When you trade currencies or commodities, you may not be very aware of “market crashes” and large sell-offs on the stock market. However, for stock traders specifically, there’s much tension related to a recent significant decline in stock prices. Many of them have a cash account, i.e. don’t have the ability to play on the short side.

So, this article is for those who are still searching for profitable opportunities in the “red area” of falling stocks.

Option 1. Buying 3x inverted ETFS:

When there’s a bloodbath on the stock market, you can play one short side without actually selling any stocks. There’s a set of instruments designed exclusively for that purpose. They allow you to benefit from declining stock indexes, and sometimes, even certain sectors. I’m talking about “inverted ETFs” - complex structured products, which are traded on the exchange just like any stocks.

For example, you may purchase SQQQ, a 3X short for “QQQ”, which follows the Nasdaq stock index. When tech stocks are falling (and they are falling quite quickly), SQQQ grows. The recent decline of Nasdaq creates buying opportunities for SQQQ.

Option 2. Buying low-beta and negative-beta stocks.

Not all stocks are following the main trends. Some of them are more robust and have even strong opposite reaction when the broad market movements. The less stock correlates with a benchmark (a stock index), the less it’s beta is. Sometimes, it’s even negative.

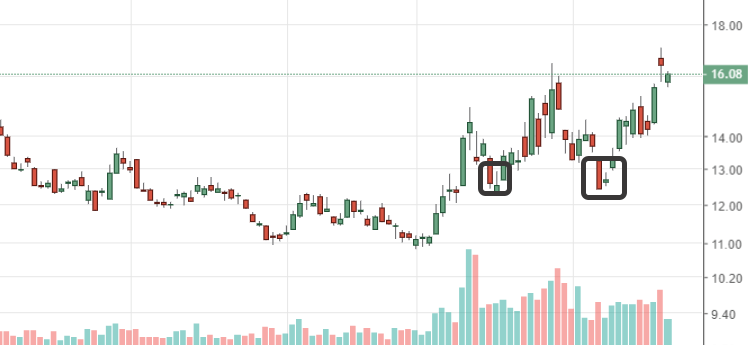

For example, take a look at MCD - McDonald’s corporation. With a beta of 0.5 as of November 23, 2018, it shows outstanding performance in comparison to the broad market:

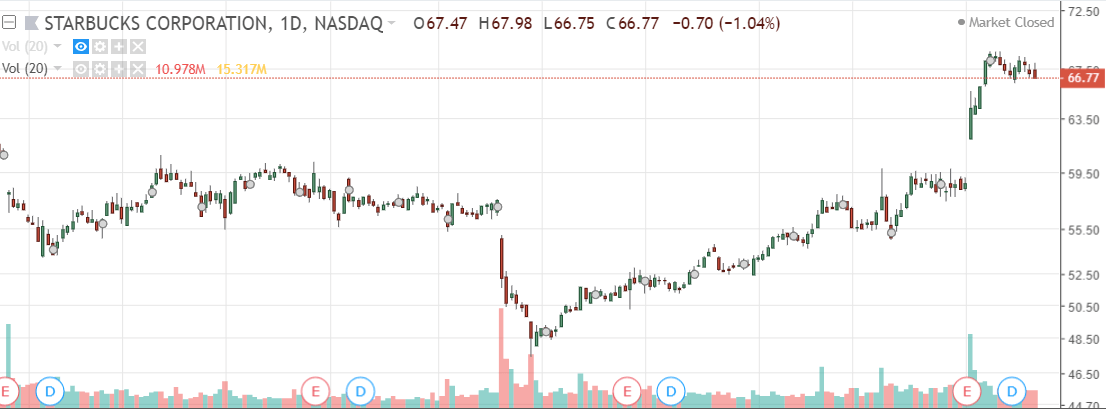

Or, let’s take SBUX (Starbucks). With a beta of 0.49 it seems bulletproof, considering the previous decline in major stocks.

Of course, not only beta parameters is important, but that’s one of the main factors which trader has to take into consideration while making decitions.

Option 3. Buying volatility ETFs.

Every time a stock market declines, we observe increasing volatility of ATM options linked to the corresponding index futures (VIX). This volatility can not only be observed but also it can be traded via volatility ETFs.

If you expect a stock index to fall, you can purchase VXX (short-term volatility) or VXZ (long-term volatility). You can see below what happens while the stock market sell-off:

Good luck and have a good trading!

Trading the financial markets is associated with increased level of risk. Past performance is not indicative of future results. All materials are provided for educational purposes only and by no means may serve as a trading or investment advice.

Editors’ Picks

AUD/USD flubs key technical level as holiday season drains market volume

AUD/USD strung itself along the 0.6700 handle for the second day in a row as the Aussie-Dollar pairing grapples with end-of-year market volumes restraining overall momentum. The Australian Dollar is looking upward as the Reserve Bank of Australia inches toward a fresh rate hiking cycle, with the US Dollar under pressure across the board from a dovish Federal Reserve (Fed) poised for further rate cuts through 2026.

USD/JPY treads water near 156.00 as Yen traders grapple with multiple headwinds

USD/JPY remains caught in near-term congestion just north of the 156.00 handle during the final week of 2025’s trading year. Yen traders are battling headwinds on multiple fronts, with the Bank of Japan carrying much of the vexation risk for Yen markets.

Gold stable above $4,350 as the year comes to an end

Gold price got to recover some modest ground on Tuesday, holding on to intraday gains and changing hands at $4,360 a troy ounce in the American afternoon. The bright metal showed no reaction to the release of the FOMC December meeting minutes.

Zcash treasury Cypherpunk Technologies acquires $29 million additional tokens as ZEC battles key resistance

Zcash (ZEC) treasury firm Cypherpunk Technologies announced on Tuesday that it has acquired 56,418 ZEC for $29 million. The company executed the latest purchase at an average price of $514 per ZEC.

Bitcoin Price Annual Forecast: BTC holds long-term bullish structure heading into 2026

Bitcoin (BTC) is wrapping up 2025 as one of its most eventful years, defined by unprecedented institutional participation, major regulatory developments, and extreme price volatility.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.