XRP Price Prediction: Ripple spells trouble

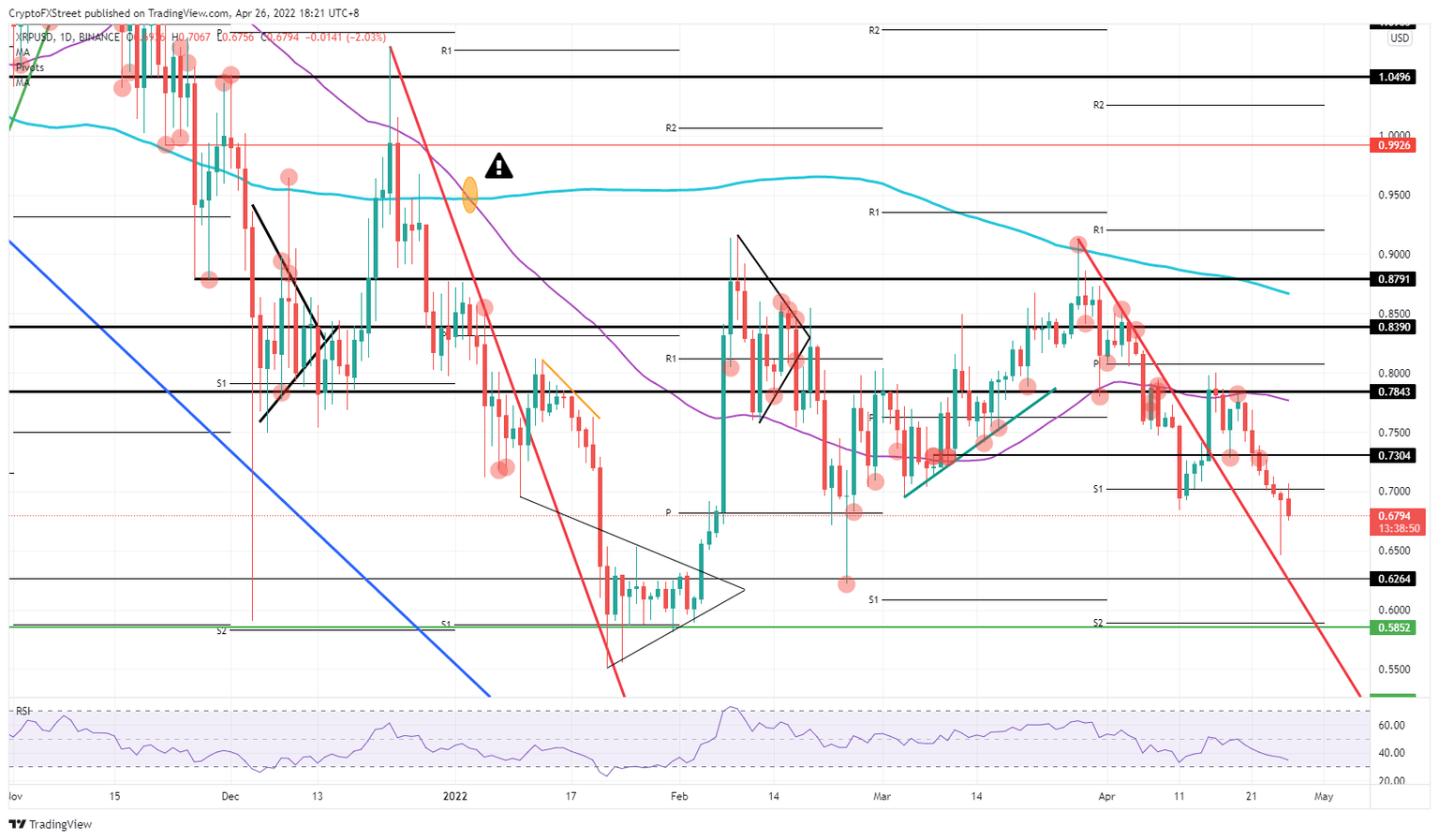

- Ripple price fails to break and consolidate above $0.70 and the monthly S1 support level.

- XRP price is set to tank 10% to 15% if the move from Monday results in a dead-cat-bounce.

- Expect investors to pull their funds as the RSI is inching further to the downside.

Ripple (XRP) price is not in a good place this Tuesday as investors are sitting on their hands and XRP price has undergone a firm rejection on the topside with the monthly S1 support level around $0.70 clearly showing resistance. Since the end of March, bears have been using the handle to complete their shorts and are looking to fulfil the Relative Strength Index (RSI) trade towards the oversold barrier. Only then will bears book profits and open the door for bulls to re-enter, but that looks like when XRP price will hit either $0.62 or $0.58 in the process.

XRP price set to drop between 10% to 15%

Ripple price saw a significant inflow on Monday as bulls jumped in near the US close after some good earnings that proved enough to shake off all the tail risks triggered on Monday. Together with Musk buying Twitter, cryptocurrencies jumped back on the front foot on the back of the news. But that sentiment is fading quickly, with only a few cryptocurrencies like Bitcoin and Dogecoin clinging to gains while XRP price is set to tank.

XRP price is thus not in the basket for the cherry-picking that cryptocurrency investors are doing at the moment. XRP price is pushed into the camp of investors awaiting the big-tech earnings and are vigilant for the spillover effect from the Nasdaq into cryptocurrencies. As of this evening, after the US close for three consecutive days, the top six big tech companies are set to report their earnings. Expect XRP price to dip further towards $0.62 or even $0.58 as the demand side dries up because of no interest, opening the door for bears to push price action even further to the downside.

XRP/USD daily chart

If a Netflix scenario is avoided for Microsoft and Alphabet, it could push investors into a good mood and see them jump into price action. For XRP price, that would mean a bounce off the red descending trend line and a possible break above the monthly S1. A jump higher towards $0.73 or even $0.78 would be a strong bullish signal to the markets, with the RSI fading away from being oversold.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.