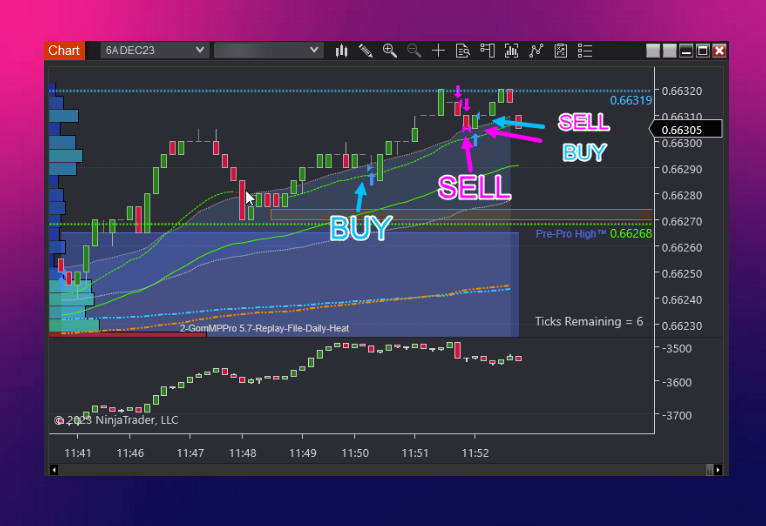

How long do you believe it takes someone to reach the trading level shown below?

Shown are trades from 3 consecutive days of trading.

To help answer the question:

First is learning to spot relative-value shifts, differentiate between speculators and commercial positioning, and know how to play the game - to see opportunities most people overlook.

You can think of this as intellectual property underpinning a successful trading business.

Next is the performance aspect of trading.

Like riding a bike, understanding what you're supposed to do is only a tiny part of the equation.

Identifying up to 10 points of evidence in real-time - while timing trades to minimise how much the market takes and maximising how much you take out of the market - takes practice.

Because at the start - whether it's riding a bike or trading - everyone is awful. Right?

But instead of you facing the daunting prospect of deciphering what mistakes you're making, how to improve, and what areas to focus on - all while not knowing what you don't know...

And even though further skill improvement is necessary - reaching the above level of trading proficiency took 6 months.

So if professional trading firms clarify to recruits - "Don't expect consistent profitability in your first nine months"...

How can someone achieve the above expertise in a comparatively short period?

Answer: Ongoing feedback. And that's the secret sauce in trader mentoring.

Below you can see the feedback accompanying the trading.

The notes are blurred to protect the intellectual property.

Imagine receiving individual feedback and guidance unique to your trading for 9-12 months.

Provided you follow the guidance, it's fair to say you'd see your performance dramatically improve. Correct?

Intuitively, everyone knows you need quality guidance and mentoring to develop successful trading. But the problem is not knowing what type of instruction is effective versus what's simply a waste of your money. Agree?

A mentor in a true sense, teaches someone how to trade professionally using proven industry methods.

They also demonstrate how to trade professionally in a real-life trading environment because practical 'in-the-field' learning is a proven approach across numerous fields, not just trading.

However, the vital piece that develops your trading performance is the ongoing assessment, individual feedback and individual guidance on your progress success.

And critically - it continues for sufficient time - a minimum of nine months - because that's how long it takes.

When you compare five people's performance who all have the same training you'll see five different sets of results.

But that doesn't mean you can't be the best version of yourself if you are serious about trading. Right? And that's all that matters.

And why does it matter?

As Fyodor Dostoyevsky - considered one of the greatest intellectual minds of his era - puts it:

"Deprived of meaningful work, men and women lose their reason for existence; they go stark, raving mad."

It's why people choose to endure a 9-12 month professional trading mentoring program.

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

NZD/USD: All eyes on RBNZ guidance and new Governor Breman's debut

NZD/USD opened Tuesday at 0.60344, reached a high of 0.60520 and a low of 0.60044, and closed at 0.60480, down 0.22%. The pair is holding well above the 50-day Exponential Moving Average at 0.59041 and the 200-day EMA at 0.58545, with both averages rising and spaced roughly 50 pips apart, confirming the underlying bullish trend that began from the January low of 0.57110.

AUD/USD extends the bounce, focus back to 0.7100

AUD/USD adds to Monday’s optimism and approaches the key 0.7100 barrier ahead of the opening bell in Asia. The pair’s positive performance comes as investors keep assessing the hawkish tilt from the RBA Minutes and despite humble gains in the Greenback. Next in Oz will be the Westpac Leading Index and the Wage Price Index.

Gold remains offered below $5,000

Gold stays on the defensive on Tuesday, receding to the sub-$5,000 region per troy ounce on the back of the persistent move higher in the Greenback. The precious metal’s decline is also underpinned by the modest uptick in US Treasury yields across the spectrum.

RBNZ set to pause interest-rate easing cycle as new Governor Breman faces firm inflation

The Reserve Bank of New Zealand remains on track to maintain the Official Cash Rate at 2.25% after concluding its first monetary policy meeting of this year on Wednesday.

UK jobs market weakens, bolstering rate cut hopes

In the UK, the latest jobs report made for difficult reading. Nonetheless, this represents yet another reminder for the Bank of England that they need to act swiftly given the collapse in inflation expected over the coming months.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.