Markus is a self-made multi-millionaire who was born in Germany. He came to the US in 2002 with $30,000 in his pocket and a dream to become a successful trader.

Over the past 20 years, he traded and invested his way to success in the stock and real estate market, making millions of dollars in the process.

Markus has written three best-selling books about trading and investing that have been translated into multiple languages. His youtube channel with over 4 million views is dedicated to his favorite topic — which is trading stocks and options.

He lives in Austin, TX where he enjoys spending time on the lake watching his kids racing their sailboats.

Trading is fun and every trader is happy when their trades move in the right direction, but when a trade goes against you, you will experience a lot of emotions:

Fear, anxiety, regret, doubt, maybe anger…

… and these emotions in trading can lead to some bad decisions that could kill your account.

In this article, I’ll show you how to control your emotions in trading so that you become a more relaxed trader.

1. Recognize Your Emotions

When trading, you WILL experience emotions. The main emotions are:

- Excitement

- Greed

- Fear

- Anger

- Frustration

Let’s talk about these emotions and how to deal with them.

Emotion #1: Excitement

When trades are going in your favor, it’s natural for you to be excited. We all love to see “green” in the account, but here’s the problem with that: when trades are going in your favor, you may be too excited and take on more risk.

I have seen this over and over again, especially when trading “The Wheel” options strategy. During the first few trades, traders are usually very careful. They do a great job in picking the right stocks, then they take a few good trades and their account is up nicely!

All of a sudden, they get overconfident. It seems that the trading system can’t lose, and so they increase risk because “things always turn out for the best,” but that’s when trouble starts.

You’re no longer looking for “the best” trades. You feel invincible and want to make as much money in a short amount of time as possible. You start trading with more & more risk, and start choosing stocks that you shouldn’t choose.

Here are a few examples:

TLRY, SPCE, WKHS, LABU

The premium is attractive, and you thought: “I’ll be fine, and if not, I can fly a rescue mission like Markus usually does,” but then you get stuck in a trade, like some of you are.

So please be careful when you experience excitement because it quickly leads to overconfidence, and the markets like to show overconfident traders who’s boss!

Emotion #2: Greed

Next on the list of emotions in trading is greed. Greed is okay as long as you don’t let it take over your trading.

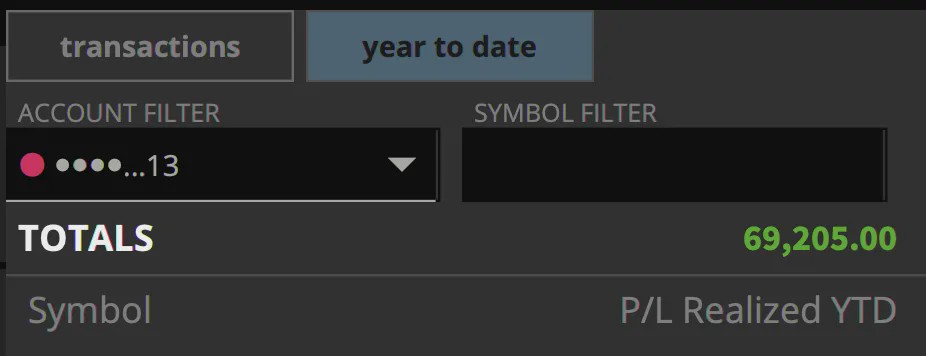

Here’s my P&L: My goal is to make $15,000 per month, and thus far, I have made almost $70,000 in less than 4 months!

I could get greedy now and say, “Why not $20,000 per month? Or $30,000?”

But I am going to keep trading with discipline and make sure that my greed doesn’t get the best of me.

Be humble! Be grateful for what the market gives you because if you are greedy and try to squeeze the last penny out of the markets, the markets WILL put you in your place!

Emotion #3: Fear

The next emotion on the list is fear. Fear is a natural human emotion that we all have. In trading, it’s easy to let fear take over because you can see your profits diminishing in front of your eyes!

