You've made a winning trade or two...

And it's a rewarding feeling.

But that feeling quickly turns to frustration when the next trades chew up all that profit. Correct?

And that's when it hits you.

Trading success is all about the trades you don't make. Agree?

The two types of losing trades

-

There are high-odds trades - like a pair of aces - that you bet on every time, even though they won't win 100% of the time. Yet overall - keep making these trades and you'll come out well in front.

-

And by contrast - there are the ultra-low-odds trades. Trades guaranteed to lose overall if you keep taking them. Right?

Tell me

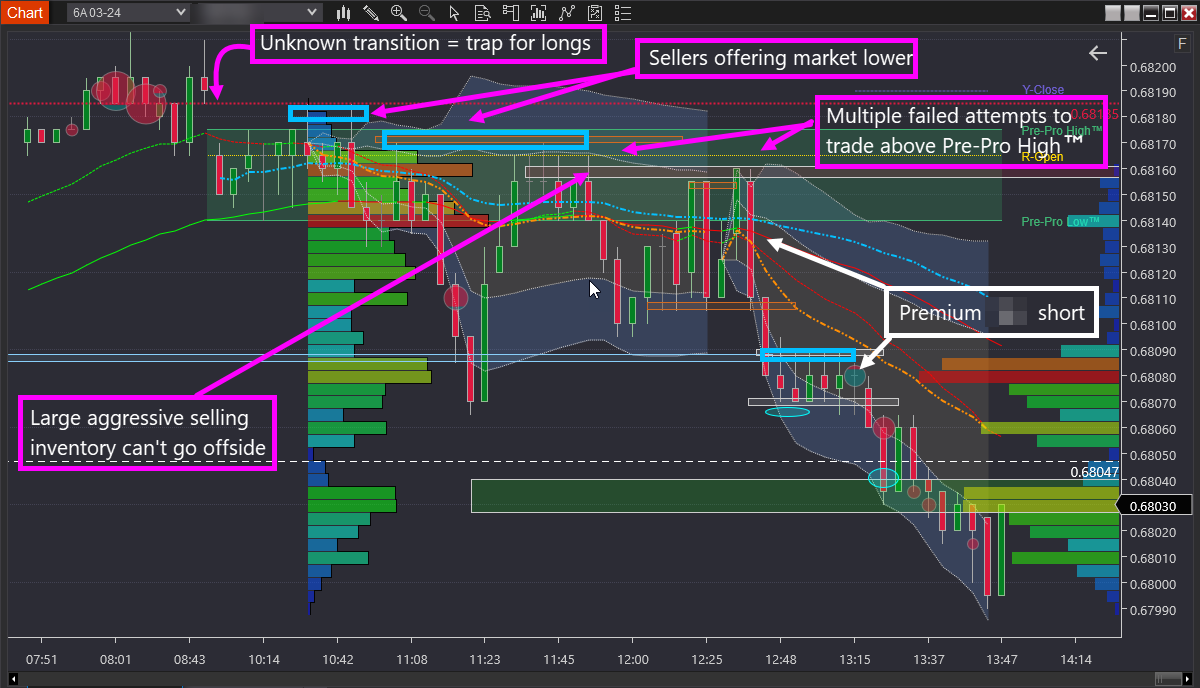

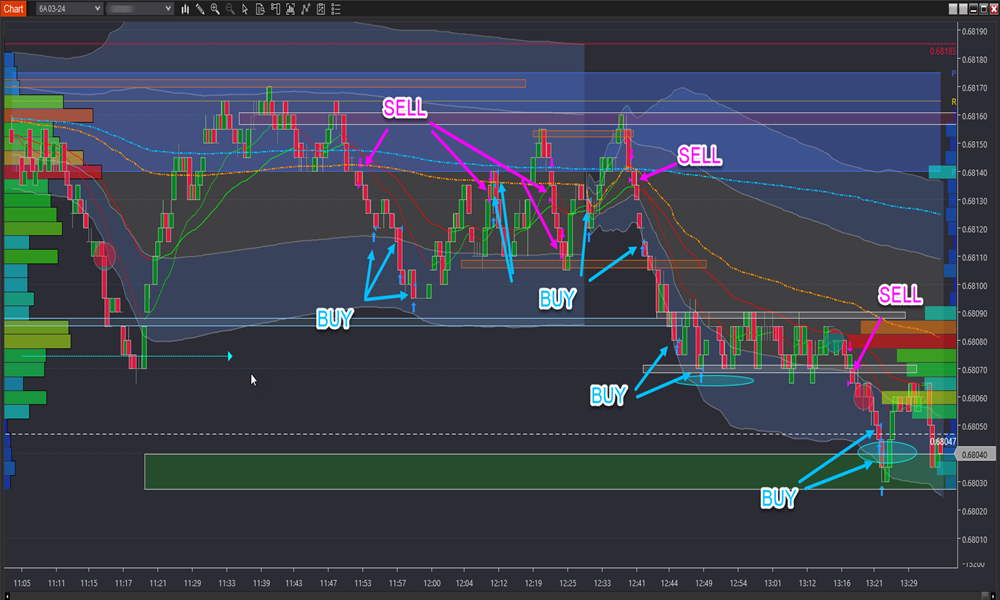

The two losing trades below - are they unlucky losses not likely to happen often?

Or are they trades you always end up losing on overall?

Not sure?

You're not alone.

The person who made these trades didn't know either.

But that's the problem, isn't it?

When you don't know you're making trades guaranteed to lose overall - you'll keep making the same trades.

What happens next?

You'll repeatedly give back your profits. Correct?

Each time you do have a winning trade, you'll relish a sense of accomplishment and pride, only to be swiftly replaced by an unsettling pit in your stomach, knowing it's just a matter of time before you reluctantly surrender those hard-earned profits back to the market.

It's a recurring cycle of triumph turned torment. Right?

About those losing trades

The person who made these trades has taken on in-depth professional trader training. But trading is a 'doing' activity - like playing a musical instrument or golf.

It doesn't matter how much theory you undertake - it won't help show you what you need to adjust to improve. Or in the case of trading - what you're doing that's putting you in trades guaranteed to lose overall.

But there's a silver lining here

When you have someone who can point out why those trades will always lose money overall - then you can make the adjustment to ensure you don't make the same trade again.

That's what genuine trading mentoring is about - working with you not only to show you how to trade professionally - but crucial to your development - providing feedback on what aspects of your trading you must change to succeed. Why the change is needed and how to make that change.

