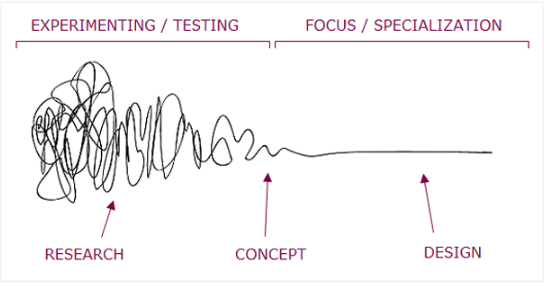

There is a wide array of technical approaches to successful trading in Forex as we have seen so far. Some are better suited to particular trading profiles and styles than others.

There are literally thousands of ways of entering trades, as more and more indicators and trading strategies are developed over time.

Please note, once again, that there is no such thing as a secret successful trading formula. Most of the methods used by our experts are publicly available. It's how you sum the edges that will make a difference.

Choose your broker and start a successful trading today

The Land Of Confusion

Basically speaking, a strategy consist in using proper indicators in order to analyze a financial instrument and thereby obtain clear signals as to when to profit from a price move. These indicators can be of a technical or fundamental nature, and strategies can use one either type or be a combination of both.

Test your strategy free of risk with an Octa FX Demo Account

With every advantage that any strategy presents, there is always a disadvantage to the technique. That is why we promote the combined use of strategies. Just like many heads, several indicators are usually better than one!

Nothing in trading works 100% of the time. There is always a certain level of unpredictability to the markets and what traders seek to do is to have a legitimate edge which helps to turn the odds in their favor.

The Purpose of Technical Analysis

The purpose of technical analysis is to carry out price forecasts. By processing historical market data of any instrument, you can try to anticipate how it should be traded. There are several premises in favor of the reliability of technical analysis that are based on the experience and prolonged observation. These premises are the following:

A market trend in motion is more likely to persist than to reverse

This is obvious by simply looking at any price chart. Of course the aim of any trader is to be aware of the overall market direction, to lock into the prevailing trend and trade it for profit.

Markets are discounting mechanisms

In other words, technical analysts assume that market fundamentals are already represented in the price so what you perceive in the charts is a reflection on any fundamental variable impacting the market. Nowadays, with instant communications this is truer than ever.

Either the unidirectional price move during a trend or the rapid reaction to any new fundamental data throws evidence that markets show up human behavior. From the above premises we can derive that human psychology is always at work in the markets and that technical analysis aims to visualize and quantify it.

What has happened in the past will happen again

This third premise is based on the assumption that human behavior as well as human psychology never change, and that price will reflect it through the repeated emergence of certain price action patterns and trends.

Based on this principle, the starting point when designing a strategy is to define what the trending condition is. This is important because if you don't know how to recognize a trend you can't know how to define a ranging condition. Following the same logic, the elements used to identify a ranging market will allow the trader to know when is best to apply a counter-trend strategy.

When looking at the charts, have you ever heard a voice in your head saying: “This trend can’t keep going. This move has to be over now.”? If you find yourself in such a situation most likely you are too late to get in, and entering the market at that stage is the worst risk/reward scenario.

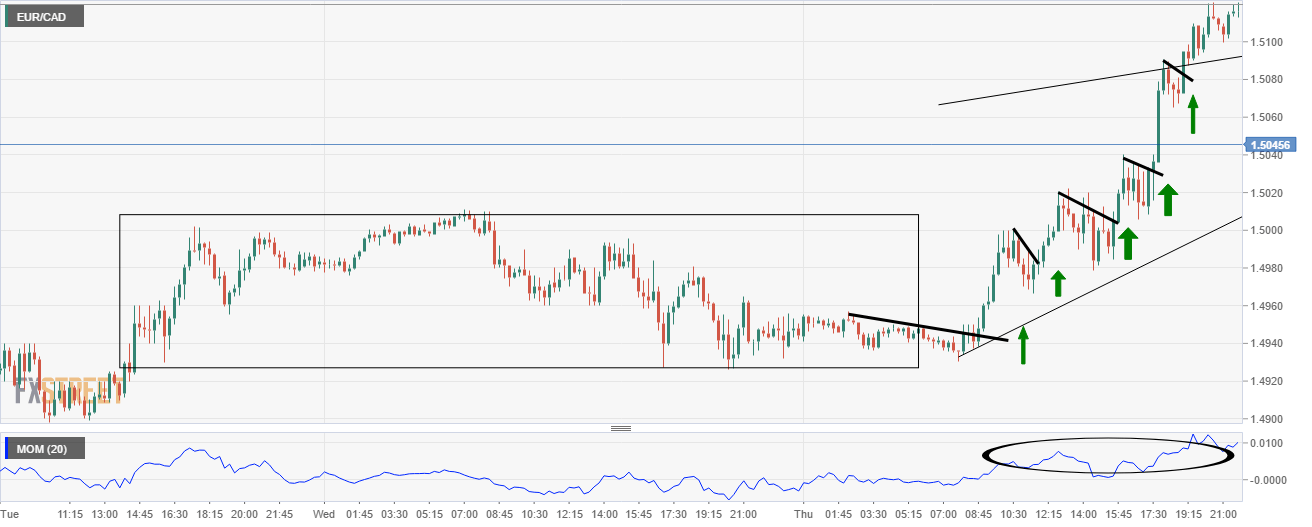

The very first question whether the market is showing a trending or a corrective impulse should help the trader identify what trading type to employ. Generally speaking, in a “trending market” you should be trading the so-called “continuation patterns” and in a “correcting market” you should be trading “reversal patterns”.

Mike lists a series of market observations which are extremely interesting. They appear in a new light when considering price movement like mentioned in the previous section.

Price moves in trends, trends move in waves – we have “impulse” waves in the direction of the trend, followed by “countertrend moves” better named “corrective waves.Just by accepting this simple truth that prices NEVER move in a straight line, you will stop trying to pick tops or bottom and view the corrections instead as an opportunity to reach a successful trading.

- Usually, movements in the market tend to have a relationship to each other. Price will alternate between areas where prices have been marked up to a new higher level or marked down to a lower level, and after a big move in either direction price will consolidates at that new price level.

- Trends usually begin from low volatility sideways or contracting price zones. Trends start from an area of price equilibrium. Once there is an increase in demand, prices breakout of this equilibrium area and are bid higher or “marked up” to the next level where the market consolidates at the new equilibrium zone. (the opposite is in a down market)

- The breakout in between equilibrium zones offers the trader the biggest profit potential.”

A Key to Successful Trading

Trying to predict where prices are going to form tops and bottoms without the proper knowledge will make you lose money. Why? Because you will be relying on hope and fear and that’s not advisable in currency successful trading. A much better approach if you want to trade with the trend is to wait for the market to confirm a trend is under way, and only then decide to enter the market. By trading with price momentum on your side, you have the odds in your favor.