Traditionally, every holiday season we remind ourselves to be thankful for what we have, as well as sit ourselves down to decide what actions (e.g. resolutions) we will plan to take in the new year. The problem is… most resolutions never seem to materialize and we simply continue to live within our perceived comfort zones. But what if, you could change your life for the better and all you had to do was commit to changing the way you perceive and manage your finances? Imagine what your life could look like if you had simply sat down and mapped out a personal finance blueprint for 2018!

10 New Year’s Resolutions to Help You Achieve Financial Freedom:

-

Create a Monthly Budget – Let’s face it, no one likes to sit down and count their pennies, but the ones that do have the highest probability of reaching their financial goals. All you need to do is sit down and track your monthly expenses and once you see just how your hard-earned money is being spent, you can create a household budget and re-direct your additional income to your savings or retirement account(s). A great tool to help you track your expenses and budgets is Intuit’s Mint.com website and app.

-

Take Inventory of your Bad Debt: – You need to review all your loans and interest-bearing credit accounts by prioritizing them from highest to lowest interest. Each month not only are you paying minimum balances against your bad debt, but you are also paying compounding interest on those outstanding balances as well. Make a resolution this year to pay off more than the minimum due each month on your loans or credit balances, paying those with the highest interest rates first so you can re-direct those interest fees toward paying off other bills, or even better, increasing your savings or retirement account(s).

-

Create a 2017 Financial Calendar – There is nothing worse than being charged late fees on top of interest. Make a point of identifying the dates that all your expenses are due and make sure to pay them in plenty of time to avoid any unnecessary fees. You should also use your financial calendar to help you determine how and when you will be paying off your highest interest-bearing balances: A month, a quarter, or a year?

-

Create a Financial Route – We all live very busy and hectic lives, but it is extremely important that you put aside at least one hour a week to review all your finances. Ideally, you should do this with your spouse, partner or significant other. The more you work as a team and hold each other accountable, the faster you will reach your overall financial goals.

-

Budget 10% of Your Monthly Income Toward Savings – Imagine when you were very young and a wise parent or grandparent told you that if you saved $.20 out of every dollar you earned for the rest of your life, you could retire at an earlier age, and you could enjoy your financial freedom. Sadly, if you never received this sage advice you must take it upon yourself now to set aside at least 10% of your monthly income toward your emergency fund, savings or retirement account(s) so you too can one day reap your own financial freedom.

-

Turn Your Dream Board Into an Action Board – To help you plan and reach your financial goals sooner, you need to take action NOW! A simple way to accomplish your dreams is by attaching dates underneath your dream board photos. This simple change will create the urgency you need to get off your butt and take action toward achieving your financial goals. Remember, dreams are for bedtime, goals are for success.

-

Manage Your Net Worth – To help you calculate your net worth, you must first take an inventory of all your assets (cash, investments, real estate, collectibles, patents/licenses) and your liabilities (your outstanding balances: mortgage, car loan, credit card debt, etc.). You current net worth (positive or negative) is determined by subtracting your liabilities from your assets. If the value of all your assets is greater than the total of your liabilities (e.g. debt), you have a positive net worth. Your long-term financial goal should be to have a large enough positive net worth that you can live off your assets. Make a resolution this year that you will do what is necessary to achieve a positive net worth.

-

Become a Strategic, Not Emotional Spender – Before you begin doling out your hard-earned cash on the next must have product or service, ask yourself the following strategic question: ‘How will this product or service contribute to my personal finance goals?’ You should never emotionally spend money without first researching and asking yourself ‘why do I need this product or service in the first place?’ Emotional spending to alleviate some emotional void in your life is never a wise idea. Make a point this year to cut out any unnecessary spending and re-direct that same money to your savings or retirement account(s).

-

Earning More Money is Not an Excuse to Spend More Money – Just because you get some extra zeros at the end of your paycheck, does not mean that you should add extra zeros to your debt. So many people talk themselves into believing that if they just earned or got more money in their life that would solve all their financial problems. But the reality is… unless you have a plan to create good financial savings and spending habits, you will just continue to spend more and more, getting yourself into even great financial debt.

-

Change Your Limiting Beliefs About Money – Most importantly, you need to stop listening to your own limiting beliefs about money. The only reason you are broke is because your life is broken. You have to start telling yourself, ‘I can save money!’ ‘I can be wealthy and have financial freedom!’ The only one holding you back from achieving your financial goals is YOU!

Make 2019, the year you finally make your New Personal Finance Resolutions come true!

Happy New Year!!

Read the original article here - 10 Life-Changing Financial Resolutions

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD holds firm near 1.1850 amid USD weakness

EUR/USD remains strongly bid around 1.1850 in European trading on Monday. The USD/JPY slide-led broad US Dollar weakness helps the pair build on Friday's recovery ahead of the Eurozone Sentix Investor Confidence data for February.

USD/JPY falls further toward 156.00 as intervention risks dominate

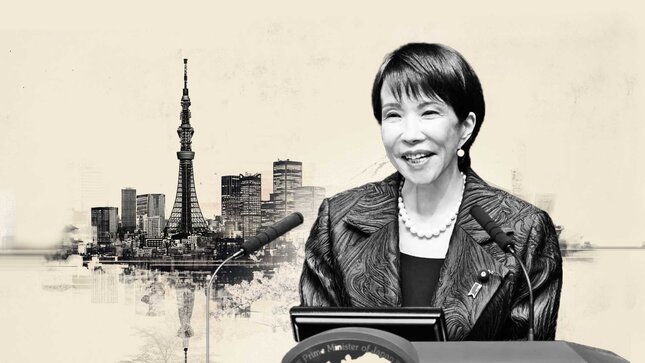

The Japanese Yen is looking to build on its strong intraday move up amid speculations that authorities will step in to stem weakness in the domestic currency. In fact, Japan’s Finance Minister Satsuki Katayama stepped up intervention warnings and confirmed close coordination with the US against disorderly FX moves. This, along with some follow-through US Dollar selling, triggers an intraday USD/JPY turnaround from the 157.65 region, touched in reaction to Prime Minister Sanae Takaichi's landslide win in Sunday's election.

Gold sticks to gains above $5,000 as China's buying and Fed rate-cut bets drive demand

Gold surges past the $5,000 psychological mark during the Asian session on Monday in reaction to the weekend data, showing that the People's Bank of China extended its buying spree for a 15th month in January. Moreover, dovish US Federal Reserve expectations and concerns about the central bank's independence drag the US Dollar lower for the second straight day, providing an additional boost to the non-yielding yellow metal.

Bitcoin, Ethereum and Ripple consolidate after massive sell-off

Bitcoin, Ethereum, and Ripple prices consolidated on Monday after correcting by nearly 9%, 8%, and 10% in the previous week, respectively. BTC is hovering around $70,000, while ETH and XRP are facing rejection at key levels.

Japan's Takaichi secures historic victory in snap election

In Japan, Prime Minister Sanae Takaichi's coalition secured a supermajority in the lower house, winning 328 out of 465 seats following a rare winter snap election. This provides her with a strong mandate to advance her legislative agenda.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.