When we are speculating in today’s markets it’s easy to think that keeping a close eye on financial news, studying economic data and paying attention to fundamental analysis is vital to success. After all, why wouldn’t we want to make sure that we were aware of anything that could affect the price of our investments? However, after a little time in the Forex markets we soon learn that often the financial news reports don’t lineup with the price action, leaving us with frustration and confusion.

It is commonly believed that because all Forex traders get financial news at the same time, this makes it somehow a more level playing field, but this is not the case. Let’s be sensible for a moment and ask ourselves the question: do the major banks and institutions make the same decisions as we do with the same information? It is hard to imagine that a major investment bank uses the same technology as retail traders, isn’t it?

In fact, it is more likely that they have access to superfast news terminals allowing them to pull the trigger on a trading opportunity way ahead of the rest of us. Inevitably, this leaves retail FX traders trailing behind the big boys and scratching their heads in frustration. This is one of the many reasons why I ignore the financial news and trade the price action in front of me.

If you have read previous articles by myself or my colleagues, you will know that Online Trading Academy chooses to focus our analysis on price and the patterns that the biggest banks and institutions create when they buy and sell. We call this our core strategy, which recognizes the footprints of institutional demand and supply and, in turn, gives us reasons to buy and sell using a rules-based process. If you take the time to develop an unemotional approach to speculating in the global currency markets, you will find that your trust in that system will grow and, at the same time, your need to follow and attempt to understand the financial news will fade.

A great example of this can be found in a live trading session I was holding with a group of our students on May 1. This was an important day on the economic calendar because the federal funds for interest rates was being published at 2 PM Eastern Standard Time.

While many analysts were expecting the Federal reserve to hold interest rates at 2.5%, it is not uncommon on a major piece of news like this to see the dollar and other currencies react in a volatile fashion. These instances often cause problems for uneducated FX traders but, on the flip side, they also create wonderful trading opportunities for those with a solid trading plan.