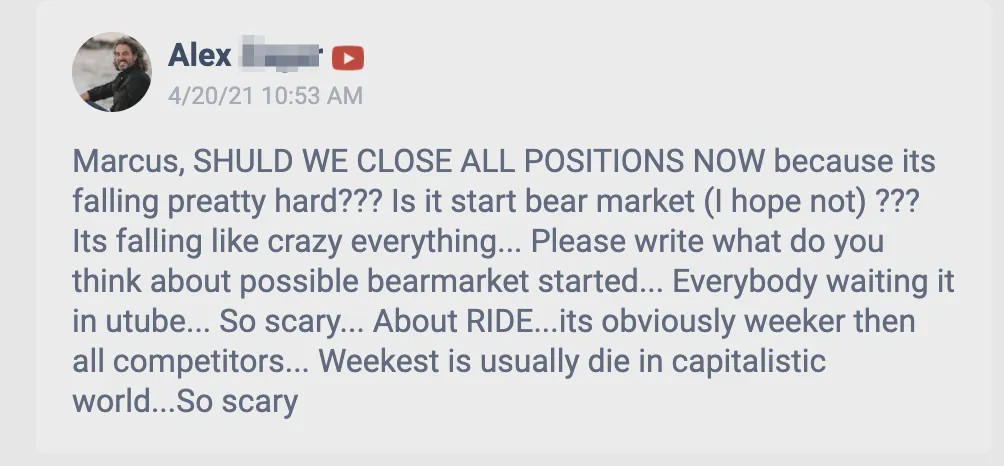

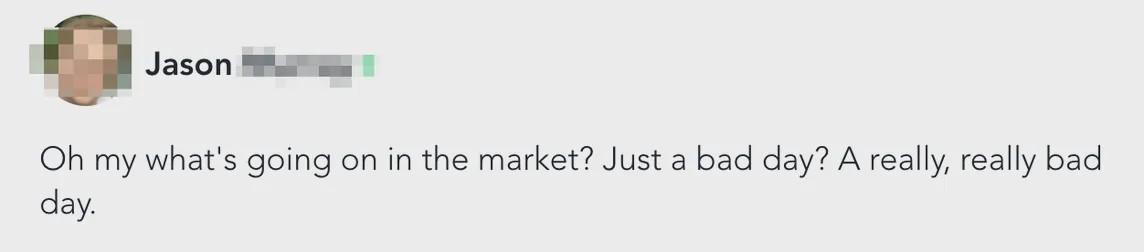

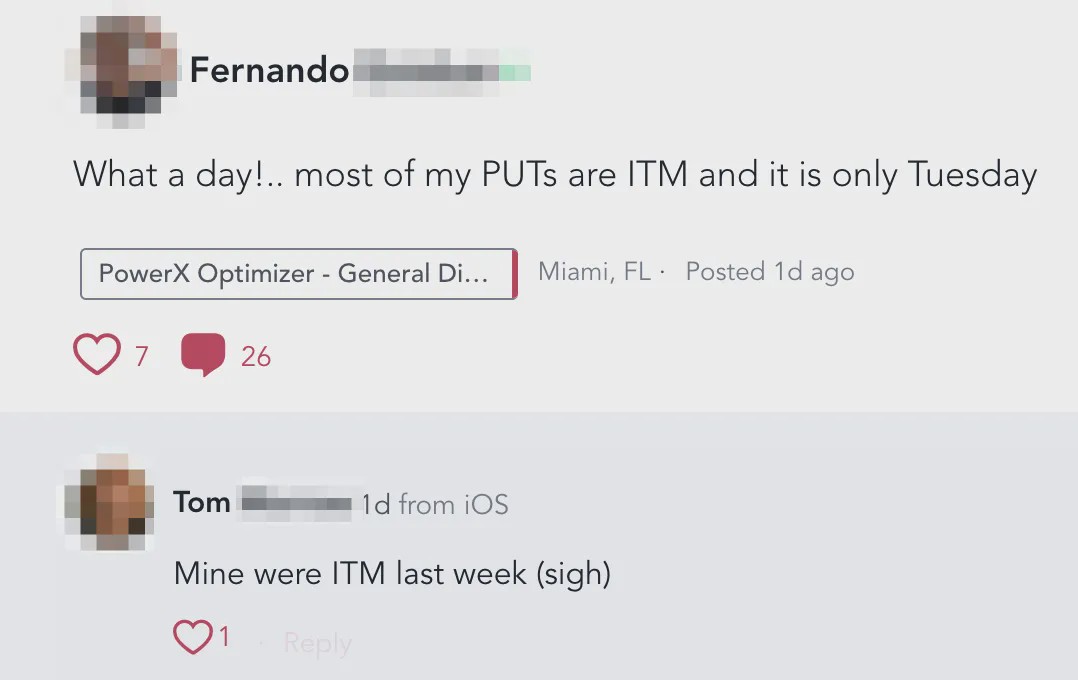

Here’s an example of a trader experiencing fear:

Here’s the problem with fear: it’s a very strong and powerful emotion that has the power to paralyze you, and cause you to have a bad day — a VERY bad day: You’re sitting in front of your computer all day staring at the “red” numbers — the unrealized losses.

Your mind goes crazy because you’re already thinking about how bad your trading account will be when you realize all these losses.

But what a difference a day can make. Have you ever realized how one day it looks bad, and the next day everything is green again?

Here is what you should do when FEAR takes over:

– Step away from the computer. Shut it down! Go outside. Do something else.

– Take some deep breaths and relax.

– Do not panic, this will cause you more harm than anything else! The market is always changing, it’s just out of our control; so instead of panicking, think about what we can control.

Emotion #4: Anger

Next on the list of emotions in trading is anger.

It’s easy to get angry at the markets because it’s so unpredictable!

- You can never tell what is going on and when it will change.

- And why are there always losers?

- Dang, I should have bought 30 minutes ago… but now the price has gone up again?!

Happened to me yesterday: Every single trade that I entered was timed wrong. I could have gotten a much better fill 30 min later!

But: anger does not get us anywhere. Anger leads to revenge trading, which can lead to catastrophic losses.

Keep in mind:

- Markets don’t know who you are.

- Markets don’t care who you are.

- Markets don’t know if you are in a winning or losing trade.

