Why traders should keep their eyes on dYdX price for the rest of November

- dYdX price rose by 130% in less than a week.

- The Volume Profile Indicator shows the largest influx of bullish volume this year.

- Invalidation of the uptrend scenario requires a breach below the $1.45 support for confirmation.

dYdX price should be on every trader's watchlist. After outperforming nearly all cryptos this month, the technicals suggest more gains could occur. Key levels have been defined to gauge DYDX’s next potential move.

dYdX price is one to watch

dYdX price has portrayed applaudable strength in the crypto market. While most altcoins have succumbed to Bitcoins’ demise, DYDX has diverged from the pact. During November's third trading week, the bulls produced a jaw-dropping 130% rally. As the price cools off, there are subtle signs embroidered in the technicals suggesting the uptrend rally is far from over.

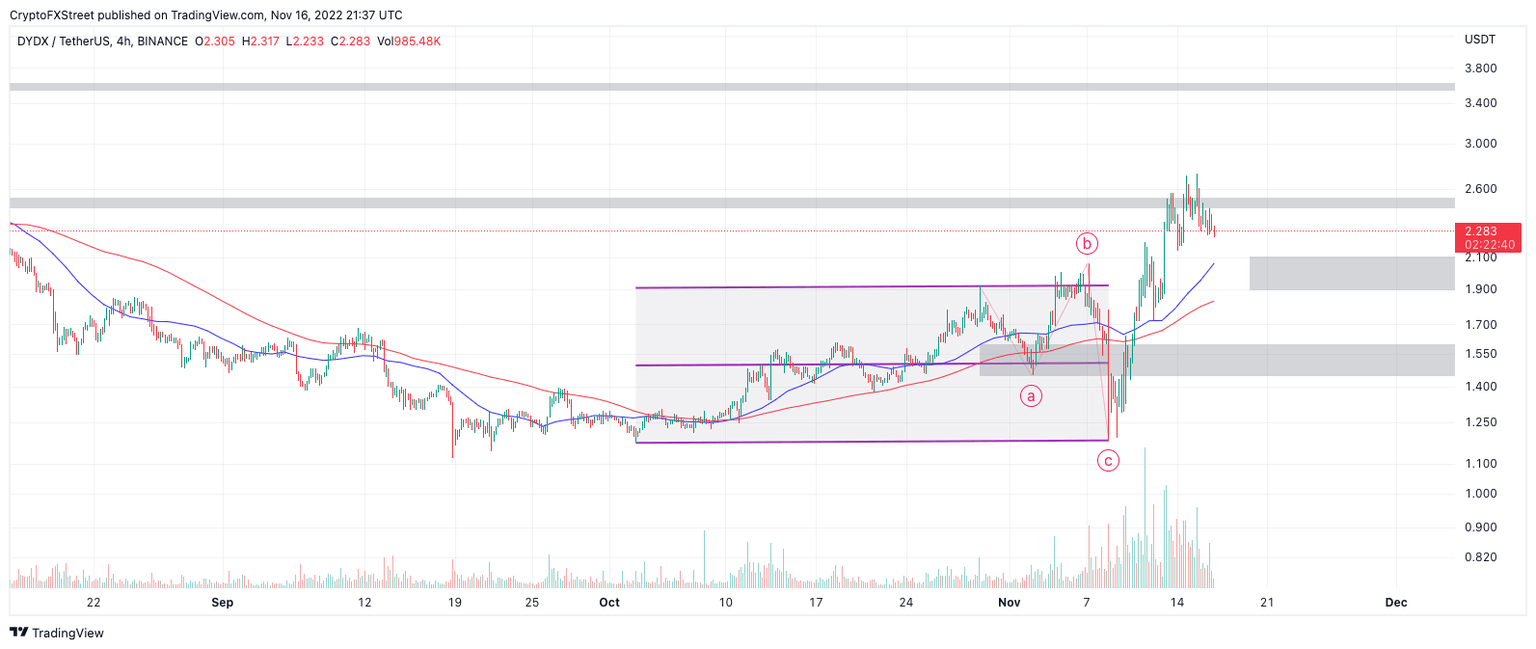

dYdX price currently auctions at $2.20 as a profit-taking consolidation occurs near the top of the newly established rally. During the ascension, the Volume Profile Indicator showed the largest uptick in transactions this year while producing a classic ramping pattern. The 8-day exponential moving average (EMA) and 21-day simple variant were dually breached during the uptrend move.

DYDXUSDT 8-hour chart

From a technical standpoint, the DYDX price rally looks genuine enough to aim for higher targets. If market conditions persist, the $3.55 and $4.00 liquidity zone stands a fair chance of being breached. Still, after such an impressive rally, traders should expect a deeper pullback as the recently breached 8-day EMA has yet to be retested. A plummet toward $1.90 could provide an excellent entry for the next swingtrade aiming for $3.55.

Still, every uptrend rally can halt no matter how promising the technicals seem. Invalidation of the bullish thesis could occur if the $1.45 support zone is breached. If the bears tag the invalidation level, a sweep-the-lows event could occur, targeting the recent double bottom near $1.12. Such a move would result in a 50% decrease from the current DYDX price.

In the following video, our analysts deep dive into the price action of Bitcoin, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.