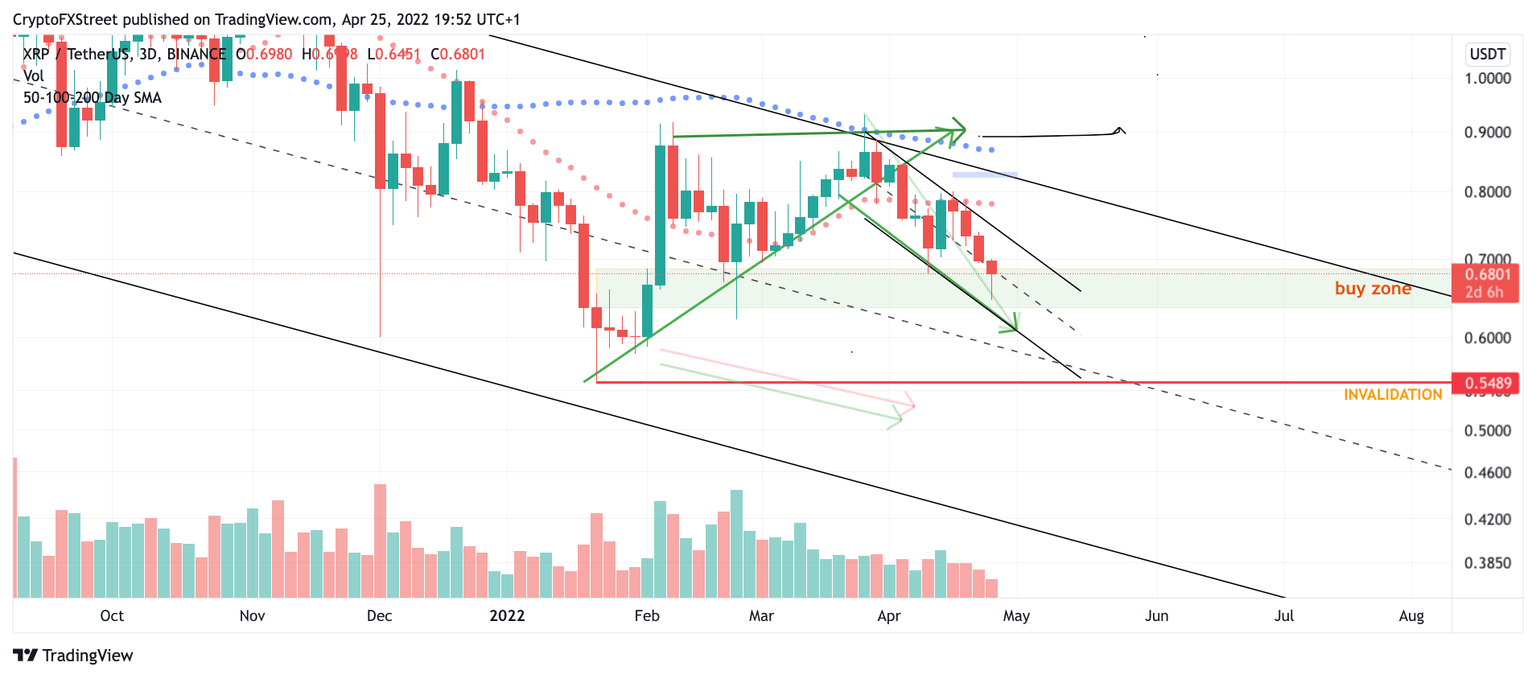

XRP price falls amidst SEC delays, liquidity below $0.62 looks unsafe

- XRP price is still macro bullish on the 3-day chart.

- XRP price has tapering sellers' volume.

- Invalidation of the bullish scenario is now a break below $0.5489.

XRP price could see liquidity grabs as the SEC delays the controversial securities hearing again. Liquidity under $0.62 has been deemed unsafe eye candy for long-term investors.

Also read: SOS Stock Price: Sos Ltd snaps losing streak despite hitting a new 52-week low price

XRP could dish out more discounts

=XRP price still looks macro bullish despite the current market decline. However, traders should consider wisely approaching the digital remittance token as games, fake-outs, and sideways price action are likely to occur at the current levels.

XRP price has invalidated the idea of the ending diagonal to kick start the widely anticipated bull run. Ripple price currently trades at $0.67, retesting the trend line below the 10% rally candle seen on April 13-15. Now that the impulse wave is invalid, long-term investors could consider XRP discounts around the $0.62 level.

XRP/USDT 3-Day Chart

XRP price is still bullish based on the sellers' volume tapering off as price trades halfway through a parallel channel at $0.67. A dollar-cost average approach could be a favored entry strategy for XRP optimists. Invalidation must be the swing low st $0.5489

If the bears breach $0.5489, expect all hell to break loose. The XRP price could see a market capitulation to $0.40, resulting in a 40% drop from the current Ripple price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.