- Markets don’t care if you try to push them around.

If you try to fight the markets, you’ll lose. It’s important not to let anger dictate your trades!

Emotion #5: Frustration

The last emotion on our list is frustration.

It’s easy to get frustrated with trading for the same reasons that I just mentioned:

- You can never tell what is going on and when it will change.

- And why are there always losers?

- Dang, I should have bought 30 minutes ago… but now the price has gone up again?!

Some people react to these events with anger, others with frustration.

Frustration can lead to impulsive trading, and that’s not a good thing.

The best way to deal with frustration is to take some time out from the markets for a few hours or even days until your head clears up.

2. Understand The Effect of Emotions While Trading

In a moment, I’ll share a technique with you on how to control these emotions but let’s first talk about the effect of emotions on your trading.

It’s ok to have feelings. It’s ok to feel these emotions — these are HUMAN emotions. The problems start when you ACT on these emotions while trading.

As you have seen, each of these emotions is causing a reaction, and none of them is good. Emotions cause irrational behavior…

… which leads to impulsive decisions,

… which leads to and bad trades,

… that often leads to losses or drawdowns.

Emotions in trading can be the number one account killer, so you MUST be able to control them.

3. Control Your Emotions By using THIS technique

I have been trading for 20 years, and I still feel these emotions. They say you shouldn’t have any emotions while trading, and based on my experience, that’s not possible! The important thing is to make sure that you don’t ACT on your emotions.

So how can you control your emotions?

