In a minute

You'll see exciting progress from a trader who's turned their trading around.

But first...

Imagine being dropped into a country where you don't speak the language. And your only option to learn the language is listening, observing and interacting with others.

How long would it take you before you get the hang of it?

I ask because my sister moved to France a little over a year ago. And despite having visited France numerous times previously, having studied French before her move, and not to mention being married to a French person, her biggest challenge?

Speaking the language

She was struggling to progress. It was also emotionally challenging because she felt alone in her struggles.

Whatever her attempts to master French they were missing what? Immersion in the environment for long enough to evolve. Right?

More on that later.

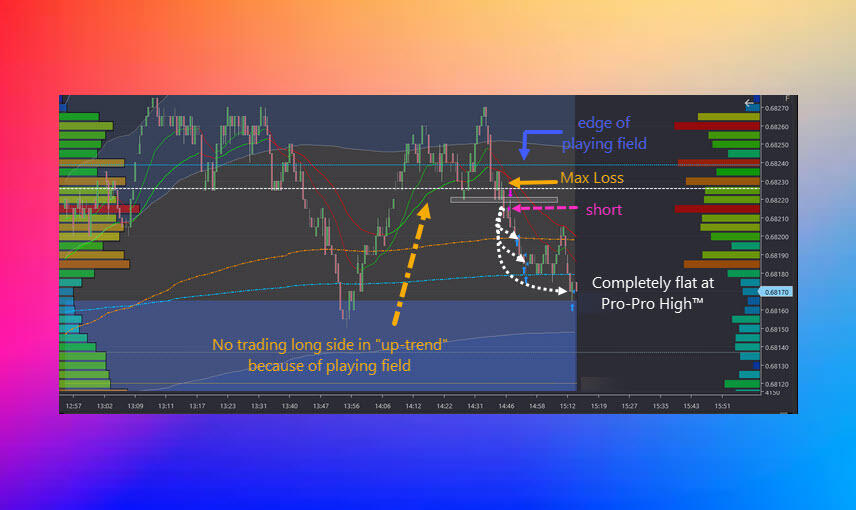

Here's a trading screenshot from the trader mentioned earlier

-

See how the Exit Before "out-of-bounds" - i.e. the edge of the playing field?

-

Problem-solving to calculate the playing field dimensions is an incredible edge.

-

It's less challenging for mature traders because problem-solving improves with age.

See the previous article describing the playing field here.

Also:

-

Do you notice the minuscule initial risk?

-

That risk is there to notify you the trade has failed.

-

Can you find out your trade failed using equally little risk?

It's a big deal having the expertise to identify opportunities with minuscule risk to find out the trade hasn't worked.

In the next trading screenshot: Can you see avoiding the trap of "trading with the trend"? Aware of the edges of the playing field, the trader avoided making a long trade which would have failed.

The third screenshot incorporates the trader's progress in turning around his performance.

Have you picked up on how the trader isn't using the same trade size for each trade?

-

A performance superpower is sizing trades according to odds ranking.

-

It's a big deal to have a playbook of trades with individual rankings to do so.

A further hard-to-recognise observation is as follows:

When looking at charts like this in hindsight, it's easy to forget that the trader can't see anything to the right at the time of a trade! And so with that in mind: You can see the executed long trade. Right? The trader was waiting for that trade to develop because it aligned with his hypothesis.

Stay with me here... There's an ol' trading saying: "Pros are patient; amateurs jump in"

Seeing the forest for the trees the trader takes the opposite side of the amateurs who jumped in on the long side.

There was never an intention to trade the short side beyond a small scalp. It was only ever intended to catch out the amateurs who jumped in early, and then follow up with the long trade.

The outcome on the short scalp was a minuscule loss. It wasn't a poor trade choice because trading is an odds-based business.

It's exciting seeing a trader grow to reach this level. Aka seeing the entire board of moves - not just an individual piece move.

How's my sister's French going?

With the help of her 14 yo daughter (who speaks French fluently), her French husband and weekly online French-speaking classes:

- It took 3 months before she was comfortable enough to converse briefly at the local food stalls. I

- t was 12 months before she reached competence. Not as a tourist doing tourist things. But as a resident living in France, doing everything a resident does.

- Rather than trying to speak French immediately her skills compounded over time.

What's harder - Speaking French or speaking market?

That's right: The Market speaks a language. Comprehending the Market's language is a skill that compounds. You don't go straight to fluency. Knowing this - another question:

Have you experienced taking a course, webinar, mentor, coach, [insert label] and not realised the success you expected?

If you knew you had to learn a language to trade successfully would you have taken a different approach?

Here's the deal

The trading you've seen is from a trader 10 months into mentoring. 10 months you say - isn't that like forever? Well 10 months is a helluva lot shorter than 3 yrs or 7 yrs or 12 yrs isn't it? Especially when you factor in still not being successful in that time.

If you're curious here's how compounding trading expertise works:

-

Playing field - 1 mo. to basic competency.

-

Identify trades where its possible to take miniature risk 3-4 mo.

-

Not trading the same size 6-7 mo. to know the playbook.

-

Playing field advanced proficiency - 8 mo.

-

Seeing the entire game several moves ahead - 9 mo. but continues to improve with experience.

-

Using the market's money to add to trades for outlier gains - 10-12 mo. (trader above not there yet).

What's your takeaway? The powerful forces of compounding are there for the taking for anyone prepared to let them work for them.

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

EUR/USD holds firm above 1.1900 as US NFP looms

EUR/USD holds its upbeat momentum above 1.1900 in the European trading hours on Wednesday, helped by a broadly weaker US Dollar. Markets could turn cautious later in the day as the delayed US employment report for January will takes center stage.

USD/JPY remains heavy around 153.00 on firmer Japanese Yen

USD/JPY is sustaining its three-day rout at around 153.00 in the European session on Wednesday, awaiting the closely-watched US NFP report. Rising bets on Fed rate cuts keep the US Dollar depressed. In contrast, expectations that PM Takaichi's policies will boost the economy and allow the BoJ to stick to its hawkish stance bolster the Japanese Yen, weighing on the pair amid intervention fears.

Gold sticks to gains near $5,050 as focus shifts to US NFP

Gold holds moderate gains near the $5,050 level in the European session on Wednesday, reversing a part of the previous day's modest losses amid dovish US Federal Reserve-inspired US Dollar weakness. This, in turn, is seen as a key factor acting as a tailwind for the non-yielding yellow metal ahead of the critical US NFP release.

US Nonfarm Payrolls expected to show modest job gains in January

The United States Bureau of Labor Statistics will release the delayed Nonfarm Payrolls data for January on Wednesday at 13:30 GMT. Investors expect NFP to rise by 70K following the 50K increase recorded in December.

S&P 500 at 7,000 is a valuation test, not a liquidity problem

The rebound from last week’s drawdown never quite shook the sense that it was being supported by borrowed conviction. The S&P 500 once again tested near the 7,000 level (6,986 as the high watermark) and failed, despite a macro backdrop that would normally be interpreted as supportive of risk.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.