Crypto winter began in January 2025, but end is near: Bitwise

- Bitwise's Matt Hougan says crypto is nearing the end of a winter season he claims began in January 2025.

- Buying momentum from ETFs and digital asset treasuries masked the depth of the crypto winter.

- CryptoQuant's Julio Moreno disagrees, arguing the bear market began last November and will last until Q3.

The crypto market has been in a "full-blown" winter season since January 2025, following a 39% and 53% drop in Bitcoin (BTC) and Ethereum (ETH) prices from their all-time highs over the past few months, according to Bitwise Chief Investment Officer Matt Hougan.

In a note on Tuesday, the firm highlighted that the crypto market has seen increased adoption and positive regulatory developments in the past year, including a Federal Reserve (Fed) Chair nominee last week who is a Bitcoin supporter. However, these developments have failed to spur an extended crypto rally because "we are in the depths of a crypto winter." "This is not a 'bull market correction' or 'a dip.' It is a full-bore, 2022-like, Leonardo-DiCaprio-in-The-Revenant-style crypto winter — set into motion by factors ranging from excess leverage to widespread profit-taking by OGs," wrote Hougan.

Despite crypto prices peaking in the latter half of last year, Hougan claims the crypto winter began in January 2025, but sustained buying momentum from exchange-traded funds (ETFs) and digital asset treasuries (DATs) clouded this reality.

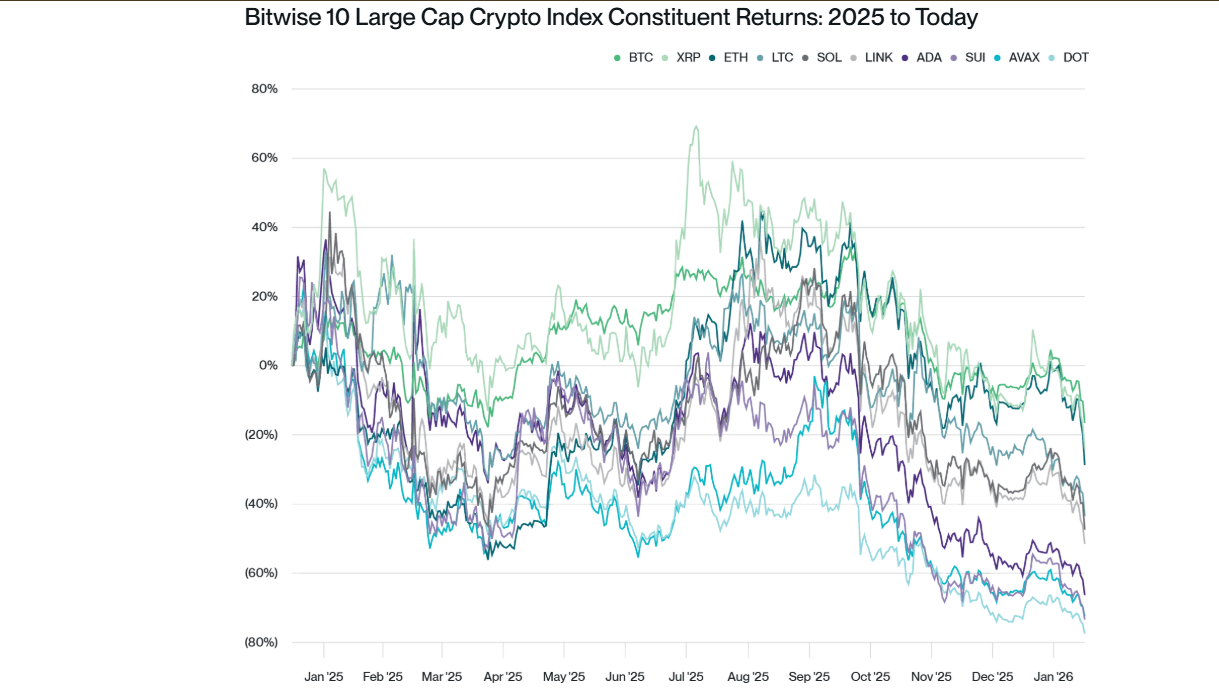

Bitwise's 10 Large Cap Index showed that the performance of top cryptocurrencies across three categories was largely mixed. Bitcoin, Ethereum and XRP, dubbed Group 1 assets, declined by 10.3% to 19.9%, while Group 2 assets — Solana (SOL), Litecoin (LTC) and Chainlink (LINK) — fell 36.9% to 46.2%. On the other hand, Group 3 assets — Cardano (ADA), Avalanche (AVAX), Sui (SUI) and Polkadot (DOT) plummeted by 61.9% to 74.7%.

Hougan stated that institutional demand is the differentiating factor among the three groups, highlighting how Group 1 assets saw strong ETF and DATs buying momentum throughout 2025. He noted that Bitcoin would have been down by 60% without the 744,417 BTC, worth about $75 billion, that these entities accumulated over the past year.

Group 2 assets received institutional access only after getting ETF approval in the latter half of 2025, while Group 3 assets didn't.

"Retail crypto has been in a brutal winter since January 2025. Institutions just papered over that truth for certain assets for a while," added Hougan.

However, he argued that the winter season is coming to an end, citing previous crypto winters in 2018 and 2022, which lasted about 13 months each. The report highlighted that the crypto market could experience a comeback if strong economic growth, progress on the Clarity Act, and signs of sovereign demand for Bitcoin emerge.

"As a veteran of multiple crypto winters, I can tell you that the end of those crypto winters feels a lot like now: despair, desperation, and malaise. But there is nothing about the current market pullback that's changed anything fundamental about crypto," Hougan concluded.

CryptoQuant disagrees, says bear market began in November

CryptoQuant's Head of Research, Julio Moreno, has been sharing a similar sentiment about crypto being in a bear market since last December. However, he disagrees with Hougan on the timing.

"The fact that we did not have a blow-off top or closed the year positive doesn't mean we were in a bear market in 2025," wrote Moreno in a Tuesday X post. "The Bitcoin bear market started in November 2025, as suggested by on-chain and market data, and the timing has implications for when it will end. My current expectation is Q3 2026."

In a report on Monday, research firm Bernstein argued somewhat similarly, noting that Bitcoin could bottom around $60,000 before bouncing back in the later part of H1 2026.

Bitcoin is trading around $74,100 at the time of publication on Tuesday, down 5% over the past 24 hours. The top crypto has shed more than 20% of its value, wiping out about $400 billion in market capitalization over the past two weeks.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi