Ralph Elliott developed the theory that bears his name based on the moves the stock market made. His strong belief was that the market is the sum of human behavior. As such, to this day, the Elliott Waves Theory is one of the best trading theories to predict financial markets’ behavior.

Forex trading is more about managing risk than being right. Any trading system should have a sound money management plan. Moreover, executing the money management plan is what makes the trading system perform.Elliott Waves Theory

The Elliott Waves Theory allows for great risk reward ratios. Not only traders know where price will go, but they can incorporate the time element too.

Price and time represent the two pillars of the holy grail in trading. Knowing where the price goes and when makes a difference between good and excellent trades.

Here’s a quick guide on how to trade with Elliott Waves Theory. Furthermore, the setups explained here have entries, stops and take profit levels based on realistic risk-reward ratios.

In this business, anything between 1:2 or 1:3 represents a realistic approach. It means that for every pip risked, traders look for a double or triple reward.

Basics of Elliott Waves Theory

Elliott found that the market moves in two distinct ways. As such, he started to look at waves as defining impulsive or corrective activity. To be more exact, the market can either form an impulsive or a corrective wave.

An impulsive wave is a five-wave structure. As a rule of thumb, any impulsive wave is labeled with numbers: 1-2-3-4-5

Elliott Waves TheoryOn the other hand, with letters, Elliott showed corrective activity. He referred to corrective waves as three-wave structures. While this is true most of the times, not every corrective pattern literally has a three-wave structure.

The idea behind impulsive and corrective waves was that together, the two make a cycle. It was Elliott’s strong belief that the market moves in cycles of different degrees.

As such, one cycle has an impulsive and a corrective wave. Or, as Elliott put it, five waves up corrected with three waves down, in a bullish trend, and five waves down corrected with three waves up in a bearish one.

The cycles of different degrees appear everywhere. For example, in a five-wave structure, labeled 1-2-3-4-5, the 2nd, and the 4th waves show corrections, while the 1st, 3rd and 5th show impulsive moves.

However, the 1st wave of the above impulsive activity must have another five-wave structure of a lower degree. And the 3rd and the 5th waves too.

This is what makes the Elliott Waves Theory a complicated method to trade if the basic idea is not properly understood from the start.

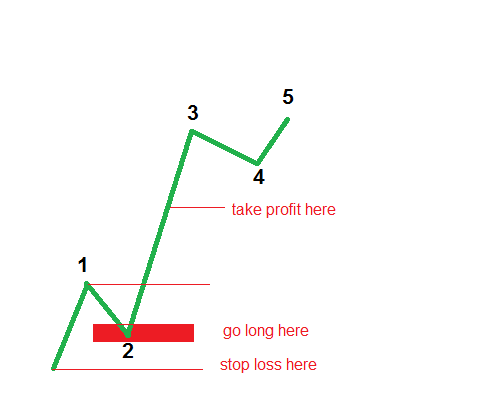

Trading the Third Wave

extended wave must be bigger than 161.8% of the other non-extended waves.

Elliott Waves TheoryIn plain English, it is the longest wave. Typically, the third wave extends.

When this happens, the previous wave (the 2nd one) retraces between 50% and 61.8% of the 1st one. Third wave extensions happen most of the time.

This gives a perfect trade. In a bullish impulsive wave, simply place a pending buy limit order between 50% and 61.8% of the 1st wave. The take profit is 161.8% projected from the end of the 2nd wave, while the stop loss must be where the impulsive activity starts.

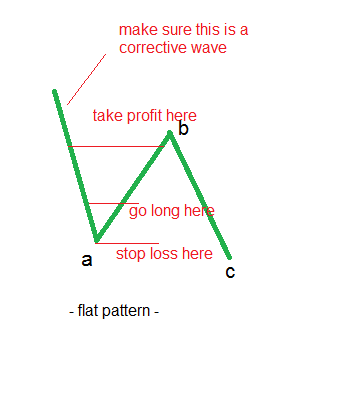

Trading a Flat Pattern

Among corrective waves, flat patterns form all the time. Elliott identified no less than ten such patterns.

Elliott Waves TheoryWhile this is a big number, all types have one thing in common: the b-wave must retrace minimum 61.8% of the previous a-wave. This is more than enough for a trade.

