XRP stays above $2.00 as on-chain activity, retail demand wane

- XRP holds support at $2.00 amid a relatively quiet cryptocurrency market on Friday.

- XRP Ledger on-chain activity slows, reflected by declining active addresses.

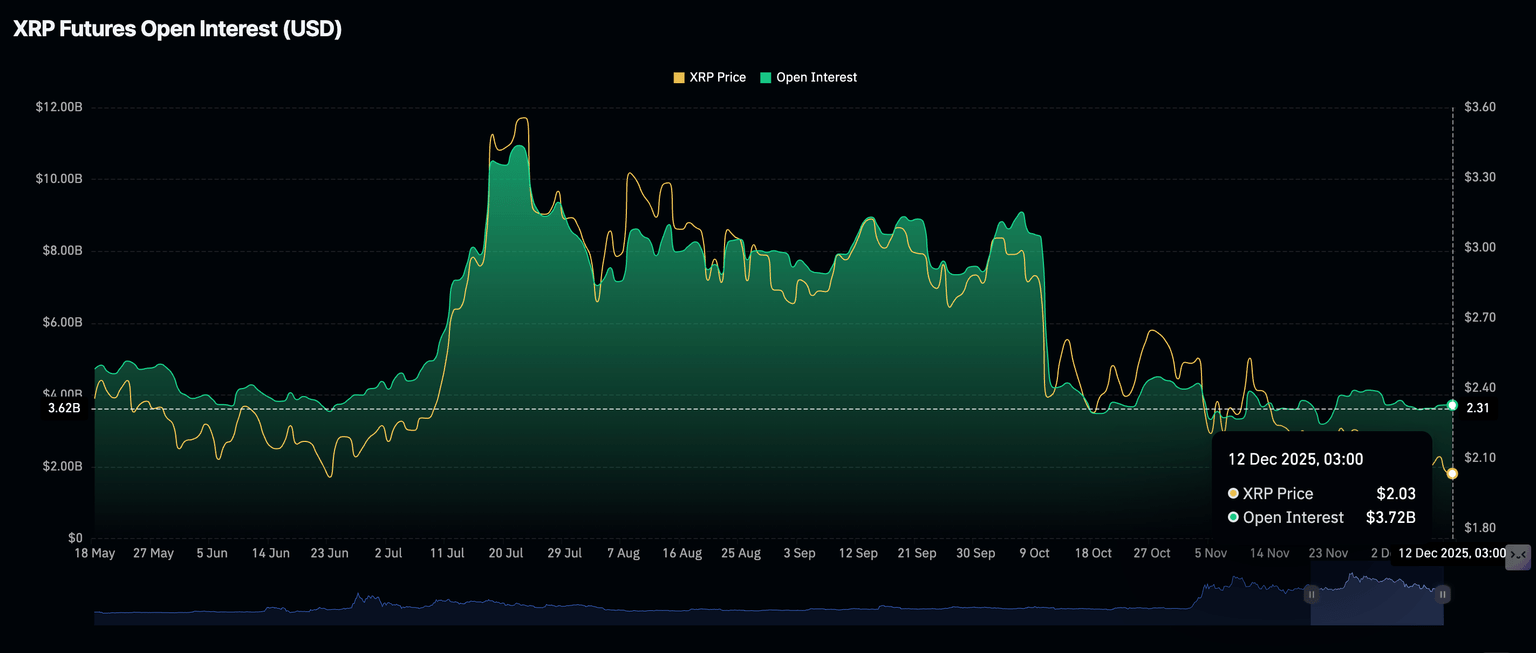

- Retail demand remains significantly suppressed, with Open Interest stabilizing at $3.72 billion.

Ripple (XRP) is extending sideways trading above support at $2.00 at the time of writing on Friday, as the dust from the Federal Reserve’s (Fed) decision settles.

The crypto market succumbed to heightened volatility as investors digested the hawkish interest rate cut by the Fed on Wednesday. Inflation risk and a weak labor market stood out as factors that could prompt the central bank to pause its monetary easing cycle, an outlook that may continue to drive macroeconomic uncertainty.

XRP adoption slows amid falling on-chain activity

The XRP Ledger (XRPL) has recorded a significant drop in the number of active addresses since early November. CryptoQuant data shows that the number of addresses actively transacting on the network averaged 20,000 as of Tuesday, down from nearly 25,000 on November 21 and approximately 32,000 on November 11.

