Fed made it clear that more tightening is coming, long USD/JPY?

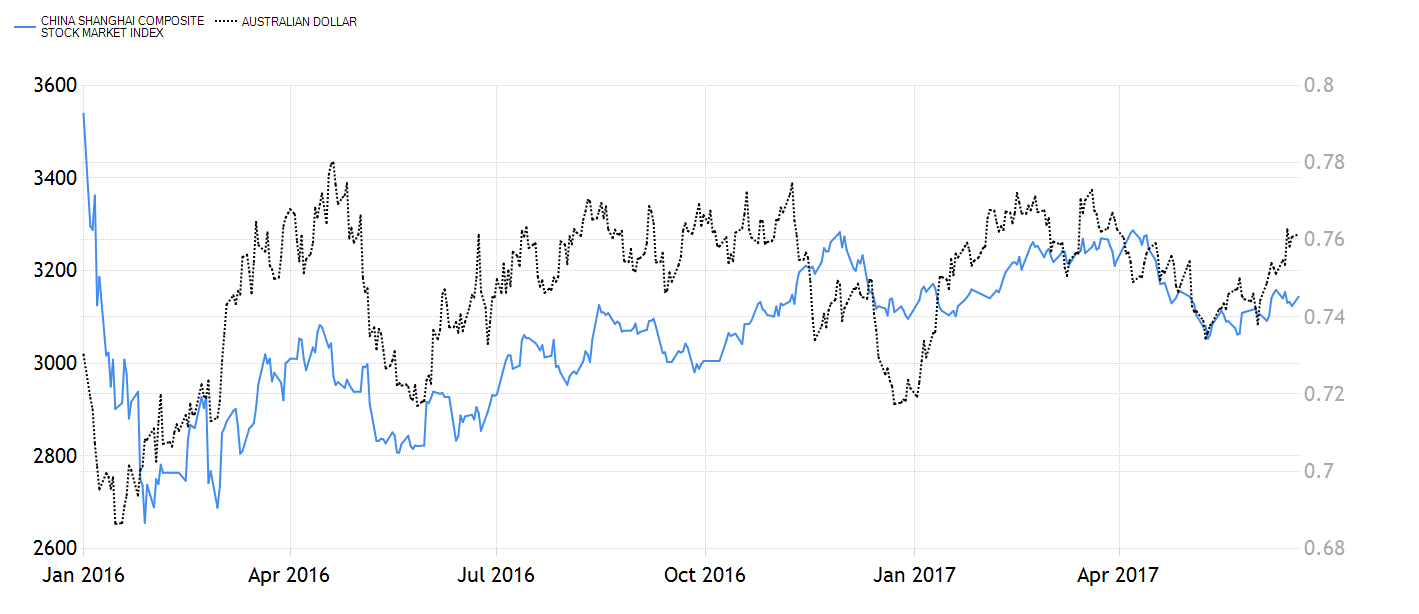

Any MSCI’s A-share inclusion may give Aussie a major boost

China’s growing acceptance into international capital markets faces an important moment as MSCI is going to make a decision to include the first batch of stocks listed on its $7tn domestic equity markets into the world’s dominant emerging markets stock index. MSCI will announce whether it would include China’s domestic A-shares in its global indices after U.S. stocks closed this Wednesday, HK time.

Inclusion into the index would be a major step forward for China as it attempts to open up their financial markets and attract foreign capital. It will also confer an unprecedented recognition upon China’s domestic capital markets and obligate funds from all over the world to pour billions into the country’s stocks.

Having in the past cited regulatory worries and accessibility for global investors, there are signs that MSCI is ready to say yes this time. Such a decision has big repercussions for global investors, as it will obligate investment funds to pump billions into China’s stocks. MSCI has markedly altered the inclusion proposal to make it more palatable to clients. The list of A-share companies to be included in the benchmark index will be just 169, down from 448 previously. If A-shares are included, they will account for only 0.5% of the MSCI EM Index and not a heavy 5% under MSCI’s previous proposal.