Therefore, the key stays with interpreting the a-wave. Is it impulsive or corrective? A flat pattern has an a-b-c structure. Moreover, waves a and b represent corrective activity, and only the c-wave shows a five-wave structure.

If the a-wave doesn’t look impulsive, it can only be corrective. As such, 61.8% retracement must follow.

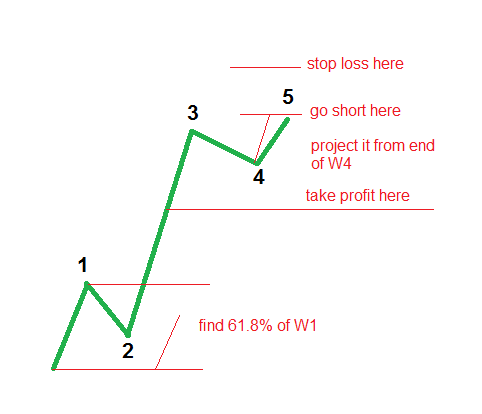

Trading the Fifth Wave

One of the most powerful rules in the theory is that the first wave should NOT equal the fifth. This gives traders an educated guess because they already know the 1st wave’s length.

Therefore, Elliott traders simply measure the length of the 1st wave and project the outcome from the 4th wave’s end. The 5th should be different.

However, not every length works. Look for the 5th wave to be 61.8% of the 1st wave. When this happens, simply go short in a bullish five-wave structure, targeting 38.2% retracement of the whole impulsive move.

Conclusion

These three possibilities to trade with Elliott Elliott Waves TheoryWaves Theory only show a few possible trading setups. The truth is that this wonderful theory allows to position for every single move the market makes.

Therefore, you will end up forecasting price on the right side of the screen based on what’s on the left. Real Elliott traders never count actual prices.

The correct approach is to let the market confirm the previous pattern first. After all, the Elliott Waves Theory basis its rules on a pattern recognition approach.

Traders make top-down analysis starting with the monthly or bigger time frames. After that, they come down all the way until the daily or lower time frames to pick a trade.

If the count on the bigger time frames makes sense and respects the Elliott rules, the theory reveals future market moves because of human behavior. Never have greed and fear been better represented in a trading theory, like in Elliott Waves Theory.

Moreover, place the stop loss where the extension gets invalidated, and nice risk-reward ratio results. Trading the 5th wave, though, is riskier, as there are multiple possibilities the market may form here.

This material is written for educational purposes only. By no means do any of its contents recommend, advocate or urge the buying, selling or holding of any financial instrument whatsoever. Trading and Investing involves high levels of risk. The author expresses personal opinions and will not assume any responsibility whatsoever for the actions of the reader. The author may or may not have positions in Financial Instruments discussed in this newsletter. Future results can be dramatically different from the opinions expressed herein. Past performance does not guarantee future results.

Editors’ Picks

EUR/USD tests nine-day EMA support near 1.1850

EUR/USD remains in the negative territory for the fourth successive session, trading around 1.1870 during the Asian hours on Friday. The 14-day Relative Strength Index momentum indicator at 56 stays above the midline, confirming steady momentum. RSI has eased but remains above 50, indicating momentum remains constructive for the bulls.

Gold recovers swiftly from weekly low, climbs back closer to $5,000 ahead of US CPI

Gold regains positive traction during the Asian session on Friday and recovers a part of the previous day's heavy losses to the $4,878-4,877 region, or the weekly low. The commodity has now moved back closer to the $5,000 psychological mark as traders keenly await the release of the US consumer inflation figures for more cues about the Federal Reserve's policy path.

GBP/USD consolidates around 1.3600 vs. USD; looks to US CPI for fresh impetus

The GBP/USD pair remains on the defensive through the Asian session on Friday, though it lacks bearish conviction and holds above the 1.3600 mark as traders await the release of the US consumer inflation figures before placing directional bets.

Solana: Mixed market sentiment caps recovery

Solana is trading at $79 as of Friday, following a correction of over 9% so far this week. On-chain and derivatives data indicates mixed sentiment among traders, further limiting the chances of a price recovery.

A tale of two labour markets: Headline strength masks underlying weakness

Undoubtedly, yesterday’s delayed US January jobs report delivered a strong headline – one that surpassed most estimates. However, optimism quickly faded amid sobering benchmark revisions.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.