The decline indicates that user engagement has slowed significantly, reducing XRP adoption and buying pressure.

-1765541256791-1765541256791.png&w=1536&q=95)

Meanwhile, demand for XRP derivatives has stabilized, albeit at significantly lower levels, with futures Open Interest (OI) averaging $3.72 billion on Friday, down from $8.36 billion on October 10 when the crypto market crashed, liquidating $19 billion in assets on a single day. OI represents the notional value of outstanding futures contracts; hence, the persistent decline from a record high of $10.94 billion reached in July continues to suppress price recovery. Moreover, a low OI suggests investors are not convinced XRP can sustain an uptrend in the near term, and are choosing to stay on the sidelines.

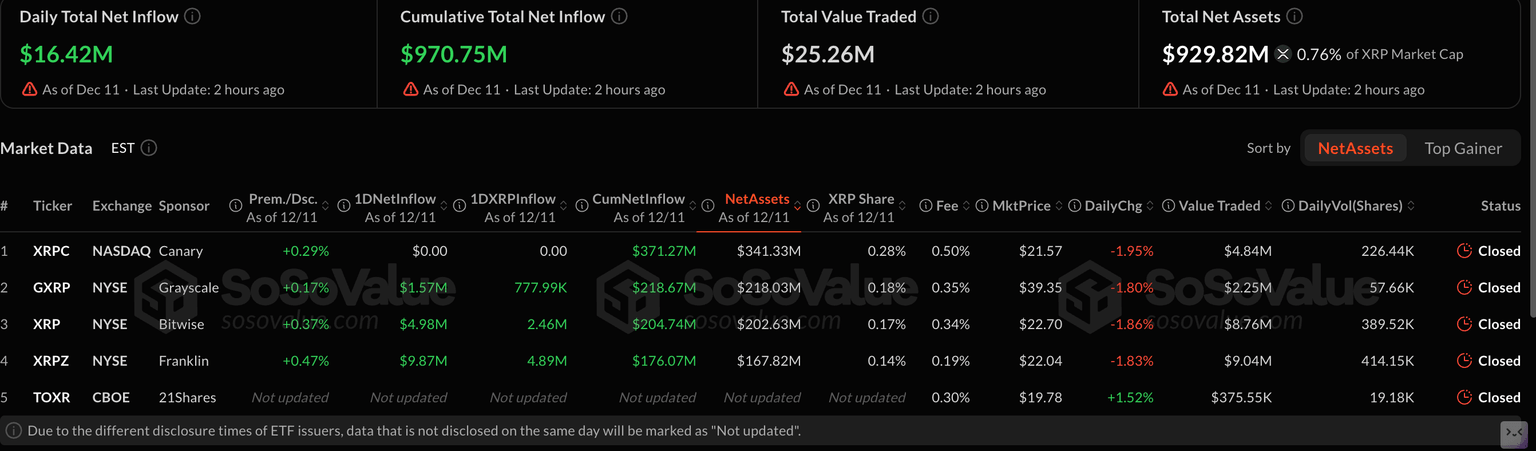

Demand for XRP Exchange Traded Funds (ETFs) remains steady, characterized by approximately $16 million in inflows on Thursday. According to SoSoValue data, the cumulative inflow volume currently stands at $971 million and is quickly approaching the $1 billion milestone. In total, XRP ETFs account for net assets of $930 million.

Technical outlook: XRP holds key support

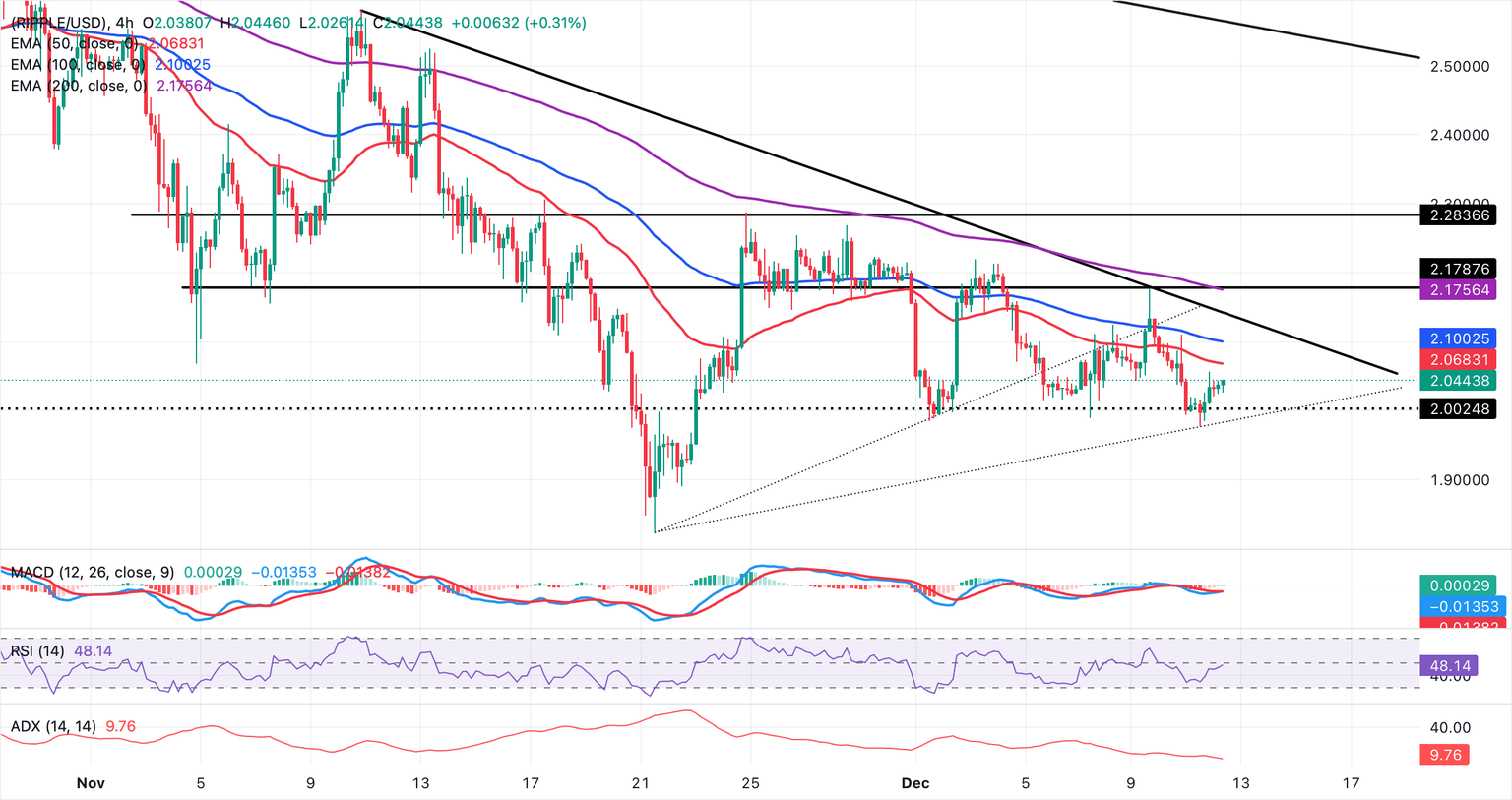

XRP is trading sideways above support at $2.00 at the time of writing on Friday. The cross-border remittance token also sits below the descending 50-period Exponential Moving Average (EMA) at $2.06, 100-period EMA at $2.10 and the 200-period EMA at $2.17 on the 4-hour chart, which cap recovery attempts and preserves a bearish configuration.

The Moving Average Convergence Divergence (MACD) green histogram bars have flipped slightly positive, while the blue MACD line stands just above the red signal line, reinforcing a neutral tone. The Relative Strength Index (RSI) at 48 (neutral) edges higher, hinting at modest improvement in momentum.

A descending trend line from $2.58 limits gains, with resistance seen at $2.13. However, a sustained push through this barrier could encourage a broader rebound.

XRP's trend strength remains subdued as the Average Directional Index (ADA) eases to 9.76, consistent with a range-bound phase. The rising trend line from $1.82 underpins the base, offering support near $1.98 and holding above this floor would keep pullbacks contained. Conversely, a breakdown could accelerate downside pressure.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

(The technical analysis of this story was written with the help of an AI tool)

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren