UNI Price Analysis: Uniswap is on its way to $6 after short hiccup

- Uniswap price fades after a 5% uptick on Tuesday.

- UNI bulls get relief from equities rallying further, underpinning the current fade and limiting losses.

- After this fade, expect another leg higher with $6.000 as the ultimate price target, potential 13% gains.

Uniswap (UNI) price action slid roughly 1% lower in the ASIA PAC session on Wednesday after the market turmoil in the past 48 hours. What was bookmarked as a steady week is simply an extension of the volatile price action from last week. Things should calm down, though, with no central banks lined up between now and January. Uniswap price action should calm down, with volume reduction, and a sense of direction to go upwards.

UNI set to relax and enjoy the trend

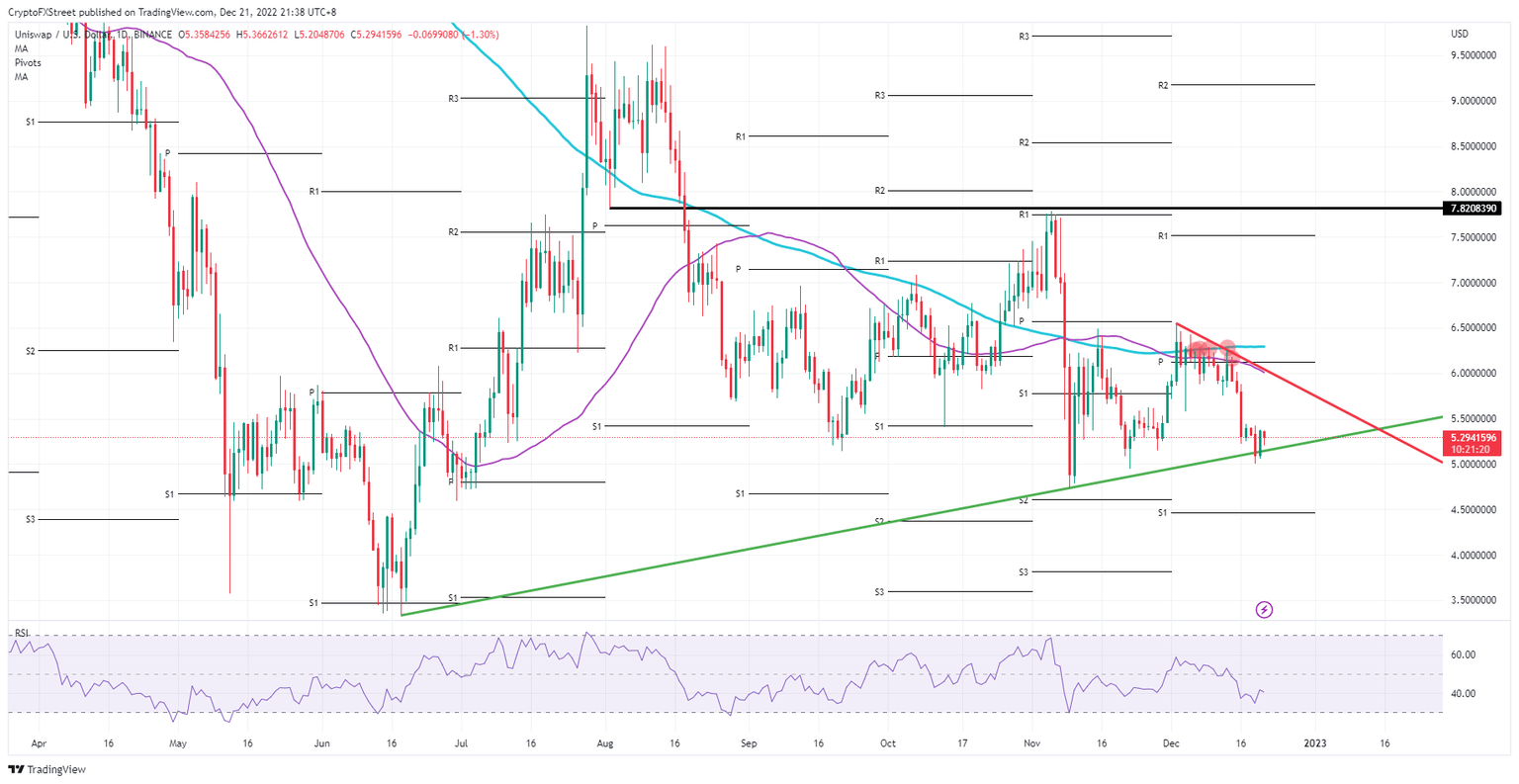

Uniswap price is set to jump higher after a purely technical event at the start of the week, where on Monday, price action tested and briefly broke and closed below the important green ascending trend line from June. The close below had UNI bears adding to the break, which must have hurt quite a few of them on Tuesday with the squeeze to the upside. The bear trap triggered heavy buying and completely washed out the bears that entered on Monday at any given point.

UNI currently gets a small fade as some profit-taking is underway from bulls that punched price action back above the green ascending trendline. Expect to see some follow-through as markets ease further with the US Dollar strength abating further, and equities finally in the green after a substantial selloff period. All these elements could bring UNI price towards $6.000, facing the cap with the 55-day Simple Moving Average (SMA) and the red descending trend line.

UNI/USD daily chart

Should the fade remain at current levels and see further limit movements, rather sideways than lower or higher, the risk is that UNI is in a consolidation phase. This means that both buyers and sellers are being pushed towards one another, followed by a breakout trade. That breakout trade could also happen to the downside, with bears firmly breaking the green ascending trend line and seeing an accelerated move toward $4.50 to find support at the monthly S1 support level.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.