XRP bulls defend uptrend and push for $1

- Ripple price gets support at a critical level to maintain an uptrend.

- XRP sees RSI drift away from oversold, giving a bullish signal.

- This week, expect a recovery on the back of improved market sentiment as Monday sees equities on the front foot.

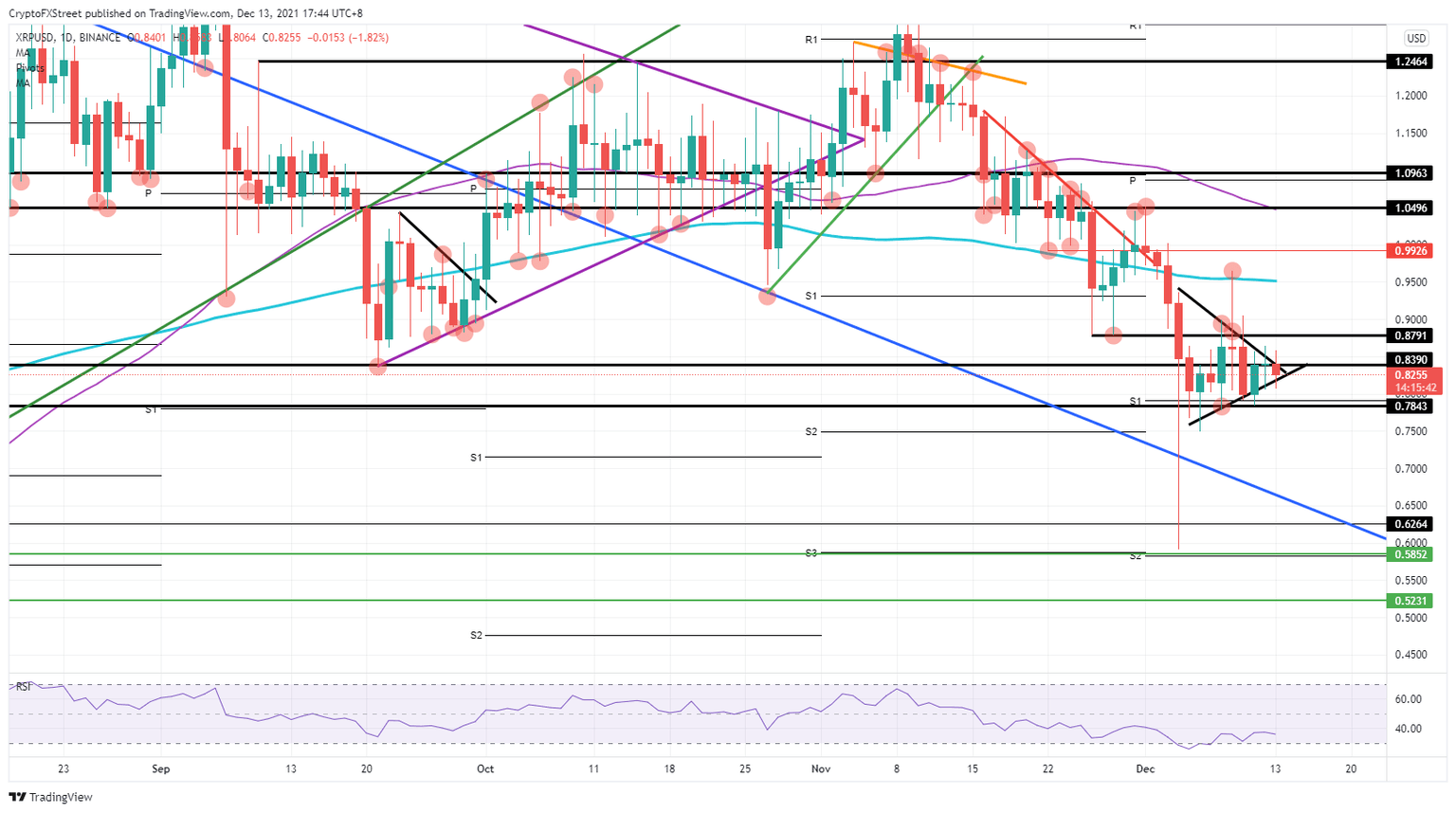

Ripple (XRP) has been stuck in a wedge or pennant pattern since last week with lower highs and higher lows, consolidating towards a breakout. The breakout looks to be unfolding today, supported by a positive turn in market sentiment, which is pushing equities into profit, and is expected to lift cryptocurrencies as well. As more investors start picking up XRP coins, expect a return towards $1.0, holding a 20% potential gain by the end of the week.

XRP sees buying volume picking up as the RSI drifts higher

Ripple price is breaking out of its consolidation in both directions. Bears might be in for a surprise, however, as certain elements appear to be turning against them this morning, opening a window for a bullish knee-jerk reaction that could last all week with a big squeeze back up to $1.0. The main driver for this is the support held over the weekend at $0.78, which was vital to defend to keep a bullish uptrend intact.

XRP is now awaiting the spillover effect from equities trading firmly in the green this morning during the European session. This has created a tailwind that should convince investors to further play the risk-on trade, which in turn could see a lift in buying volume, making XRP price break higher, above $0.88. From there, a jump towards $0.95 could meet resistance and slowdown when it encounters the 200-day Simple Moving Average (SMA), as it triggers profit-taking as happened on December 09.

XRP/USD daily chart

Expect the recovery to continue as long as the Relative Strength Index (RSI) keeps moving higher on higher buying volume, and as long as the equities tailwind remains. These factors could push XRP price action back to $0.99 and possibly $1.05 by the end of the week. Should central banks rattle markets with very hawkish tones and rate hikes, however, expect those tailwinds to fade quickly and flip to headwinds, with sell-offs in equity indices and cryptocurrencies. XRP would then break lower towards $0.78 and possibly spiral even further down towards $0.62.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.