.

-

You look at what the competition is watching through a different lens.

Do this and you shift to unique.

Example to illustrate using AUD/USD

For context:

-

upside moves occurred each previous day this week.

-

reversion to downside during HKE lunch a thing.

-

"hole" in value to the upside existed.

-

*prior day demonstrated greater internal strength over other days.

*from game planning notes: "less flashing on the DOM, didn't need to grab profits off the table quickly before they vanished, sloppy long entries not penalised". Conclusion: internal strength but not evidenced by price moving up. But most are unaware of the last two points. So something unique was discovered!

But how do you turn it into a trade idea?

If internal strength continues but people are not aware of it - they'll keep entering into short trades.

Price could ultimately rip to the upside to force the short sellers to cover - their buying fuelling a move upwards.

But to force a short covering move, the time to execute is when:

-

liquidity is down (HKE lunch).

-

traders are expecting reversion.

Problem?

-

How will the idea's integrity be maintained without giving away the game?

-

What will this look like in the hours prior?

Solution

*from the game planning notes: "Likely have to outlast the competition as starting point. Hole in value above relative value after an already strong move up. Shorts need time to gain confidence to initiate. Longs need be irritated, causing them to cover and/or reverse."

Here's what that looks like on a chart. You can see why short sellers are attracted to this market. Right?

How did it play out? You'll see in a minute.

First?

Question: What's a problem behaviour people aren't aware of?

Answer: How often have you heard people say "I knew it was going to do that"?

But why's it a problem? Well...

How do you monetise that? Agree?

You see:

Your idea isn't a trade.

You still need a mechanism to monetise it. Make sense?

The wrong way.

You see trade executions on a chart.

You conclude the trader was trading chart price action. Right?

But that's not the case for unique trading.

What do you do? You use a multiple-evidence approach. But rather than speak gobbledygook here's a professional trading setup using a multiple-evidence approach to be unique.

See all the different windows?

You combine to uncover multiple evidence points.

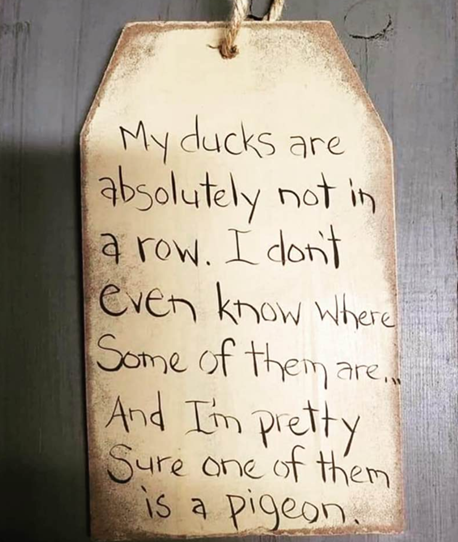

Imagine it as you having many ducks in a row.

Dont't have all your ducks? No trade!

And trading the idea?

You can see how monetising it looks on a chart bearing in mind many points of evidence were combined for each execution.

Watch the competition through a different lens

There's a correlation between how many unique opportunities you uncover and your knowledge of the game.

No giving it away before hand...

Watch catching out the competiton below.

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

EUR/USD: Fed calm, ECB steady, but the Dollar still leads Premium

EUR/USD is still struggling to find real traction. The pair has tried to stabilise, but momentum keeps fading, leaving the door open to further weakness.

Gold: Falling US yields, geopolitics help XAU/USD hold ground Premium

Gold (XAU/USD) gained traction and climbed above $5,200, ending the fourth consecutive week in positive territory. The next round of US-Iran talks and crucial macroeconomic data releases from the US will be watched closely by market participants in the short term.

GBP/USD: Will Pound Sterling defend key 1.3450 support ahead of US jobs data? Premium

The Pound Sterling (GBP) entered a bearish consolidation phase against the US Dollar (USD), after having tested critical support near the 1.3450 level on several occasions.

Bitcoin: Another month of losses, and it’s been five

Bitcoin (BTC) price is stabilizing around $68,000 at the time of writing on Friday, but the Crypto King is poised to close February on a fragile footing, marking its fifth consecutive month of losses since October and a rare start to the year with back-to-back monthly corrections.

US Dollar: At a crossroads; Fed steady, tariffs in flux Premium

The US Dollar’s (USD) upward momentum from the previous week seems to have encountered a tough nut to crack in the 98.00 region, as measured by the US Dollar Index (DXY).

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.