In our opinion, if there is a successful inclusion, it could drive the Shanghai composite index towards 3,300 this month. Chart below shows any rally in shanghai stocks is likely to give AUD/USD a major boost.

Fed to shrink balance sheet is positive for U.S. dollar

Fed chair Janet Yellen and her colleagues raised the federal funds rate from 1% to 1.25% overnight, and reiterated they expect inflation to return to target in a few years. At the same time, they stressed they are watching low inflation numbers “closely” after a series of disappointing readings.

Most importantly, Fed officially discussed its plan to reduce their $4.5 trillion balance sheet. FOMC will reduce reinvestment of principal payments received on maturing securities in its portfolio. Payments will only be reinvested to the extent they exceed a set of gradually rising caps, according to the statement. For Fed’s holdings of Treasuries, FOMC anticipated the cap will start at $6bn per month, and increase in steps of $6bn at three-month intervals over 12 months until it reaches $30bn a month. For incoming payments on mortgage-backed securities, caps will start at $4bn per month and increase in steps of $4bn at three-month intervals over 12 months until they reach $20bn per month.

Balance sheet shrinking plan is very new to the market at this stage. It is difficult to assess its impact at this moment. However, uncertainties may drive dollar higher in coming weeks.

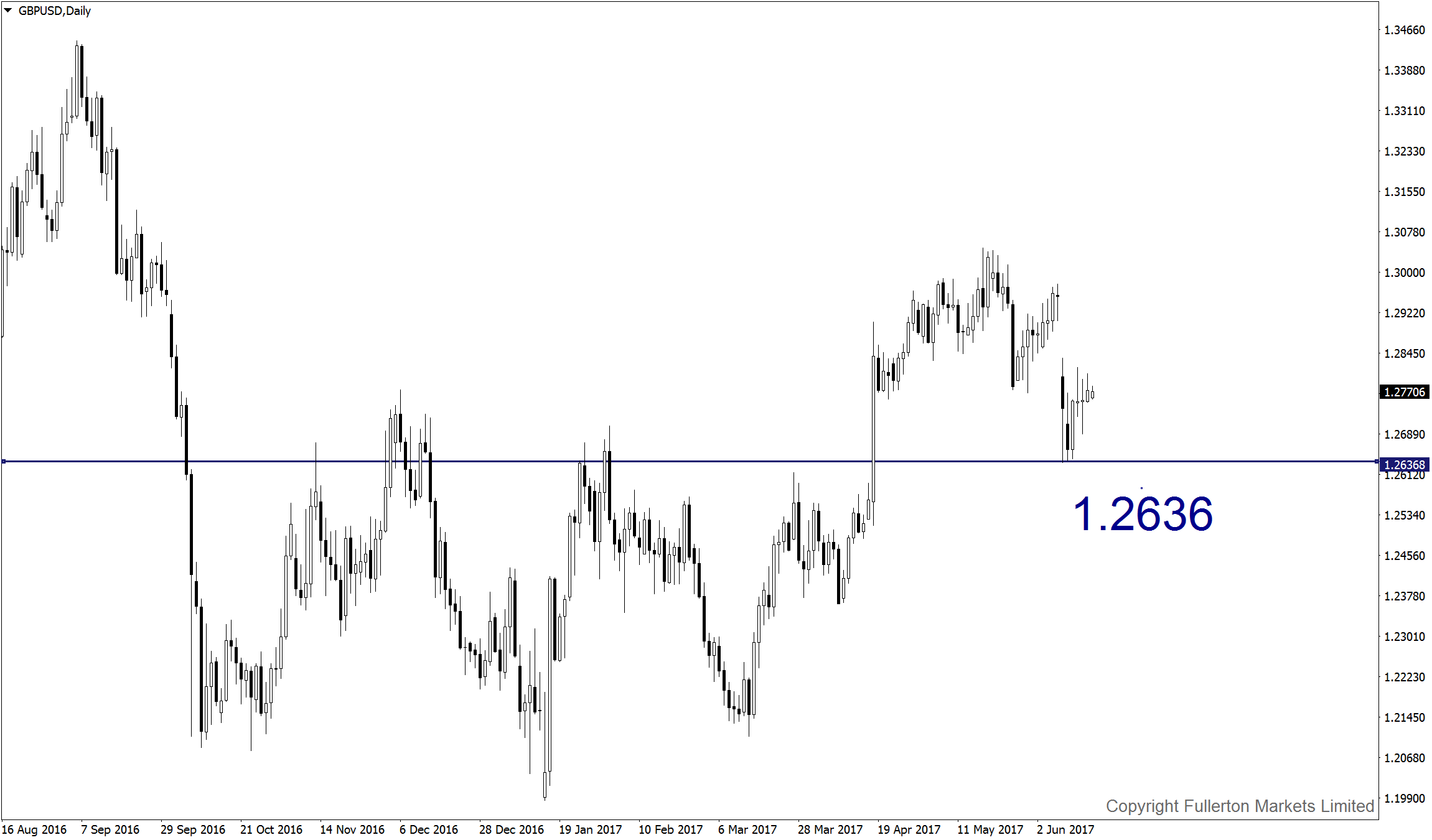

Official Brexit talk kicks off, pound may be under pressure

Brexit secretary David Davis is set to meet Michel Barnier, EU’s chief negotiator, in Brussels today to begin formal talks on the process of untangling the UK from the bloc. EU will focus on issues of citizens’ rights and Brexit bill for the next few months, a sequence to which UK had previously objected.

Now that the British election has thrown a wrench into an already complicated and unpredictable proceeding, investors will be watching closely to see the reactions from both camps.