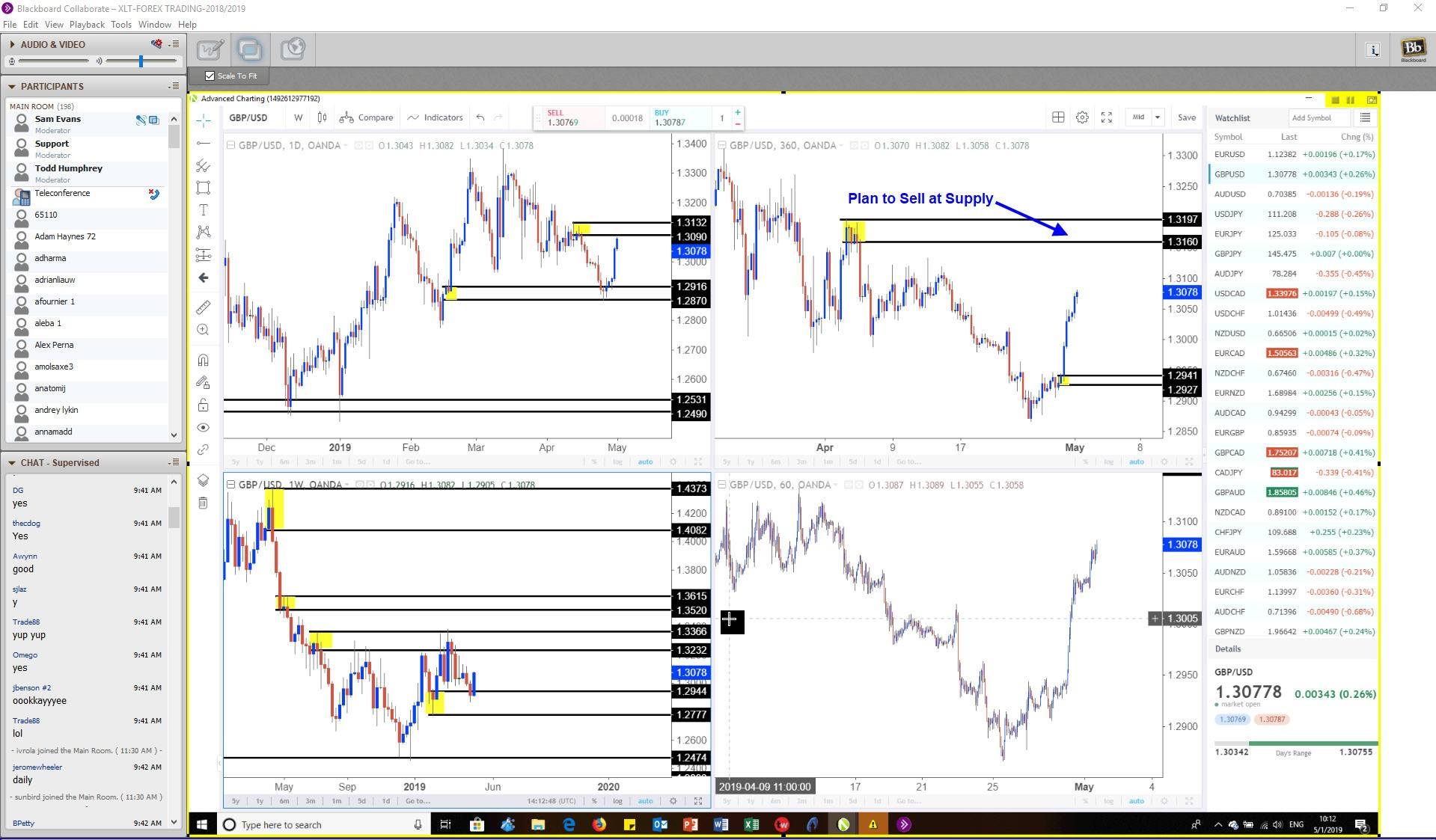

Around three hours before the statement, we set up two low risk high reward trading opportunities. One was on the EURUSD with a short at an institutional supply zone, and the other was also a shorting opportunity at a supply zone on the GBPUSD pairing. Look at the screenshots below of the live trading room in real time when we set these trades up:

Ironically, to the untrained eye both markets were in uptrends at the time which suggested prices were going to go higher. However, our strategy suggested the opposite, with major institutional selling leaving a major footprint at the predetermined supply zones. This is where we placed our orders to sell the pair with a tight stop loss just above the zone in case we were wrong, and a profit target farther down for a generous risk to reward ratio if hit.

The beauty of set ups like these, is that they can be set up ahead of time with all the components of the stop, entry and target placed in the system. This allows us to remove emotion and let the plan fold out either way. Here are the results as they happened:

At the time of writing, the GBP trade has taken partial profits and we are looking for a final target lower, with only profit and no risk on the trade. The EUR trade had a very tight zone and produced around 10 to 1 reward to risk. Both trades worked out according to plan and without any need to understand the rate statement or why rates were held at 2.5%.

We must always realize that news is called news because it has already happened. News reports only explain what happened in the past. As traders, we need to predict what is going to happen in the future and financial news cannot do that. Learn to manage your downside risk and develop a consistent, simple rules-based approach and you will soon find that you’ll be able to focus on the one thing that matters above all, which is price itself.

Be well and take care.

Read the original article here - Financial News and Trading Forex

The information provided is for informational purposes only. It does not constitute any form of advice or recommendation to buy or sell any securities or adopt any investment strategy mentioned. It is intended only to provide observations and views of the author(s) or hosts at the time of writing or presenting, both of which are subject to change at any time without prior notice. The information provided does not have regard to specific investment objectives, financial situation, or specific needs of any specific person who may read it. Investors should determine for themselves whether a particular service or product is suitable for their investment needs or should seek such professional advice for their particular situation. Please see our website for more information: https://bustamanteco.com/privacy-policy/

Editors’ Picks

EUR/USD flirts with daily highs, retargets 1.1900

EUR/USD regains upside traction, returning to the 1.1880 zone and refocusing its attention to the key 1.1900 barrier. The pair’s slight gains comes against the backdrop of a humble decline in the US Dollar as investors continue to assess the latest US CPI readings and the potential Fed’s rate path.

GBP/USD remains well bid around 1.3650

GBP/USD maintains its upside momentum in place, hovering around daily highs near 1.3650 and setting aside part of the recent three-day drop. Cable’s improved sentiment comes on the back of the Greenback’s irresolute price action, while recent hawkish comments from the BoE’s Pill also collaborate with the uptick.

Gold clings to gains just above $5,000/oz

Gold is reclaiming part of the ground lost on Wednesday’s marked decline, as bargain-hunters keep piling up and lifting prices past the key $5,000 per troy ounce. The precious metal’s move higher is also underpinned by the slight pullback in the US Dollar and declining US Treasury yields across the curve.

Crypto Today: Bitcoin, Ethereum, XRP in choppy price action, weighed down by falling institutional interest

Bitcoin's upside remains largely constrained amid weak technicals and declining institutional interest. Ethereum trades sideways above $1,900 support with the upside capped below $2,000 amid ETF outflows.

Week ahead – Data blitz, Fed Minutes and RBNZ decision in the spotlight

US GDP and PCE inflation are main highlights, plus the Fed minutes. UK and Japan have busy calendars too with focus on CPI. Flash PMIs for February will also be doing the rounds. RBNZ meets, is unlikely to follow RBA’s hawkish path.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.