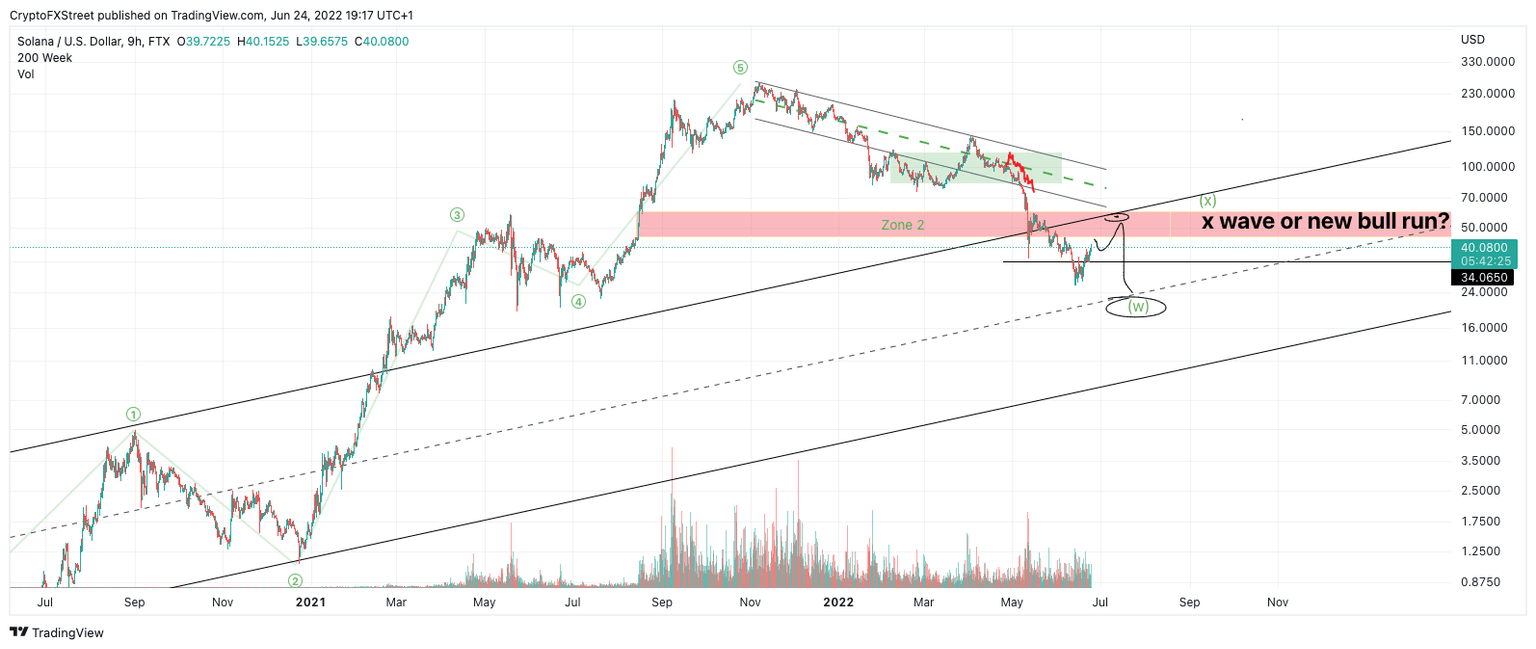

Why Solana price could rally to $50 before the next collapse

- Solana price has increased 40% since the June 13 lows at $27.80.

- The relative strength back and forth nature signals increased volatility throughout summer.

- Invalidation of the downtrend is a break above $60.

Solana price has room to rise before the bears attack again.

Solana price is for short-term traders only

Solana price shows an increased momentum going into the third weekend of June. Still, a bull run is unconfirmed. The bulls have managed to recover 40% of lost gains since the June 12 low at $27.80. The rise in value comes with sparse volume, as most investors are unsure of the current market conditions.

Solana price currently trades at $40 as the bulls continue to hike upwards on the 9-hour chart. If the short-term rally is genuine, the bulls could rise to the $52 for an additional 40% gain. The Relative Strength Index shows unstable tug-of-war-like movement, which suggests an increase in volatility that short-term scalpers could enjoy in the coming weeks. Traders should also beware that Solana price has bearish confluence targets in the $20 region, as previously mentioned. Hence, if you are looking to join the continued uptrend move be sure to keep a tight stoploss and secure profits accordingly.

SOL/USDT 9-Hour Chart

From a macro perspective, $60 is the invalidation level to call a new bull run for the Solana price confidently. If the bulls manage to breach the $60 level, a $140 target will be back on the cards resulting in up to a 280% increase from the current Solana price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.