You want to be right, right?

And why is that?

It's a chicken and egg thing...

At an unconscious level, your human psyche is naturally tilted towards loss aversion. But it's what happens next...

When you first enter the world of trading you're at your most inexperienced. Correct?

So it's precisely when your trading ear tunes into what sounds good at first impression rather than what actually works or makes sense. Agree?

Bombarded with hundreds of trading systems and services promoting incredibly high winning percentages — your new logic says the best way to succeed as a trader is to be right (i.e. book winners) as often as humanly possible.

But this thinking is a trick and a trap — an expensive indulgence of your primal wiring.

Hooked, line and sinker — you now associate trading with win rates that, quite frankly, are not achieved by discretionary traders.

My best trader makes money only 63 percent of the time. Most traders make money only in the 50 to 55 percent range.

Steve Cohen — SAC Capital

(Stock Market Wizards)

So is there a way you can be right always? — You'll see in a minute.

But first: what are the following you know all too well?

Failing to initiate a trade when you should have.

Getting stopped out, only to see the market move as intended without you.

Holding for a larger profit target, only to give back gains or, worse, incur a loss.

Exiting too early as the market continues moving without you.

Neglecting to add to a winning trade, missing out on substantial rewards.

Waiting indefinitely for trades to move out of the red.

Your account goes up but goes down by more.

Answer?

They're the outcomes of the wrong decision.

You see:

A win is the wrong kind of right.

The only kind of right that matters is the right decision.

How so?

When you make the right trading decisions, you succeed at trading - even when you win half the time. Want proof?

Show you in a minute. But first...

Do you think it's possible to make the right decision most of the time?

The answer is absolutely.

Sounds like a huge promise. Right?

Well, it's not a promise.

It's just skill.

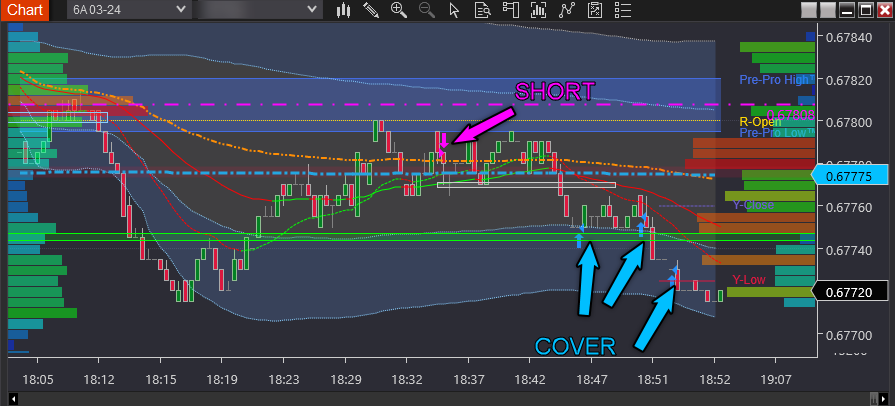

Look at the actual trading below. (the buys and sells).

And to prove it's skill

Now...

Imagine how you'd feel if everything you did on the trading field was mostly the right decision (none of us are perfect so we make mistakes).

Isn't that when you no longer simply identify as someone who makes trades but instead identify as someone who's 'a trader'? Agree?

So when you meet someone new

And they ask. "What do you do?"

You say. "I'm a trader"

Isn't that the whole reason you started making trades to start with? So you can reach the next step to say, "I'm a trader". Correct?

And then when that someone asks you "How do you do it"

You say:

"It's skill. Skill to make the right decisions. And keep my mistakes to a minimum"

And the good news?

Skill in making the right trading decisions can be transferred. So you can partner with someone who can impart this skill to you.

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

USD/JPY slides back below 156.00 as Tokyo CPI backs further BoJ rate hikes

USD/JPY attracts fresh sellers for the second straight day following the release of Tokyo CPI, which grew slightly more than expected in February. This comes on top of hawkish comments by BoJ officials and backs the case for further policy tightening, providing a modest lift to the Japanese Yen. Apart from this, sustained safe-haven buying, amid trade-related uncertainties and geopolitical tensions, benefits the JPY's safe-haven status. However, reduced Fed rate cut bets underpin the US Dollar and could help limit losses for the currency pair.

AUD/USD consolidates around 0.7100 as trade and geopolitical uncertainties counter hawkish RBA

AUD/USD steadies around 0.7100 following the previous day's modest pullback and remains on track to register gains for the sixth week in a row as the RBA's hawkish stance continues to underpin the Aussie. However, reduced bets for a more aggressive easing by the US Fed keep the US Dollar close to the monthly peak. Furthermore, trade uncertainties and threats of imminent US strikes on Iran act as a headwind for the risk-sensitive Australian Dollar.

Gold remains below $5,200 despite tariff jitters and geopolitical risks

Gold is seen consolidating in a range below the $5,200 mark during the Asian session on Friday amid mixed cues. Trade jitters, along with the risk of a potential US-Iran war, act as a tailwind for the safe-haven bullion. Meanwhile, the Fed's hawkish outlook keeps the US Dollar close to the monthly high and caps the non-yielding yellow metal. Nevertheless, the commodity remains on track to register gains for the fourth straight week, though the fundamental backdrop warrants some caution for bullish traders.

How AI, blockchain, stablecoins are shaping a new global economy – Circle CEO Jeremy Allaire

Artificial Intelligence (AI), blockchain technology and stablecoins are emerging as core pillars of a new global economic system, according to Circle’s CEO, Jeremy Allaire.

Changing the game: International implications of recent tariff developments

The Supreme Court ruling on International Emergency Economic Powers Act (IEEPA) tariffs provides limited relief for the rest of the world, with weighted average tariff rates modestly lower.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.