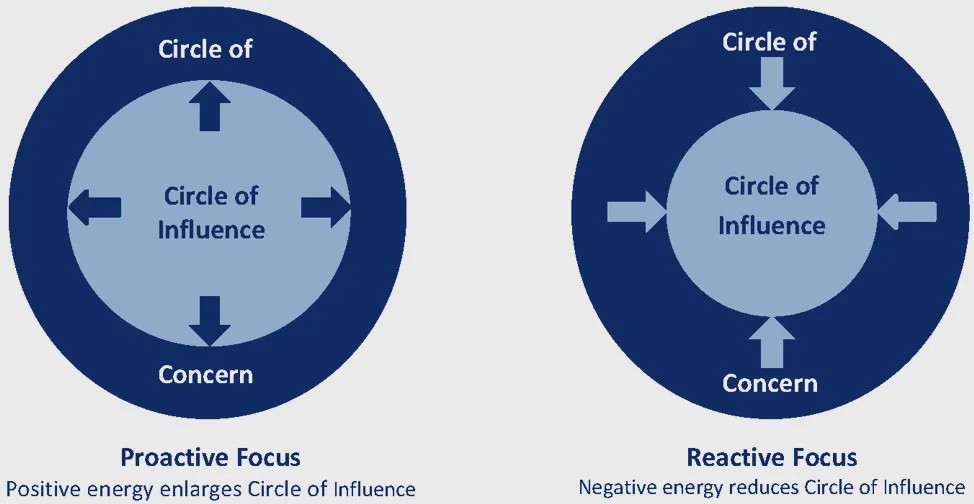

Stephen Covey said it best in his book “The 7 Habits of Highly Effective People”:

Focus on what you CAN control, and don’t worry about what you can’t control.

Here’s an excellent example:

And if you think about it, there are only 2 things you CAN control:

Your Thoughts

Your Actions

You can’t control what the markets are doing, you can’t control whether Hindenburg Research is releasing a report on a company you’re in, you can’t control when a big hedge fund gets in trouble and has to dump a bunch of positions, but you can choose how you react.

Let me give you a personal example:

As you know, I am in RIDE.

And the position is MASSIVELY going against me.

- I could be angry at short-sellers, especially Hindenburg Research.

- I could be frustrated with Lordstowns PR efforts, which suck.

- I could look at my unrealized loss every day and fear “What will happen it Lordstown doesn’t recover?”

I could have a lot of negative emotions around it, and NOTHING would change — other than me getting bitter, and maybe even depressed.

So I keep following my plan, which is selling more premium.

This week, I will make $1,050 on RIDE, no matter what the price is doing. If it goes up, good. If it goes down… oh well, I can’t change that.

I just know THIS:

I won’t let emotions dictate my day, and I won’t let emotions dictate my trading.

I believe the Serenity Prayer says it best:

“God, grant me the serenity to accept the things I cannot change, courage to change the things I can, and wisdom to know the difference.“

Trading Futures, options on futures and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. The lower the day trade margin, the higher the leverage and riskier the trade. Leverage can work for you as well as against you; it magnifies gains as well as losses. Past performance is not necessarily indicative of future results.

Editors’ Picks

EUR/USD: Fed calm, ECB steady, but the Dollar still leads Premium

EUR/USD is still struggling to find real traction. The pair has tried to stabilise, but momentum keeps fading, leaving the door open to further weakness.

Gold: Falling US yields, geopolitics help XAU/USD hold ground Premium

Gold (XAU/USD) gained traction and climbed above $5,200, ending the fourth consecutive week in positive territory. The next round of US-Iran talks and crucial macroeconomic data releases from the US will be watched closely by market participants in the short term.

GBP/USD: Will Pound Sterling defend key 1.3450 support ahead of US jobs data? Premium

The Pound Sterling (GBP) entered a bearish consolidation phase against the US Dollar (USD), after having tested critical support near the 1.3450 level on several occasions.

Bitcoin: Another month of losses, and it’s been five

Bitcoin (BTC) price is stabilizing around $68,000 at the time of writing on Friday, but the Crypto King is poised to close February on a fragile footing, marking its fifth consecutive month of losses since October and a rare start to the year with back-to-back monthly corrections.

US Dollar: At a crossroads; Fed steady, tariffs in flux Premium

The US Dollar’s (USD) upward momentum from the previous week seems to have encountered a tough nut to crack in the 98.00 region, as measured by the US Dollar Index (DXY).

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.