When trading or investing in markets, the simple truth is you’re either thinking like a professional or providing income for one. You either have a competitive edge or you’re giving some of your hard earned money to someone who does. It is amazing to me that people in general focus very little on this most important topic. Most traders and investors buy when things look or feel good and sell when things look or feel bad which ensures they will not have an edge and never come close to achieving their financial goals. Two key items that give the select few an edge are:

-

Your Mental Makeup: Having a mental edge is a combination of proper reality based thinking (void of illusion), having extreme self control, and focus.

-

Proper Strategy: Having a strategic edge means owning a rule based strategy that ensures success over others. Your trading or investing strategy must have many people buying after you buy and many selling after you sell.

I started my career on the floor of the Chicago Mercantile Exchange facilitating institutional order flow. In other words, I started on the institution side of the business, not the retail side. So, I had the privilege of learning how the game of making and losing money really happens in trading. In this piece, I’ll share with you how that works while looking at a price chart.

To convey this important piece of information, let’s use a trading opportunity from our new Core Strategy XLT (our Core Strategy live trading room).

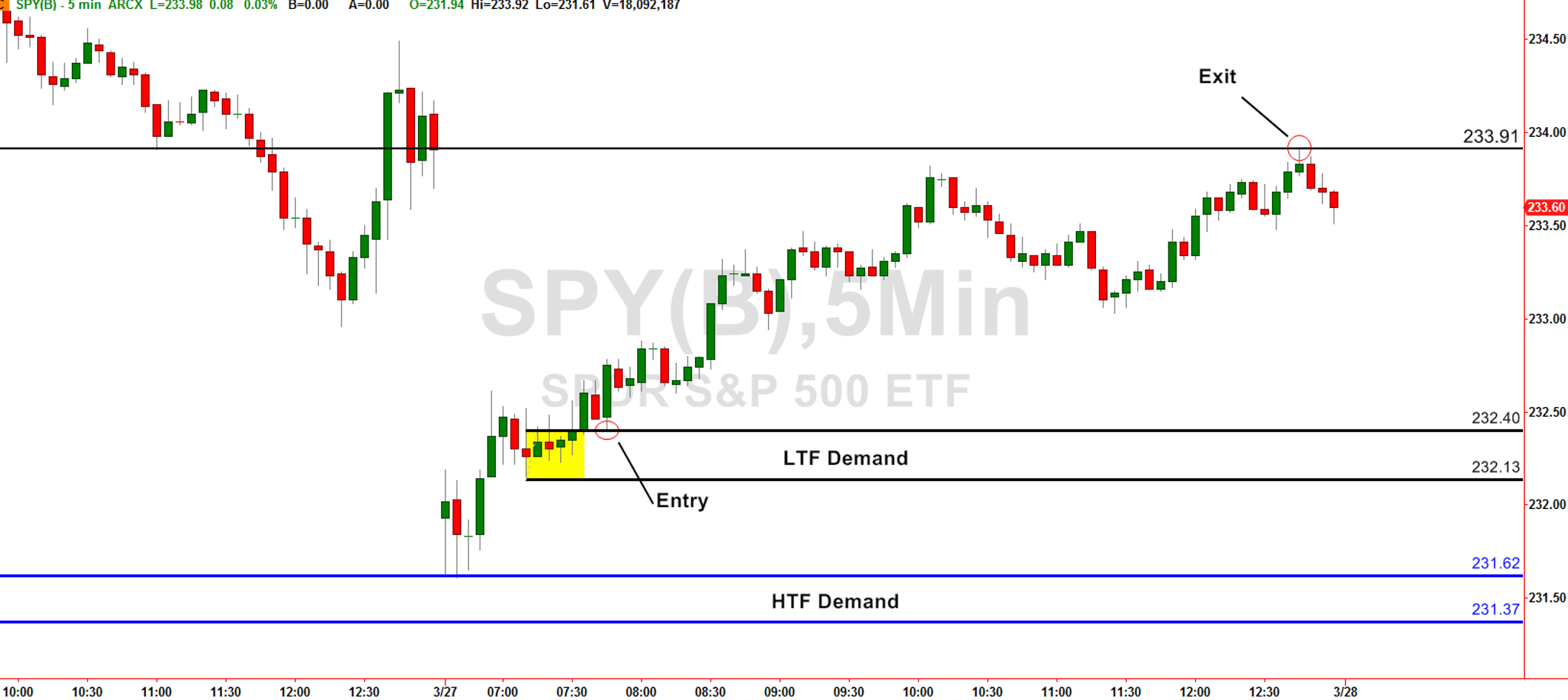

“New” Live Core Strategy Trading Room – SPY (S&P) Demand 3/27/17 – The Setup

The screen shot above is of our new Core Strategy Live Trading room for Online Trading Academy members. On March 27th, there was a gap down in price followed by the formation of a demand zone. This is a price level where our strategy told us there were unfilled buy orders from banks and financial institutions (strong demand). With the room above from the gap, this offered us a nice profit zone to the upside, a very quality buying opportunity.

“New” Live Core Strategy Trading Room – SPY (S&P) Demand 3/27/17 – The Result

When price came back to our demand zone, it was time to buy. Who would sell to us on a gap down in price and also on a decline in price back to our demand zone? Only someone who sells when things look and feel bad/weak. Price gapped down that day because of some bad news. Retail novice market speculators will typically sell. All the supply that comes into the market on those days forces price down to demand as that is where all those new sell orders can be filled (this is how markets work). Then, when that last sell order is filled, there is only one place for price to go, up. This is reflected in the picture outlined on the chart and in this article. It is also the reason the astute market speculator buys when most are selling.

My hope from this piece is that you understand how important it is to have a competitive edge when putting your hard earned money at risk in the markets. No one is pushing you to trade or invest. If you decide to, make sure you know what you’re doing and think like a pro. Each day, wealth is transferred from those without an edge into the accounts of those who have one.

Hope this was helpful, have a great day.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD bounces off lows, back to 1.1860

EUR/USD now manages to regain some balance, retesting the 1.1860-1.1870 band after bottoming out near 1.1830 following the US NFP data on Wednesday. The pair, in the meantime, remains on the defensive amid fresh upside traction surrounding the US Dollar.

GBP/USD rebounds to 1.3660, USD loses momentum

GBP/USD trades with decent gains in the 1.3660 region, regaining composure following the post-NFP knee-jerk toward the 1.3600 zone on Wednesday. Cable, in the meantime, should now shift its attention to key UK data due on Thursday, including preliminary GDP gauges.

Gold stays bid, still below $5,100

Gold keeps the bid tone well in place on Wednesday, retargeting the $5,100 zone per troy ounce on the back of humble gains in the US Dollar and firm US Treasury yields across the curve. Moving forward, the yellow metal’s next test will come from the release of US CPI figures on Friday.

Ripple Price Forecast: XRP sell-side pressure intensifies despite surge in addresses transacting on-chain

Ripple (XRP) is edging lower around $1.36 at the time of writing on Wednesday, weighed down by low retail interest and macroeconomic uncertainty, which is accelerating risk-off sentiment.

US jobs data surprises to the upside, boosts stocks but pushes back Fed rate cut expectations

This was an unusual payrolls report for two reasons. Firstly, because it was released on Wednesday, and secondly, because it included the 2025 revisions alongside the January NFP figure.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.