The good news?

The person who made the trades above is no longer making the same error in their trading - meaning they're hanging on to more of their winning trades.

This level of professional guidance while rare, is available for people serious about making a significant turnaround in trading.

It's the difference in mentoring and training that leads to people seeing genuine positive outcomes.

As you reflect on your own trading journey, consider the profound impact personalized mentoring can have on steering you away from pitfalls and ensuring a more resilient strategy.

For example:

Imagine trading the same strategy taken from today's trading as shown below:

Overview:

Executions:

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

EUR/USD: Fed calm, ECB steady, but the Dollar still leads Premium

EUR/USD is still struggling to find real traction. The pair has tried to stabilise, but momentum keeps fading, leaving the door open to further weakness.

Gold: Falling US yields, geopolitics help XAU/USD hold ground Premium

Gold (XAU/USD) gained traction and climbed above $5,200, ending the fourth consecutive week in positive territory. The next round of US-Iran talks and crucial macroeconomic data releases from the US will be watched closely by market participants in the short term.

GBP/USD: Will Pound Sterling defend key 1.3450 support ahead of US jobs data? Premium

The Pound Sterling (GBP) entered a bearish consolidation phase against the US Dollar (USD), after having tested critical support near the 1.3450 level on several occasions.

Bitcoin: Another month of losses, and it’s been five

Bitcoin (BTC) price is stabilizing around $68,000 at the time of writing on Friday, but the Crypto King is poised to close February on a fragile footing, marking its fifth consecutive month of losses since October and a rare start to the year with back-to-back monthly corrections.

US Dollar: At a crossroads; Fed steady, tariffs in flux Premium

The US Dollar’s (USD) upward momentum from the previous week seems to have encountered a tough nut to crack in the 98.00 region, as measured by the US Dollar Index (DXY).

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.