Our Picks

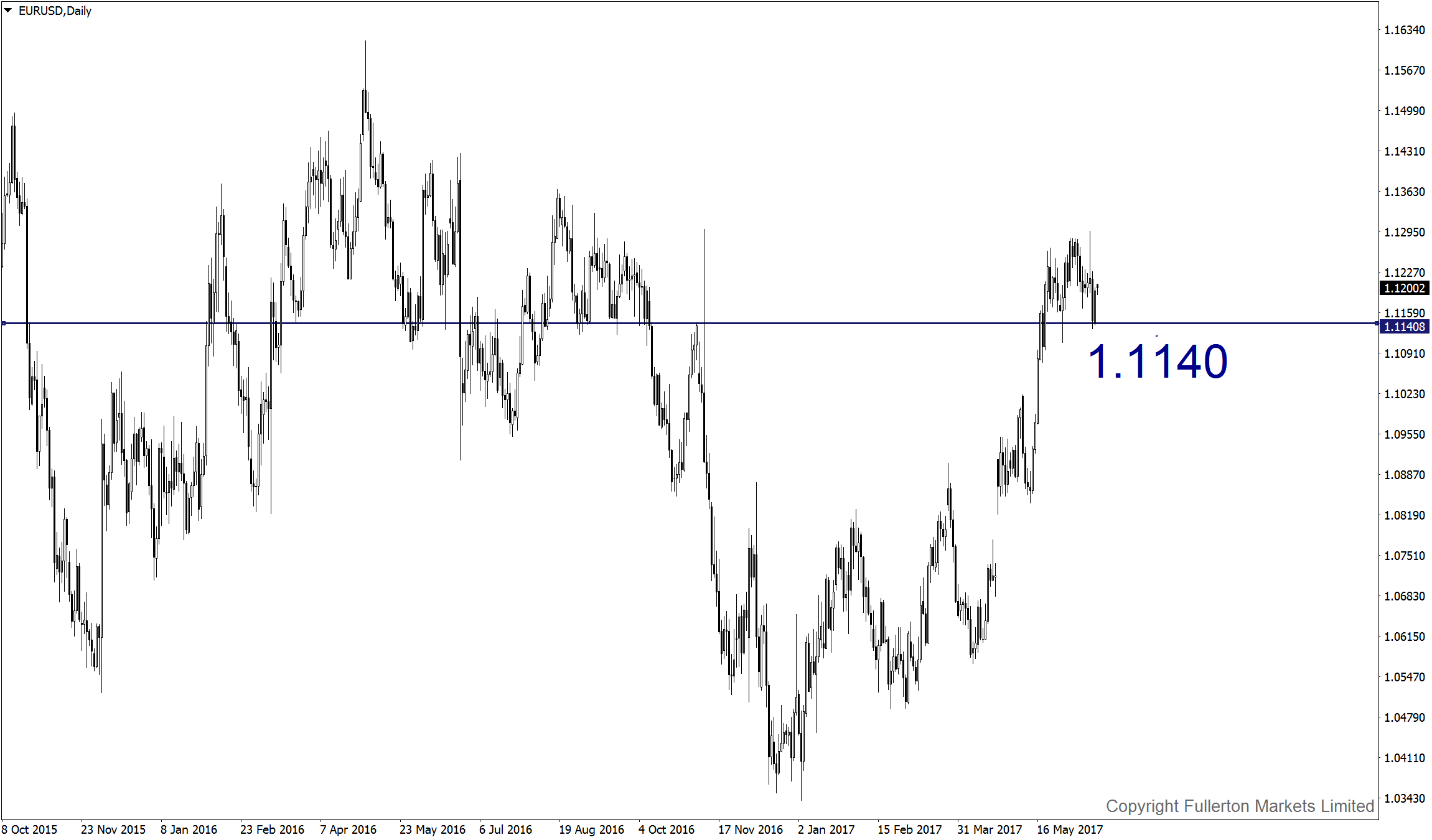

EUR/USD – Slightly bearish. The uptrend is showing a bit exhausted in near term after FOMC meeting. This pair may move towards 1.1140 in coming days.

GBP/USD – Slightly bearish. Price will fall further towards 1.2636 as Brexit talk is kicking off.

XAU/USD (Gold) – Slightly bearish. Potential dollar strength may pressure gold towards 1240.

Top News This Week (GMT+8 time zone)

New Zealand: RBNZ rate decision. Thursday 22nd June, 5am.

We expect figures to remain unchanged at 1.75%.

Euro Zone: Flash manufacturing PMI. Friday 23rd June, 4pm.

We expect figures to come in at 56.5 (previous figure was 57.0).

Fullerton Markets Research Team

Your Committed Trading Partner

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

Editors’ Picks

EUR/USD hovers around nine-day EMA above 1.1800

EUR/USD remains in the positive territory after registering modest gains in the previous session, trading around 1.1820 during the Asian hours on Monday. The 14-day Relative Strength Index momentum indicator at 54 is edging higher, signaling improving momentum. RSI near mid-50s keeps momentum balanced. A sustained push above 60 would firm bullish control.

Gold sticks to gains above $5,000 as China's buying and Fed rate-cut bets drive demand

Gold surges past the $5,000 psychological mark during the Asian session on Monday in reaction to the weekend data, showing that the People's Bank of China extended its buying spree for a 15th month in January. Moreover, dovish US Federal Reserve expectations and concerns about the central bank's independence drag the US Dollar lower for the second straight day, providing an additional boost to the non-yielding yellow metal.

GBP/USD holds medium-term bullish bias above 1.3600

The GBP/USD pair trades on a softer note around 1.3605 during the early European session on Monday. Growing expectation of the Bank of England’s interest-rate cut weighs on the Pound Sterling against the Greenback.

Bitcoin, Ethereum and Ripple consolidate after massive sell-off

Bitcoin, Ethereum, and Ripple prices consolidated on Monday after correcting by nearly 9%, 8%, and 10% in the previous week, respectively. BTC is hovering around $70,000, while ETH and XRP are facing rejection at key levels.

Weekly column: Saturn-Neptune and the end of the Dollar’s 15-year bull cycle

Tariffs are not only inflationary for a nation but also risk undermining the trust and credibility that go hand in hand with the responsibility of being the leading nation in the free world and controlling the world’s reserve currency.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.