Why is the crypto market crashing?

- Bitcoin briefly fell to $73,000, while ETH breached $2,200.

- The decline, which comes alongside weakness in the stock market, wiped out over $755 million in leveraged positions from the crypto market.

- Crypto's decline stems from rising correlation with stocks, especially during downturns.

Bitcoin (BTC) and the broader crypto market are experiencing a heavy downturn on Tuesday amid negative sentiment following the latest tech earnings.

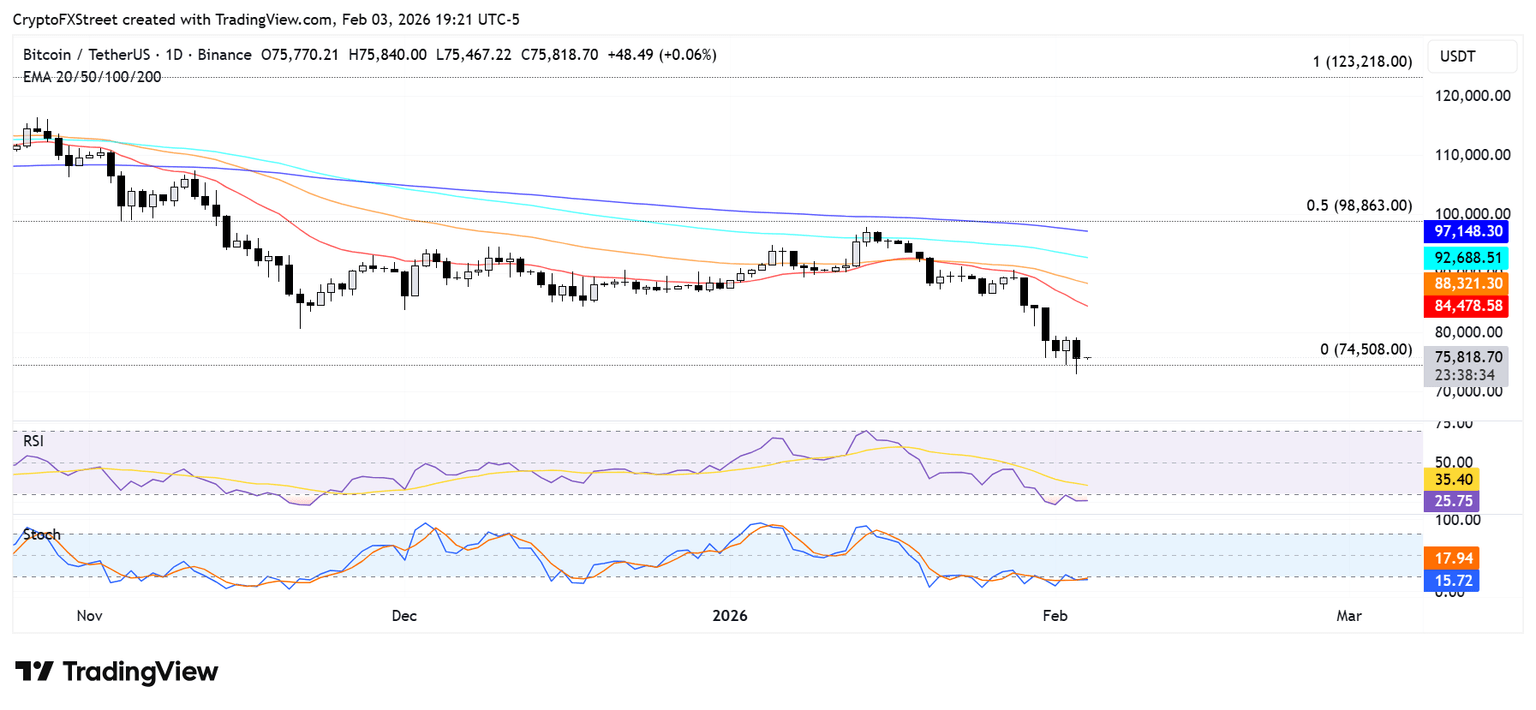

The top crypto briefly declined more than 5% over the past 24 hours, sliding below $73,500 before quickly recovering above $75,000 at the time of publication. Over the past two weeks, Bitcoin has lost more than 23%, eroding about $401 billion in market capitalization.

A similar move is evident in Ethereum (ETH), which briefly traded below $2,200 before reclaiming $2,300. The move has stretched its decline in the past two weeks to about 34%.

The sharp plunge has wiped out $755 million in leveraged positions in the crypto market over the past 24 hours, with $551 million in long liquidations.

Stocks trade lower amid signs of rising correlation with cryptocurrencies

Alongside crypto, stocks are bleeding, with the S&P 500 dropping about 0.8% and the Nasdaq Composite by 1.4%. The decline comes as investors digested several tech-based earnings, with software stocks falling as precious metals posted notable gains.

The similar moves in crypto and stocks align with earlier estimates from trading firm Wintermute, which found that Bitcoin behaves more like the Nasdaq during market downturns.

Meanwhile Bitwise CIO Matt Hougan predicts that crypto could rebound soon as it's nearing the end of a winter season that dates back to January 2025.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi