When you ask the question as to what fundamentally moves the currency markets, the answers may vary. While there are a lot of factors that influence the exchange rate of a currency, Central bank monetary policy plays an important role, if not one of the major roles. For the average trader, one can be mistaken for ignoring Central bank policies. However, if you are serious about trading for the long term, it is important to understand the role Central banks play in the financial markets and more importantly how central bank monetary policies influence the sentiment and the exchange rate fluctuations in the market.

What are Central Banks?

Central bank is a sovereign national bank that provides financing and banking services for the sovereign government's banking system. The Central banks operate independently of the government and uses its power to influence monetary policy. It is often referred to as a 'lender of last resort' and acts as a bank for the nation's commercial banks.

The primary goal of Central banks is to maintain price stability by controlling inflation. Some central banks (such as the US Federal Reserve) also have a dual mandate of achieving maximum employment. You might wonder how a financial institution can play a role in creating jobs in the economy. You will find the answer to this later in the article. The Central bank is also the only legal financial institution that is allowed to print money as a legal tender.

How do Central banks control inflation, create jobs and thus influence the economy?

The Central banks operate within two main areas of interest, which are as follows:

Macroeconomic policies: These policies are usually limited to regulating inflation and maintain price stability by changing the benchmark interest rates.

Microeconomic policies: The microeconomic policies are limited to the scope of acting as a 'lender of last resort' for commercial and private banks. In this role, the Central bank also sets out financial regulations governing the nation's financial institutions.

In order to maintain price stability and thus control inflation, Central banks operate through the 'Open market transactions' which is used as a 'gas pedal' to increase the flow of money supply by means of either printing more money or cutting interest rates to encourage lending in an environment of slowing growth while at the same time, the Central bank can ease off the 'gas pedal' and hike interest rates and reduce the amount of money in circulation to slow down an overheating economy.

The Central bank thus achieves its mandate of price stability by keeping a close eye on inflation. Most Central banks usually set a target inflation rate which forms the benchmark for policy shifts. For example the Bank of England has aninflation target of 2%, where as the Reserve Bank of Australia has an inflation target of 2 - 3%. As you can see, it varies from one central bank to another.

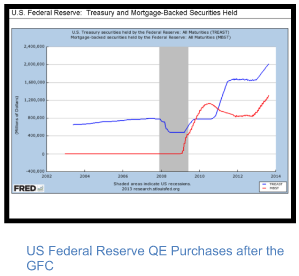

More recently, after the global financial crisis, Central Bank policies across various economies took on unconventional means of stimulating the economy and thus control inflation by means of Quantitative easing, which simply put involves buying sovereign bonds and thus injecting money or increasing the money supply in the markets. Jobs are created when there is more money available and cheaper credit that allows businesses to borrow more in order to kick start or expand their businesses, which in turn involves an increased pace of hiring and thus jobs. The more jobs that are created, the more people are employed, which in turn results in an increased pace of purchases in the economy. As you can see, it is a closed cycle.

Why should you, as a trader bother about Central bank policies?

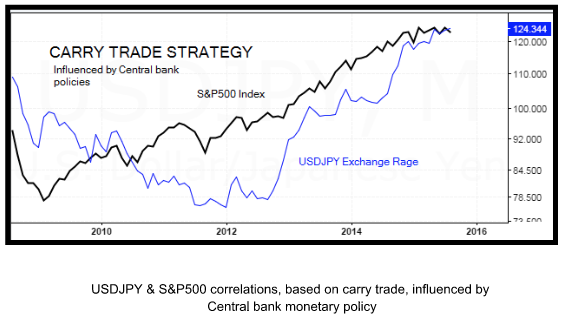

From a trader’s perspective, Central bank policies play a role in terms of shaping money flows into a currency, it also influences the bond markets as well as some of the well talked about trading strategies such as ‘Carry trade strategy’ which is primarily designed around Central bank interest rate and monetary policies.

As a simple example, when a Central Bank ‘A’ has lower interest rates and pledges to keep interest rates low for a prolonged period of time, traders tend to look for currencies (economies) where the other Central Bank ‘B’ has higher interest rates. In such a scenario, traders can either park their money in the currency of the Central Bank ‘B’ to get higher returns via interest or they can borrow currency from Central Bank ‘A’ (which anyway offers lower interest rate) which is then used to fund investments in the other currency.

A real life example is the Yen. The Bank of Japan, the Japanese Central bank, in a bid to boost inflation has embarked on a massive Quantitative easing policy, which besides printing money also includes maintaining low interest rates. Therefore, the Yen has become a preferred currency for carry trade strategists, who borrow money in Yen (paying lower interest rates) and use it to fund a foreign currency where the prevailing interest rates are higher. The carry trade strategy can also be used to fund foreign or domestic equities as well.

Besides the above example, fundamentally, a country or economy whose Central bank levies higher interest rates is often more stronger or carries a higher exchange rate than compared to a country or economy whose Central bank charges a lower interest rate. Higher interest rates also signify that general health of the economy.

To conclude, while Central bank monetary policies may seem complicated to some, they are indeed one of the very basic and simplest to understand in terms of gauging what the Central bank thinks about the economy and how it uses its interpretation of the economic indicators to influence monetary policy in the future by managing interest rates, which in turn tends to play role in controlling inflation, creating jobs and thus overall influence the economy it is operating for.

The analysis published by XGLOBAL Markets or its representatives should not be considered as solicitation to trade. Any views, opinions or findings are simple market commentary and only for information purposes. Information in our published content should definitely not be taken as investment advice. XGLOBAL Markets or its representatives shall not be held accountable for any incorrect trading decisions or money lost by individuals that decide to follow our market commentary.

Editors’ Picks

EUR/USD: Yes, the US economy is resilient – No, that won’t save the US Dollar Premium

Some impressive US data should have resulted in a much stronger USD. Well, it didn’t happen. The EUR/USD pair closed a third consecutive week little changed, a handful of pips above the 1.1800 mark.

Gold: Metals remain vulnerable to broad market mood Premium

Gold (XAU/USD) started the week on a bullish note and climbed above $5,000 before declining sharply and erasing its weekly gains on Thursday, only to recover heading into the weekend.

GBP/USD: Pound Sterling remains below 1.3700 ahead of UK inflation test Premium

The Pound Sterling (GBP) failed to resist at higher levels against the US Dollar (USD), but buyers held their ground amid a US data-busy blockbuster week.

Bitcoin: BTC bears aren’t done yet

Bitcoin (BTC) price slips below $67,000 at the time of writing on Friday, remaining under pressure and extending losses of nearly 5% so far this week.

US Dollar: Big in Japan Premium

The US Dollar (USD) resumed its yearly downtrend this week, slipping back to two-week troughs just to bounce back a tad in the second half of the week.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.