XLM Price Prediction: Stellar at risk of a massive 20% correction

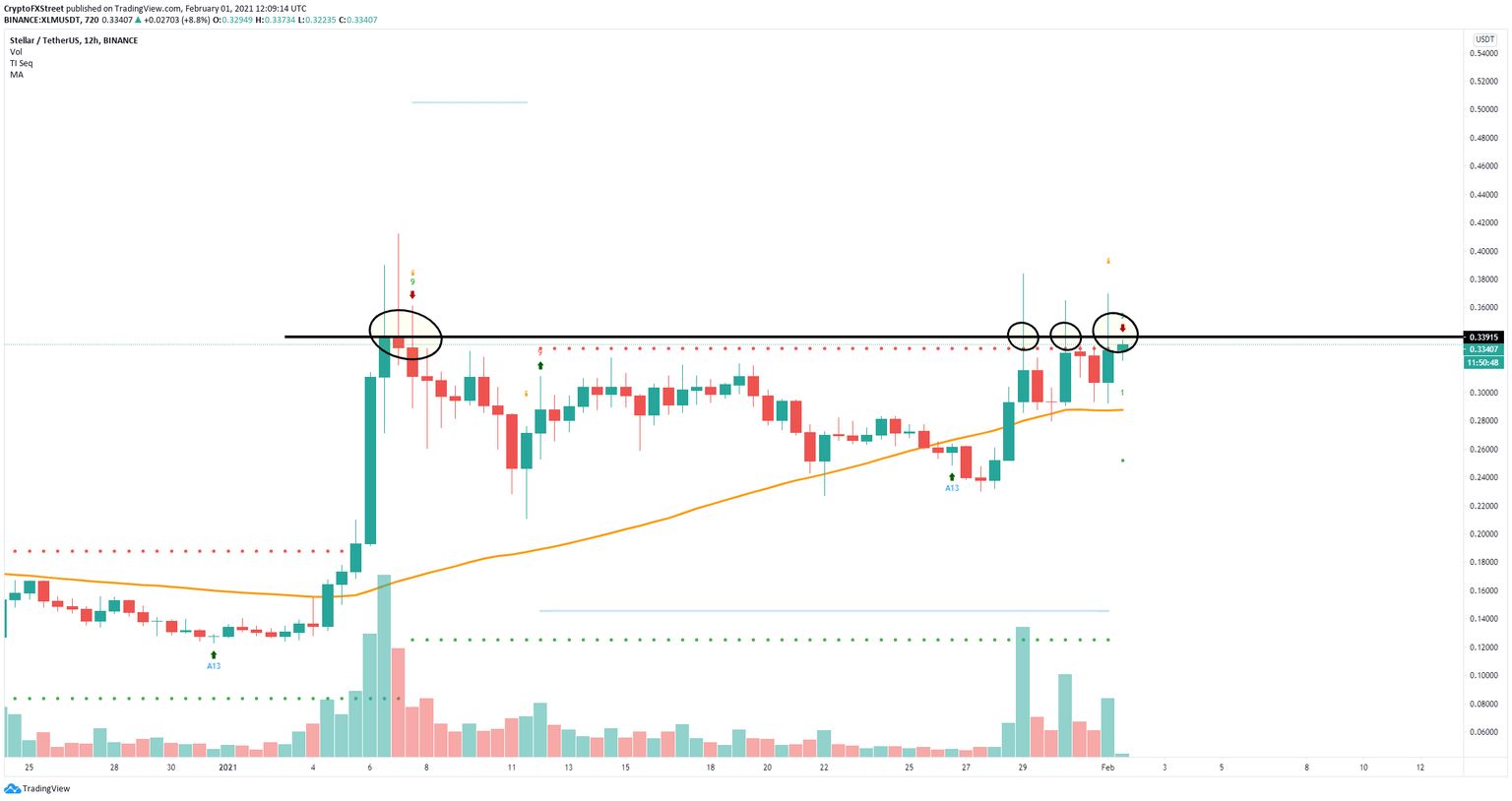

- XLM price got rejected several times from a crucial resistance level at $0.34.

- TD Sequential indicator has presented a sell signal on the 12-hour chart.

- The social volume of Stellar has increased again, which often leads to a correction.

On January 7, XLM price peaked at $0.411 but had a major correction down to $0.21 in the next week. On January 28, the digital asset tried to climb above $0.34 unsuccessfully, closing below there. XLM attempted to crack this resistance level in the following days, again, failing to do so.

Another rejection from $0.34 will lead XLM price down to $0.28

On the 12-hour chart, XLM price has not managed to close above $0.34 in the past month, making this resistance level crucial. Additionally, the TD Sequential indicator has just presented a sell signal which indicates XLM price is most likely going to see another pullback.

XLM/USD 12-hour chart

The 50-SMA located at $0.287 will be the next price target for the bears. Additionally, the social volume of Stellar, which measures the number of mentions of the asset across different social media channels, has seen a significant spike again which often indicates a pullback is underway.

XLM Social Volume

On the other hand, if XLM bulls can finally manage to crack the $0.34 resistance level, XLM price can quickly climb towards the last 2021-high at $0.411 and higher to $0.45 as there are no other barriers on its way.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B13.10.04%2C%252001%2520Feb%2C%25202021%5D-637477783584891887.png&w=1536&q=95)