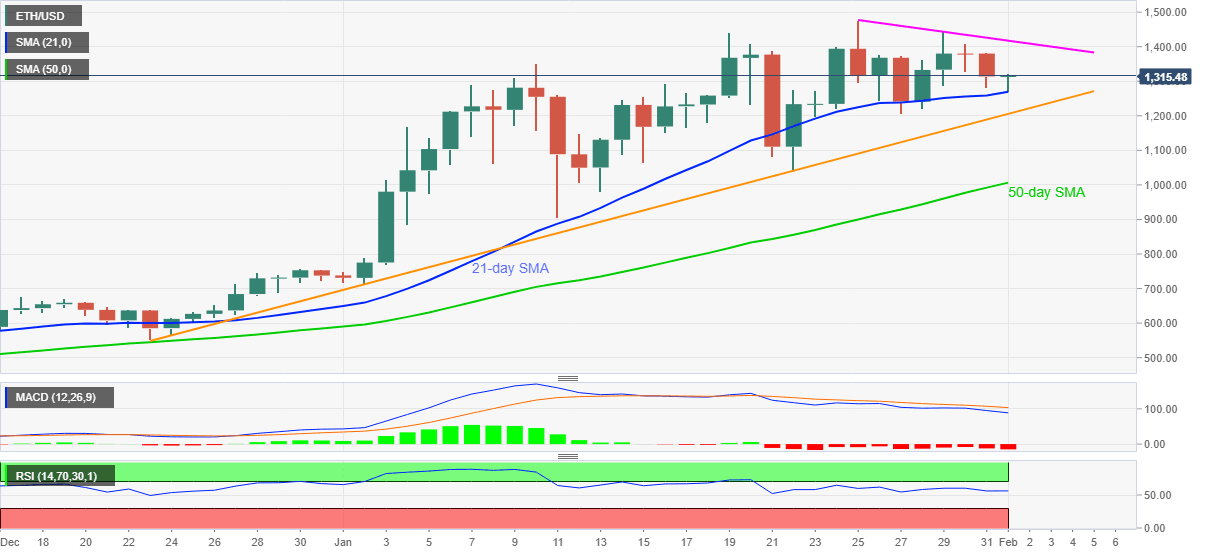

Ethereum Price Analysis: ETH buyers keep lurking around 21-day SMA

- ETH/USD eases from intraday top while keeping the bounce off three-day low.

- Bearish MACD, one-week-old resistance line test buyers, six-week-old support line adds to the downside filters.

ETH/USD steps back from the day’s high of $1,322 to $1,311, down 0.16%, during early Monday. The Ethereum buyers recently returned, like multiple times in the last one week, from 21-day SMA even as bearish MACD and a falling trend line from last Thursday challenge the upside momentum.

The altcoin’s latest pullback can’t be considered serious unless breaking 21-day SMA, at $1,269 now, a break of which will drag the quote an ascending trend line from December 23 near $1,205.

It should, however, be noted that a downside break of $1,205 will need validation from the $1,200 threshold before challenging the 50-day SMA level of $1,006.

Meanwhile, the sustained upside will attack the short-term resistance line, currently around $1,417, before directing ETH/USD bulls to January top, also the record high of $1,477.

During the quote’s run-up beyond $1,477, the $1,500 psychological magnet could gain the market’s attention.

Overall, ETH/USD is in an uptrend but short-term pullbacks can’t be ruled out.

ETH/USD daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.